Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

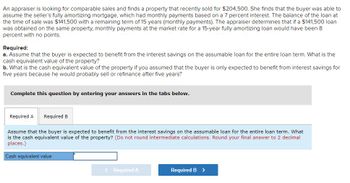

Transcribed Image Text:An appraiser is looking for comparable sales and finds a property that recently sold for $204,500. She finds that the buyer was able to

assume the seller's fully amortizing mortgage, which had monthly payments based on a 7 percent interest. The balance of the loan at

the time of sale was $141,500 with a remaining term of 15 years (monthly payments). The appraiser determines that if a $141,500 loan

was obtained on the same property, monthly payments at the market rate for a 15-year fully amortizing loan would have been 8

percent with no points.

Required:

a. Assume that the buyer is expected to benefit from the interest savings on the assumable loan for the entire loan term. What is the

cash equivalent value of the property?

b. What is the cash equivalent value of the property if you assumed that the buyer is only expected to benefit from interest savings for

five years because he would probably sell or refinance after five years?

Complete this question by entering your answers in the tabs below.

Required A Required B

Assume that the buyer is expected to benefit from the interest savings on the assumable loan for the entire loan term. What

is the cash equivalent value of the property? (Do not round intermediate calculations. Round your final answer to 2 decimal

places.)

Cash equivalent value

< Required A

Required B >

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Nkosi is 64 years old. During the current year of assessment, he sold a pre- valuation date value asset for R7 600 000. Included in the amount is the agent's commission who he had paid for getting a buyer for him. The commission is 5% of the selling price. The valuation date value of the asset was correctly calculated to be R3 440 000. Just before the asset was sold Nkosi incurred improvement costs worth R1 000 000 to increase his chance of being able to sell the asset. YOU ARE REQUIRED to determine the base cost of the asset. Select one: a. R3 440 000 b. R4 820 000 c. R4 440 000 d. R 3 820 000arrow_forwardAnna owns an investment property in Sai Kung for many years which has been rented out at $30,000 per month. She holds a non refundable rental deposit of $90,000. In the year of assessment 2023/24, she was able to collect rent for the first three months only. She finally repossessed the property and rented the property on 1 February 2024 at a new rent of $20,000 per month. Rates and management fees paid by Anna during the year was $36,000 and $24,000 respectively. What is the net assessable value for property tax purposes for the year of assessment 2023/24?Question 21Select one: a. $192,000 b. $144,000arrow_forwardSebastian purchases two pieces of equipment for $100,000. Appraisals of the equipment indicate that the fair market value of the first piece of equipment is $72,000 and that of the second piece of equipment is $108,000. What is Sebastian's basis in these two assets? Do not round your interim calculations. If required, round your final answers to the nearest dollar. Sebastian's basis for the first piece of equipment is $____ and $_______ for the second piece of equipment.arrow_forward

- Brian acquired a rental house in 2004 for a cost of $80,000. Straight-line depreciation on the property of $26,000 has been claimed by Brian. In January 2020, he sells the property for $120,000, receiving $20,000 cash on March 1 and the buyer's note for $100,000 at 10 percent interest. The note is payable at $10,000 per year for 10 years, with the first payment to be received 1 year after the date of sale. Calculate his taxable gain under the installment method for the year of sale of the rental house. In your computations, round any division to two decimal places. Gain reportable in 2020 is $fill in the blank 1.arrow_forwardStephen purchased a rental property on 03 August 2020 and has rented the property from this date.He incurred the following expenses when purchasing the property –> $6,320 Lender’s Mortgage Insurance> $15,987 Stamp duty on transfer of the property> $1,500 Mortgage broker’s fee> $750 Conveyancing fees> $600 Bank loan establishment fee> $700 Stamp duty on the mortgageCalculate how much Stephen can claim in borrowing costs for the 2021 year and select the correct answer below. $1,766 $1,658 $1,311 $1,442 $1,879arrow_forwardLaura sold her office building to the accounting firm that bought her firm. Unfortunately, she had to repossess the building after less than a year. Choose the response that correctly states the amount of Laura's gain or loss on the repossessed real property, based on the following facts. The building had a fair market value of $54,000 on the date of repossession. The unpaid balance of the installment obligation at the time of repossession was $56,000, the gross profit percentage was 25%, and the costs of repossession were $600. (a) Loss of $13,400 (b) Loss of $11,400 (c) Gain of $11,400 (d) Gain of $13,400arrow_forward

- Lorissa owes Waterbury State Bank $200,000. During the current year, she isunable to make the required payments on the loan and negotiates the followingterms to extinguish the debt. Lorissa transfers to Waterbury ownership ofinvestment property with a value of $90,000 and a basis of $55,000, and commonstock with a value of $50,000 and a basis of $70,000. Lorissa also pays Waterbury$5,000 cash, and Waterbury forgives the remaining amount of debt. Before theagreement, Lorissa's assets are $290,000, and her liabilities are $440,000.Determine how much gross income Lorissa has from the extinguishment of the debt.arrow_forwardThe answer I got for C was 225,818 but I want someone to verify it.arrow_forwardBob, not a dealer, sold an apartment building for $600,000. His adjusted basis in the building was $350,000 and it was subject to $40,000 of depreciation recapture. Bob received $150,000 in the year of sale, the buyer assumed Bob’s mortgage payable of $240,000, and the buyer gave Bob an 8% (the current Federal rate) note of $210,000 due in five years. The interest on the note was payable each June 30, beginning in the year following the year of the sale. Bob incurred $30,000 of selling expenses which he paid in the year of sale. Compute Bob’s installment sales gain that should be reported in the year of sale.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education