Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

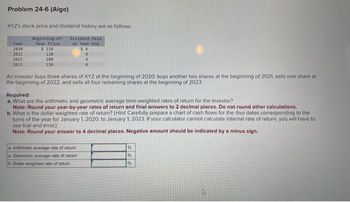

Transcribed Image Text:Problem 24-6 (Algo)

XYZ's stock price and dividend history are as follows:

Beginning of

Year Price

$ 110

Year

2020

2021

2022

2023

120

100

110

Dividend Paid

at Year-End

$4

An investor buys three shares of XYZ at the beginning of 2020, buys another two shares at the beginning of 2021, sells one share at

the beginning of 2022, and sells all four remaining shares at the beginning of 2023.

Required:

a. What are the arithmetic and geometric average time weighted rates of return for the investor?

Note: Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations.

b. What is the dollar-weighted rate of return? (Hint Carefully prepare a chart of cash flows for the four dates corresponding to the

turns of the year for January 1, 2020, to January 1, 2023. If your calculator cannot calculate internal rate of return, you will have to

use trial and error.)

Note: Round your answer to 4 decimal places. Negative amount should be indicated by a minus sign.

a.Arithmetic average rate of return

a. Geometric average rate of return

b. Dollar-weighted rate of return

%

%

%

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- rmn.3arrow_forwardQuestion 12 of 14 View Policies Current Attempt in Progress Blue Corporation earned net income of $402.040 in 2025 and had 95,000 shares of common stock outstanding throughout the year. Also outstanding all year was $850,000 of 5% bonds, which are convertible into 16,000 shares of common. Blue's tax rate is 30 percent. Compute Blue's 2025 diluted earnings per share. (Round answer to 2 decimal places, e.g. 3.55) Diluted earnings per share < eTextbook and Media Save for Later $arrow_forward18 Long Answer Problem - Investments Below are two investment scenarios. Please review each scenario and select the 21 appropriate responses to compete the journal entries. Investment Scenario A 24 On December 1, 2022, Paper and Paint Inc. (P&P) purchased 17,500 common shares in Craft Co. for $3.50 per share. Paper and Paint Inc. intends to sell these shares as quickly as possible to make gains on the market. Craft Co. paid no dividends during 2022 and on December 31, 2022 (P&P's year end) its shares were trading at $4.25 per share. Paper and Paint Inc. sells the shares on January 15, 2023 when the shares are trading at $4.00.arrow_forward

- Subject: acountingarrow_forwardQuestion 3 On 6 July 2021, Falta Limited paid $300 to purchase a put option on Zebra Limited when the market price per ordinary shares was $120. The option gives Falta Limited to sell 500 shares at an exercise price of $120 and the option expires on 1 February 2022. Market price per share $ Time value of put Option $ Date 30 September 2021 31 December 2021 123 180 115 100 1 February 2022 112 30 Required: Prepare the journal entries for Falta for the following dates: (a) On 6 July 2021 to record the investment in the put option. (b) On 30 September 2021 when Falta Limited prepared the financial statements. (c) On 31 December 2021 when Falta Limited prepared the financial statements. (d) On 1 February 2022 when Falta Limited settled the call option.arrow_forwardBrief Exercise 10-50Preferred and Common Stock Dividends Brookshed Corporation has a single class of common stock and a single class of cumulative preferred stock. The cumulative preferred stock requires the corporation to pay an annual dividend of $11,000 to preferred stockholders. On January 1, 2019, Brookshed's preferred dividends were 1 year in arrears, which means that Brookshed declared neither preferred nor common dividends in 2018. During the next 3 years (2019–2021), Brookshed's board of directors determined they would be able to pay $17,000, $18,000, and $21,000, respectively. Required: Show how these anticipated payments will be split between preferred and common stockholders. If an amount box does not require an entry, leave it blank and if the answer is zero, enter "0".arrow_forward

- Please do not give solution in image format thankuarrow_forwardQuestion 16 A stock expects to pay a dividend of $3.97 per share one year from today. After paying the dividend, the stock can be sold for $82.85 per share. If the appropriate discount rate for the stock is 16.81 percent, how much is one share of the stock worth today? a $74.33 $492.86 $70.93 None of these options are correct $23.62arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education