Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Amarindo, Inc. (AMR), is a newly public firm with 9.0 million shares outstanding. You are doing a valuation analysis of AMR. You estimate its free cash flow in the coming year to $14.58 million, and you expect the firm's free cash flows to grow by 3.9% per year in subsequent years. Because the firm

has only been listed on the stock exchange for a short time, you do not have an accurate assessment of AMR's equity beta. However, you do have beta data for UAL, another firm in the same industry: AMR has a much lower debt-equity ratio of 0.45, which is expected to remain stable, and its

debt is risk free. AMR's corporate tax rate is 20%, the risk-free rate is 5.2%, and the expected return on the market portfolio is 10.8%.

a. Estimate AMR's equity cost of capital.

b. Estimate AMR's share price.

a. Estimate AMR's equity cost of capital.

The equity cost of capital is%. (Round to two decimal places.)

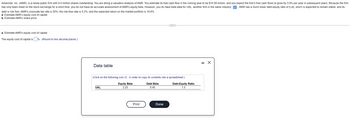

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Equity Beta

2.25

UAL

Print

Debt Beta

0.45

Done

Debt-Equity Ratio

1.5

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Similar questions

- Sea Side, Incorporated, just paid a dividend of $2.20 per share on its stock. The growth rate in dividends is expected to be a constant 4.30 percent per year indefinitely. Investors require a return of 19.00 percent on the stock for the first three years, then a return of 14 percent for the next three years, and then a return of 12 percent thereafter. What is the current share price? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Share pricearrow_forwardMembo Inc. just paid a dividend of $4.6 per share. Dividends are expected to grow at 6%, 5%, and 3% for the next three years respectively. After that the dividends are expected to grow at a constant rate of 2% indefinitely. Stockholders require a return of 9 percent to invest in Membo’s common stock. Compute the value of Membo’s common stock today. (SHOW ALL WORK PLEASE)arrow_forwardPlease provide the correct solution. Previously it has been partially incorrect, so this is a repost. Please double-check the yes or no question and the calculations. Stocks that don't pay dividends yet Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $5.00000 dividend at that time (D₃ = $5.00000) and believes that the dividend will grow by 26.00000% for the following two years (D₄ and D₅). However, after the fifth year, she expects Goodwin’s dividend to grow at a constant rate of 4.26000% per year. Goodwin’s required return is 14.20000%. Fill in the following chart to determine Goodwin’s horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to…arrow_forward

- Amarindo, Inc. (AMR), is a newly public firm with 11.0 million shares outstanding. You are doing a valuation analysis of AMR. You estimate its free cash flow in the coming year to be $15.41 million, and you expect the firm's free cash flows to grow by 3.8% per year in subsequent years. Because the firm has only been listed on the stock exchange for a short time, you do not have an accurate assessment of AMR's equity beta. However, you do have beta data for UAL, another firm in the same industry: lower debt-equity ratio of 0.45, which is expected to remain stable, and its debt is risk free. AMR's corporate tax rate is 20%, the risk-free rate is 5.3%, and the expected return on the market portfolio is 10.7%. AMR has a much a. Estimate AMR's equity cost of capital. b. Estimate AMR's share price. a. Estimate AMR's equity cost of capital. The equity cost of capital is 21.16%. (Round to two decimal places.) Data table SID (Click on the following icon in order to copy its contents into a…arrow_forwardGoodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $5.25000 dividend at that time (D₃ = $5.25000) and believes that the dividend will grow by 27.30000% for the following two years (D₄ and D₅). However, after the fifth year, she expects Goodwin’s dividend to grow at a constant rate of 4.32000% per year. Goodwin’s required return is 14.40000%. Fill in the following chart to determine Goodwin’s horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. Term Value Horizon value Current intrinsic value Assuming that the markets are in equilibrium, Goodwin’s current expected dividend yield is , and…arrow_forwardBretton, Inc., just paid a dividend of $3.15 on its stock. The growth rate in dividends is expected to be a constant 5 percent per year, indefinitely. Investors require a return of 13 percent on the stock for the first three years, a rate of return of 11 percent for the next three years, and then a return of 9 percent thereafter. What is the current share price for the stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share pricearrow_forward

- Use the following information to answer the question(s) below. Nielson Motors (NM) is a newly public firm with 25 million shares outstanding. You are doing a valuation analysis of Nielson and you estimate its free cash flow in the coming year to be $40 million. You expect the firm's free cash flows to grow by 4% per year in subsequent years. Because the firm has only been listed on the stock exchange for a short time, you do not have an accurate assessment of Nielson's equity beta. However, you do have the following data for another firm in the same industry: Equity Beta Debt Beta 0.4 Debt - Equity Ratio 1.5 1.8 Nielson has a much lower debt - equity ratio of .5, which is expected to remain stable, and Nielson's debt is risk free. Nielson's corporate tax rate is 40%, the risk - free rate is 5%, and the expected return on the market portfolio is 10%. Nielson's estimated equity beta is closest to: O A. 0.95 OB. 1.25 O C. 1.00 OD. 1.45arrow_forwardStorico Co. just paid a dividend of $1.50 per share. The company will increase its dividend by 20 percent next year and will then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. If the stock price is $24.94, what required return must investors be demanding on Storico stock? (Hint: Set up the valuation formula with all the relevant cash flows, and use trial and error to find the unknown rate of return.)arrow_forwardOne year ago, Barkley's stock sold for $28 a share. During last year, Barkley's paid $1.23 per share in dividends and saw its stock price increase by 7 percent for the year. Today, the firm announced that it will pay $1.30 per share in dividends this year. What do you know with certainty about the performance of Barkley's stock for this year? Multiple Choice The capital gains yield will be positive. The dividend yield for this year will be lower than it was last year. The total rate of return will be lower this year than it was last year. The total rate of return will be higher this year than it was last year. The dividend yield for this year will be higher than it was last year.arrow_forward

- After unexpectedly hosting an event for an out-of-favour political candidate, Four Seasons Total Landscaping expects to see its profits steadily decline each year going forward. Having recently paid its annual dividend of $$21.2521.25 per share, shares of Four Seasons Total Landscaping currently trade at a market price of $$77.0277.02 each. After analysing its business, you determine that the appropriate cost of equity capital for the firm is 18.118.1% per annum due to relatively high levels of fixed costs and debt financing. Based on the above information, at what rate per annum does the market seem to believe that the dividends of Four Seasons Total Landscaping will decrease? The annual dividends are expected to decline in size by % per annum.(Round to FOUR decimal places)arrow_forwardMetallica Bearings, Incorporated, is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a dividend of $12 per share 10 years from today and will increase the dividend by 6 percent per year thereafter. If the required return on this stock is 11 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share pricearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education