ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

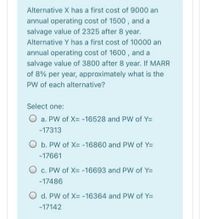

Transcribed Image Text:Alternative X has a first cost of 9000 an

annual operating cost of 1500, and a

salvage value of 2325 after 8 year.

Alternative Y has a first cost of 10000 an

annual operating cost of 1600 , and a

salvage value of 3800 after 8 year. If MARR

of 8% per year, approximately what is the

PW of each alternative?

Select one:

O a. PW of X= -16528 and PW of Y=

-17313

O b. PW of X= -16860 and PW of Y=

-17661

O c. PW of X= -16693 and PW of Y=

-17486

O d. PW of X= -16364 and PW of Y=

-17142

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- For the cash flows shown, determine the incremental cash flow between machines B and A for (a) year 0, (b) in year 3, and (c) in year 6. Machine First cost, $ AOC, $ per year Salvage value, $ Life, years A -15,000 -1,600 3.000 (a) = = -10000 (b) = 13200 (c) =6000 (a) = -10000 (b) = -1800 (c) = 4200 3 (a) = -10000 (b) = 13200 (c) = 4200 (a) = -10000 (b) = -1800 (c) = 3000 B -25,000 -400 6.000 6arrow_forwardb) National Homebuilders, Inc., plans to purchase new cut-and-finish equipment. The details of the 2 alternative options are summarized in the table below. The interest rate is 10% per year. First Cost, S Annual Operating Cost, S Salvage Value, S Equipment Life (years) Consider only machine A now. Alternative A 15,000 3,500 1,000 4 Alternative B 18,000 3,100 2,000 8 a) Calculate the AW of Machine A for one life cycle. b) Calculate the AW of Machine A for LCM = 8 years (2 life cycles). c) Demonstrate the equivalence of AW over 2 life cycles and AW over one life cycle.arrow_forwardA large textile company is trying to decide which sludge dewatering process it should use ahead of its sludge drying operation. The costs associated with centrifuge and belt press systems are shown. Compare them on the basis of their annual worths using an interest rate of 10% per year. System First cost, $ Centrifuge -250,000 AOC, $/year -31,000 Overhaul in year 2, $ Salvage value, $ 40,000 Life, years 6 Belt Press -170,000 -35,000 -26,000 10,000 4 The annual worth of the centrifuge system is $- 76216 ✪, and the annual worth of the belt press system is $- 82283.7 The system selected on the basis of the annual worth analysis is the centrifuge system.arrow_forward

- 6arrow_forwardCompare the alternatives C and D on the basis of a present worth analysis using an interest rate of 13% per year and a study period of 10 years. Alternative C $-46,000 $4,000 $-1,300 $6,000 10 First Cost AOC, per Year Annual Increase in Operating Cost, per Year Salvage Value Life. Years The present worth of alternative C is $1 (Click to select) offers the lower present worth. HELIME BIEN D $-20,000 $-7,500 $-100 $1,300 5 and that of alternative D is $ Aarrow_forwardPlease no written by handarrow_forward

- I need help only with the second part of inputting this data into excel calculating the Annual Worth for both options. Then using Goal Seek to find out the new salvage value that will equal AW equations, thank you.arrow_forwardA consulting engineering firm is considering two models of SUVs for the company principals. A GM model will have a first cost of $36,000, an operating cost of $4000, and a salvage value of $15,000 after 3 years. A Ford model will have a first cost of $32,000, an operating cost of $3100, and also have a $15,000 resale value, but after 4 years. (a) At an interest rate of 15% per year, which model should the consulting firm buy? Conduct an annual worth analysis. (b) What are the PW values for each vehicle?arrow_forwardCompare the alternatives C and D on the basis of a present worth analysis using an interest rate of 15.00% per year and a study period of 10 years. (Include a minus sign if necessary.) Alternative First Cost AOC, per Year Annual Increase in Operating Cost, per Year Salvage Value Life, Years The present worth of alternative C is $ с $-50000 $-8000 $-1500 $14000 10 $-21000 $-9000 $-200 $1500 5 and that of alternative D is $arrow_forward

- Following cash flows for alternatives X and Y at an interest rate of 10% per year. Machine X Machine Y -146,000 -220,000 Initial cost, $ AOC, $/year Annual revenue, $/year Salvage value, $ Life, years -15,000 80,000 10,000 3 -10,000 75,000 25,000 6 In comparing the alternatives on a present worth basis, the PW of Machine X is closest toarrow_forward5.24 For the cash flows below, use an annual worth comparison to determine which alternative is best at an interest rate of 1% per month. First cost, $ M&O costs, $/month Overhaul every 10 years, $ Salvage value, $ Life, years X -90,000 -400,000 -30,000 -20,000 - Y 7000 3 - 25,000 10 Z -900,000 -13,000 -80,000 200,000 8arrow_forwardMechanical engineer at Company B is considering five equivalent projects, some of which have different life expectations. Salvage value is nil for all alternatives. Assuming that the company’s MARR is 13% per year, determine which should be selected (a) if they are independent, and (b) if they are mutually (c) Explain why your selection in part (b) is correct. First Cost, $ Net Annual Income, $/Year Life, Years A -20,000 +5,500 4 B −10,000 +2,000 6 C −15,000 3,800 6 D −60,000 +11,000 12 E −80,000 +9,000 12arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education