FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

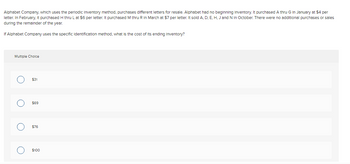

Alphabet Company, which uses the periodic inventory method, purchases different letters for resale. Alphabet had no beginning inventory. It purchased A thru G in January at $4 per letter. In February, it purchased H thru L at $6 per letter. It purchased M thru R in March at $7 per letter. It sold A, D, E, H, J and N in October. There were no additional purchases or sales during the remainder of the year.

If Alphabet Company uses the specific identification method, what is the cost of its ending inventory?

Multiple Choice

-

$31

-

$69

-

$76

-

$100

Transcribed Image Text:Alphabet Company, which uses the periodic Inventory method, purchases different letters for resale. Alphabet had no beginning Inventory. It purchased A thru G In January at $4 per

letter. In February, It purchased H thru L at $6 per letter. It purchased M thru R In March at $7 per letter. It sold A, D, E, H, J and N in October. There were no additional purchases or sales

during the remainder of the year.

If Alphabet Company uses the specific Identification method, what is the cost of its ending Inventory?

Multiple Choice

O

O

$31

$69

$76

$100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alphabet Company, which uses the periodic inventory method, purchases different letters for resale. Alphabet had no beginning inventory. It purchased A thru G in January at $5.00 per letter. In February, it purchased H thru L at $7.00 per letter. It purchased M thru R in March at $8.00 per letter. It sold A, D, E, H, J and N in October. There were no additional purchases or sales during the remainder of the year. If Alphabet Company uses the specific identification method, what is the cost of its ending inventory? Multiple Choice O O $81 $118 $36 $91arrow_forwarddont provide handwriing solution ...arrow_forwardDengerarrow_forward

- Delta Apparel Inc. uses a perpetual inventory system. At the beginning of the year inventory amounted to $ 50,000. During the year, the company purchased merchandise for $ 230,000 and sold merchandise costing $ 245,000. A physical inventory taken at year-end indicated shrinkage losses of $4,000. Prior to the recording of these shrinkage losses, the year-end balance in the companys Inventory account was :- a. $ 31,000 b. $ 35,000 c. $ 50,000 d. $ 55,00arrow_forwardFor all problems, assume the perpetual inventory: system is used unless stated otherwise. Accounting principles for inventory and applying the lower-of-cost-or-market rule Some of L and K Electronics ’s merchandise is gathering dust. It is now December 31, 2018, and the current replacement cost of the ending merchandise inventory is $32,000 below the business’s cost of the goods, which was $98,000. Before any adjustments at the end of the period, the company’s Cost of Goods Sold account has a balance of $410,000. Requirements Journalize any required entries. At what amount should the company report merchandise inventory on the balance sheet? At what amount should the company report the cost of goods sold on the income statement? Which accounting principle or concept is most relevant to this situation?arrow_forwardIntercontinental, Incorporated, uses a perpetual inventory system. Consider the following information about its inventory: August 1, purchased 10 units for $910 or $91 per unit, August 3, purchased 15 units for $1,590 or $106 per unit; August 14, sold 20 units; August 17, purchased 20 units for $2,300 or $115 per unit; August 28, purchased 10 units for $1,190 or $119 per unit; August 30, sold 23 units. Using FIFO, the cost of goods sold for the sale of 23 units on August 30 is and the inventory balance at August 30 is Cost of goods sold Inventory balancearrow_forward

- Intercontinental, Incorporated, uses a perpetual inventory system. Consider the following information about its inventory: August 1, purchased 10 units for $910 or $91 per unit; August 3, purchased 15 units for $1,590 or $106 per unit; August 14, sold 20 units; August 17, purchased 20 units for $2,300 or $115 per unit; August 28, purchased 10 units for $1,190 or $119 per unit; August 30, sold 23 units. Using FIFO, the cost of goods sold for the sale of 23 units on August 30 is ____ and the inventory balance at August 30 is _____.arrow_forwardPoole Company purchased two identical inventory items. One of the items, purchased in January, cost $40. The other, purchased in February, cost $52. One of the items was sold in March at a selling price of $140. Poole uses LIFO. Which of the following statements is true? Multiple Choice The balance in ending inventory would be $52. The amount of ending inventory would be $46. The amount of cost of goods sold would be $40. The amount of gross margin would be $88.arrow_forwardTamarisk, Inc. took a physical inventory on December 31 and determined that goods costing $190,000 were on hand. Not included in the physical count were $29,000 of goods purchased from Sheffield Corp., FOB, shipping point, and $24,000 of goods sold to Wildhorse Co. for $33,000, FOB destination. Both the Sheffield purchase and the Wildhorse sale were in transit at year-end. What amount should Tamarisk report as its December 31 inventory? Ending Inventory $arrow_forward

- Allied made its first and only purchase of inventory for the period on May 3 for 1,000 units at a price of $7 cash per unit (for a total cost of $7,000). Allied sold 500 of the units in inventory for $11 per unit (invoice total: $5,500) to Macy Co. under credit terms 2/10, n/60. Record the cost of goods sold. Macy returns 50 units because they did not fit the customer’s needs (invoice amount: $550). Allied restores the units, which cost $350, to its inventory. Macy discovers that 50 units are scuffed but are still of use and, therefore, keeps the units. Allied gives a price reduction (allowance) and credits Macy's accounts receivable for $150 to compensate for the damage. Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns, allowances, and any cash discount.arrow_forwardMoosier Inc. has been in operation for 3 years and uses the FIFO method of pricing inventory. During the fourth year, Moosier changes to the average-cost method for all its inventory. How will Moosier report this change?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education