FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

How do I solve 2,3 and 4

Transcribed Image Text:**Depreciation Expense Calculation Practice**

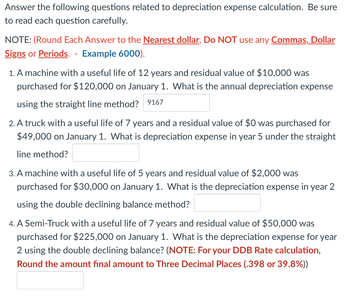

Answer the following questions related to depreciation expense calculation. Be sure to read each question carefully.

**NOTE:** (Round Each Answer to the **Nearest dollar**, Do **NOT** use any **Commas, Dollar Signs** or **Periods**. - Example 6000).

1. A machine with a useful life of 12 years and residual value of $10,000 was purchased for $120,000 on January 1. What is the annual depreciation expense using the straight line method?

- _Answer: 9167_

2. A truck with a useful life of 7 years and a residual value of $0 was purchased for $49,000 on January 1. What is depreciation expense in year 5 under the straight line method?

- _Answer:_

3. A machine with a useful life of 5 years and residual value of $2,000 was purchased for $30,000 on January 1. What is the depreciation expense in year 2 using the double declining balance method?

- _Answer:_

4. A Semi-Truck with a useful life of 7 years and residual value of $50,000 was purchased for $225,000 on January 1. What is the depreciation expense for year 2 using the double declining balance?

- _NOTE: For your DDB Rate calculation, Round the amount final amount to Three Decimal Places (.398 or 39.8%)._

- _Answer:_

Expert Solution

arrow_forward

Step 1: Meaning of depreciation

Depreciation means the loss in value of assets because of usage of assets , passage of time or change in technology.

Due to our policy , we can answer only first independent question. For rest answer , please post the question again with specific direction to solve the specific question.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Part 1 is incorrect. Could you try the problem again?arrow_forwardQuestion 5 Listen Looking at the graphs of the two functions below, can you state which of the function operations match with the given correct output values? Two Polynomial Graphs + 4 /g(2) 2 -2 f(x) -2 2 (f+g)(1) a. -2 (1-9)(1) b. 2 (g-(1) c. 6arrow_forwardWhat is The NPV for Machine B=arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education