FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:TB MC Qu. 15-93 Polson Pool Company is involved in...

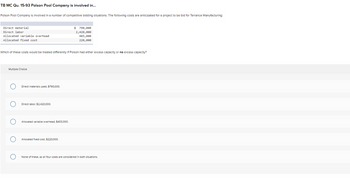

Polson Pool Company is involved in a number of competitive bidding situations. The following costs are anticipated for a project to be bid for Terrance Manufacturing:

Direct material

Direct labor

Allocated variable overhead

Allocated fixed cost

Which of these costs would be treated differently If Polson had either excess capacity or no excess capacity?

Multiple Choice

Direct materials used, $790,000.

Direct labor, $2,420,000.

Allocated variable overhead, $403,000.

$ 790,000

2,420,000

403,000

220,000

Allocated fixed cost, $220,000.

None of these, as all four costs are considered in both situations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Need ANSWER please provide Solutionsarrow_forwardThe JAG Company has assembled the following data pertaining to certain costs that cannot be easily identified as either fixed or variable. JAG Company has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation. The following are data from the most recent periods: Cost Hours $25,000 5,025 25,100 4,000 34,000 7,515 60,370 15,500 38,000 9.500 Required: (a) Using the high-low method, estimate the cost function. Round to two decimal places. Show work to receive partial credit!! (b) Calculate the estimated total costs at an operating level of 6,000 hours. Show work to receive partial credit!!!arrow_forward1. Top-down versus bottom-up estimates. pts. a. Describe the methods and uses of each of the approaches. 2. Compare the advantages and disadvantages of each of the approaches. 3. What are the three types of costs discussed in the text? Define them. 4. For a small project requiring 120 hours at $50/hr and having a direct overhead rate of 40%, calculate the direct cost (Exercise 1 in Chapter 5). To that add indirect costs (G&A) at 20% and then profit at 20% for a total project price. What are the estimated costs for: Design Programming In-house testing Which “approach to estimating” is this? What weaknesses are inherent in this approach? 5. Take another look at Exercise #5. Use Exercise Figure 5.1 on page 160. But now you are asked to do a bottom-up estimate based on the following data and compare it with the top-down estimate of $800,000. If confronted with these two estimates, what, if any, actions would you take? Deliverables Estimated Hours Rate:…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education