Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

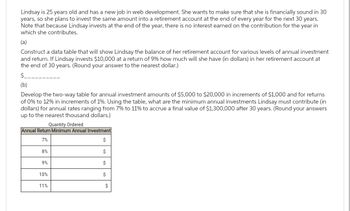

Transcribed Image Text:Lindsay is 25 years old and has a new job in web development. She wants to make sure that she is financially sound in 30

years, so she plans to invest the same amount into a retirement account at the end of every year for the next 30 years.

Note that because Lindsay invests at the end of the year, there is no interest earned on the contribution for the year in

which she contributes.

(a)

Construct a data table that will show Lindsay the balance of her retirement account for various levels of annual investment

and return. If Lindsay invests $10,000 at a return of 9% how much will she have (in dollars) in her retirement account at

the end of 30 years. (Round your answer to the nearest dollar.)

$

(b)

Develop the two-way table for annual investment amounts of $5,000 to $20,000 in increments of $1,000 and for returns

of 0% to 12% in increments of 1%. Using the table, what are the minimum annual investments Lindsay must contribute (in

dollars) for annual rates ranging from 7% to 11% to accrue a final value of $1,300,000 after 30 years. (Round your answers

up to the nearest thousand dollars.)

Quantity Ordered

Annual Return Minimum Annual Investment

7%

$

$

8%

9%

10%

11%

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Sara met with a financial planner and has determined that she will need $1,250,000 when she retires in 30 years. She has found an annuity that pays 5.65%, compounded monthly. What will she need to save each month, if a) Sara begins saving nowz?arrow_forwardA couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 24.00 years and pool the money into a savings account that pays 4.00% APR. They plan on living for 30.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal? Yearly Contribution $1,000.00 Account Fidelity Mutual Fund Vanguard Mutual Fund Employer 401k Balance $21,452.00 $183,845.00 $307,061.00 Submit Answer format: Currency: Round to: 2 decimal places. $10,000.00 $15,000.00 APR 7.00% 7.00% 6.00%arrow_forwardBaghibenarrow_forward

- Which of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardSue plans to save $4765, $0, and $5419 at the end of Years 1 to 3, respectively. What will her investment account be worth at the end of the Year 3 if she earns an annual rate of 5.98 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Note: It is highly recommended to use Excel (or Google Sheets) or a financial calculator to solve this problem.arrow_forwardPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS2.Alejandra Marrufo wants to know how much she should deposit today, so that in 10 years she will have the amount (VF) of 77,150.00, which she needs to make a pension payment for her domestic worker, a) if the account pays 8.125% interest compoundable semiannually; b) if the account pays 9.65% compoundable monthlarrow_forward

- a) Anu wants to put aside an amount at the beginning of each month while working for the next 5 years (60 months). At the end of 60 months, she wants to start a business and she plans to have a budget for it of at least $50,000. How much should she put aside each month if interest payable on her savings is 0.125% per month? [Hint: think about a Geometric Sequence (GP).] (Give your answer to 2 decimal places.) b) Suppose that the sum of $100 is invested at an annual rate of interest of 10%. Calculate the value of the investment in 5 years’ time if the interest is compounded (i) weekly and (ii) semi-annually Show all your calculations. (Give your answer to 2 decimal places.)arrow_forwardDiscuss the overarching idea of Asset Liability Management and its key objectives. How does the process of Gap Analysis support Asset Liability Management?arrow_forwardShenli would like to plan for retirement. With the help of a financial planner, she estimates that she will need $2,300,000 when she retires 40 years from now. Assume her investments produce returns of 10% per year. How much would Shenli need to save each year if she makes equal end of year deposits for the next 40 years that she works? Click here to access the TVM Factor Table calculator. Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±5.arrow_forward

- Helen Quick made an investment of $20,542.75. From this investment, she will receive $2,400 annually for the next 15 years starting one year from now. Click here to view the factor table What rate of interest will Helen's investment be earning for her? (Hint: Use Table 4.) (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to O decimal places, e.g. 25%.) Rate of interest %arrow_forwardMonica has decided that she wants to build enough retirement wealth, if invested at 10 percent per year, to provide her with $4,000 c monthly income for 20 years. To date, she has saved nothing, but she still has 25 years until she retires. How much money does she need to contribute per month to reach her goal? First compute how much money she will need at retirement, then compute the monthly contribution to reach that goal. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Contribution per montharrow_forwardSarah Wiggum would like to make a single investment and have $1.2 million at the time of her retirement in 30 years. She has found a mutual fund that will earn 4 percent annually. How much will Sarah have to invest today? If Sarah invests that amount and could earn a 14 percent annual return, how soon could she retire, assuming she is still going to retire when she has $1.2 million? Click on the table icon to view the PVIF table To have $1.2 million at retirement, the amount Sarah must invest today is $ (Round to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education