Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

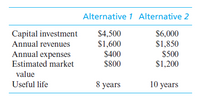

Consider these two alternatives. Solve, a. Suppose that the capital investment of Alternative 1 is known with certainty. By how much would the estimate of capital investment for Alternative 2 have to vary so that the initial decision based on these data would be reversed? The annual MARR is 15% per year. b. Determine the life of Alternative 1 for which the AWs are equal.

Transcribed Image Text:Alternative 1 Alternative 2

Capital investment

$4,500

$6,000

Annual revenues

$1,600

$1,850

Annual expenses

Estimated market

$400

$800

$500

$1,200

value

Useful life

8 years

10 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- K You have been offered a unique investment opportunity. If you invest $11,300 today, you will receive $565 one year from now, $1,695 two years from now, and $11,300 ten years from now. a. What is the NPV of the opportunity if the cost of capital is 5.7% per year? Should you take the opportunity? b. What is the NPV of the opportunity if the cost of capital is 1.7% per year? Should you take it now? a. What is the NPV of the opportunity if the cost of capital is 5,7% per year? If the cost of capital is 5.7% per year, the NPV is $. (Round to the nearest cent.)arrow_forwardSuppose an investment has an initial capital cost of $1100, an ongoing cost of $6.50 per year and an annual benefit of $80. If the project lasts for 20 years and the discount rate is 7%, the internal rate of return is: Provide your answer in percentage form (e.g. an IRR of 17.66% should be entered as 17.66) to 2 decimal places. Do not include any $ or % 's in your response.arrow_forwardCompute the value of a real option using the following information: PV(project cash flows) = 51.6, NPV(project cash flows) = 1.6, Project upfront cost = 50, Risk-free rate = 4%, NPV volatility = 45.9%, Years to expiration = 1, d1 = 0.0674, d2 = -0.3795, N(d1) = 0.5269, N(d2) = 0.3522, el-04"1) – 0.960789 Round your answer to two decimal places, e.g. 92.993 --> 92.99, 92.987 --> 92.99arrow_forward

- Suppose you have a project that has a 0.4 chance of tripling your investment in a year and a 0.6 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places.) What is the standard deviation?arrow_forwardProject X has an initial investment at time O of $1,000 and it returns $250 one year from now and$1,000 two years from now. Project Y has an initial investment at time O of $2,000 and it returns$2,534.40 two years from now. The risk level and the net present values of the two projects areequal. Calculate the required return for project X. Answer: 12% please do not solve with excelarrow_forwardA project under consideration has an internal rate of return of 16% and a beta of 0.9. The risk free rate is 6% and the expected rate of return on the market portfolio is 16%. A. What is the required rate of return? B. Should the project be accepted? C. What is the required rate of return on the project if it's beta is 1.90? D. If the projects beta is 1.90 should the project be accepted?arrow_forward

- For the following table, assume a MARR of 15%per year and a useful life for each alternative of eightyears which equals the study period. The rank-orderof alternatives from least capital investment to greatestcapital investment is Z → Y → W → X. Completethe incremental analysis by selecting the preferredalternative. “Do nothing” is not an option. (6.4)FE PRACTICE PROBLEMS 307Z → Y Y → W W → X! Capital −$250 −$400 −$550investment! Annual cost 70 90 15savings! Market 100 50 200value! PW(15%) 97 20 ???(a) Alternative W (b) Alternative X(c) Alternative Y (d) Alternative ZThe following mutually exclusive investment alternatives have been presented to you.arrow_forwardA project under consideration has an internal rate of return of 17% and a beta of 0.5. The risk-free rate is 9% and the expected rate of return on the market portfolio is 17%. A. What is the required rate of return on the project? B. Should the project be accepted? C. What is the required rate of return on the project if the beta is 1.50? D. If projects beta is 1.50, should the project be accepted?arrow_forwardYou are considering two alternative two-year investments: You can invest in a risky asset with a positive risk premium and returns in each of the two years that will be identically distributed and uncorrelated, or you can invest in the risky asset for only one year and then invest the proceeds in a risk-free asset. Which of the following statements about the first investment alternative (compared with the second) are true?a. Its two-year risk premium is the same as the second alternative.b. The standard deviation of its two-year return is the same.c. Its annualized standard deviation is lower.d. Its Sharpe ratio is higher.e. It is relatively more attractive to investors who have lower degrees of risk aversion.arrow_forward

- You are considering two similar but mutually exclusive investments. You have calculated that: Project A has an NPV = $7,600 and IRR = 19.80% Project B has an NPV = $11,200 and IRR = 17.30% Which project would you select? Project A O Project Barrow_forwardYou have been offered a unique investment opportunity. If you invest $8,900 today, you will receive $445 one year from now, $1,335 two years from now, and $8,900 ten years from now. a. What is the NPV of the opportunity if the cost of capital is 6.7% per year? Should you take the opportunity? b. What is the NPV of the opportunity if the cost of capital is 2.7% per year? Should you take it now?arrow_forwardA project under consideration has an internal rate of return of 18% and a beta of 0.5. The risk-free rate is 6%, and the expected rate of return on the market portfolio is 18%. a. What is the required rate of return on the project? (Do not round intermediate calculations. Enter your answer as a whole percent.) b. Should the project be accepted? c. What is the required rate of return on the project if its beta is 1.50? (Do not round intermediate calculations. Enter your answer as a whole percent.) d. If project's beta is 1.50, should the project be accepted?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education