FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

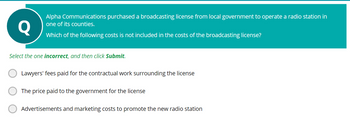

Transcribed Image Text:Alpha Communications purchased a broadcasting license from local government to operate a radio station in

one of its counties.

Q

Which of the following costs is not included in the costs of the broadcasting license?

Select the one incorrect, and then click Submit.

Lawyers' fees paid for the contractual work surrounding the license

The price paid to the government for the license

Advertisements and marketing costs to promote the new radio station

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- i need the answer quicklyarrow_forwardAs a result of remodeling services it performed on the site, La Mesa Construction, Inc. files a claim against Sister's Café to ensure the payment for its services. This claim would be O a levy, O a gamishment. O a mechanic's lien. O a guaranty.arrow_forward[The following information applies to the questions displayed below.] A recent annual report for Commonwealth Delivery included the following note: NOTE 1: DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES PROPERTY AND EQUIPMENT. Expenditures for major additions, improvements and flight equipment modifications are capitalized when such costs are determined to extend the useful life of the asset or are part of the cost of acquiring the asset. Expenditures for equipment overhaul costs of engines or airframes prior to their operational use are capitalized as part of the cost of such assets as they are costs required to ready the asset for its intended use. Maintenance and repairs costs are charged to expense as incurred . . . Assume that Commonwealth Delivery made extensive repairs on an existing building and added a new wing. The building is a garage and repair facility for delivery trucks that serve the Denver area. The existing building originally cost…arrow_forward

- The city of Belle collects property taxes for other local governments—Beau County and the Landis Independent School District (LISD). The city uses a Property Tax Collection Custodial Fund to account for its collection of property taxes for itself, Beau County, and LISD.The following transactions and events occurred for Belle's Custodial Fund.1. Property taxes were levied for Belle ( $1,000,000), Beau County ( $500,000) andLISD ( $1,500,000). Assume taxes collected by the Custodial Fund will bepaid to Belle’s General Fund.2. Property taxes in the amount of $2,250,000 are collected. The percentage collectedfor each entity is in the same proportion as the original levy.3. The amounts owed to Beau County and LISD are recognized.4. The Custodial Fund distributes the amounts owed to the three governments.Prepare journal entries to record the above transactions and events for Belle’s Custodial Fund. If an entry affects more than one debit or credit account, enter the accounts in order of…arrow_forwardZoomer inc. purchased a parcel of land with the intention of mining for phosphate. How should ghe land be recorded in zoomer ‘s financial statement while the company is determing the technical feasibility of mining the land? Assume that zoomer reports under ifrsarrow_forwardThe general real estate practice term for the standard by which real estate commission disputes are decided is, "Which real estate professional was the 4. of the sale?" The general real estate term for a real estate buyer who offers to purchase a property owner's property on terms otherwise acceptable to the owner/seller, who also has the financial capability to complete the purchase, is a buyer who is 5. andarrow_forward

- In 2020, Company W elected under Section 179 to expense $19,300 of the cost of qualifying property. However, it could deduct only $15,000 of the expense because of the taxable income limitation. In 2021, Company W's taxable income before any Section 179 deduction was $1,812,000. Required: a. Compute its 2021 Section 179 deduction if the total cost of qualifying property purchased in 2021 was $13,600. b. Compute its 2021 Section 179 deduction if the total cost of qualifying property purchased in 2021 was $1,048,000. Complete this question by entering your answers in the tabs below. Answer is complete but not entirely correct. Required A Required B Compute its 2021 Section 179 deduction if the total cost of qualifying property purchased in 2021 was $1,048,000. Deduction $ 1,040,000 Xarrow_forwardA buyer working with QRS Realty wants to make an offer on a property. To save time, the buyer makes a verbal offer of $210,000 and the seller agrees. The offer is: -invalid because it does not include a closing date-unenforceable because it is not in writing-voidable because the licensee did not review the offer-unilateral because the contract is not exclusivearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education