ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

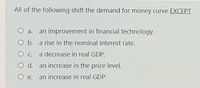

Transcribed Image Text:All of the following shift the demand for money curve EXCEPT

O a.

an improvement in financial technology.

O b. a rise in the nominal interest rate.

a decrease in real GDP.

O d. an increase in the price level.

O e.

an increase in real GDP.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- and the real money If the inflation rate is higher than the rate of growth of the nominal money supply, the nominal money supply supply (M/P) O a. Stays constant; rises O b. Stays constant; falls O c. Rises; falls O d. Rises; stays constant mo thonarrow_forwardThe quantity theory of money begins with the equation of exchange, MV = PY, and then adds the assumptions that Select one: A. velocity and potential GDP are independent of the quantity of money. B. potential GDP and the price level are independent of the quantity of money. C. velocity and the price level are independent of the quantity of money. D. potential GDP and the quantity of money are independent of the price level. O E. velocity varies inversely with the interest rate, and the price level is independent of the quantity of money.arrow_forwardIn regard to monetary policies, nonactivists have various proposals. True or False: Some nonactivists believe in the Taylor rule, which suggests that the annual money-supply growth rate should be based on the growth rates of velocity and Real GDP to ensure that the price level does not fluctuate. O False O True Which of the following statements best explains the difference between the Taylor rule and the two other nonactivist rules (the constant-money growth rate rule and the predetermined-money growth rate rule)? O The Taylor rule does not take into account the stability of prices. O The Taylor rule suggests how much the money supply should grow. O The Taylor rule does not take into account the current state of the economy. O The Taylor rule is not a derivation of the equation of exchange.arrow_forward

- Which point/s represent an equilibrium in the goods market? a. A only O b. A and D O c. A and C O d. All of the above Which point/s represent an equilibrium in the money market? O a. A and D O b. All of the above O c. A only O d. A and C A decrease in autonomous spending will decrease the equilibrium interest rate. O a. False; keep O b. False; increase O c. False; not affect because autonomous spending is not related to interest rate O d. Truearrow_forwardIn the short run, what would be the result of an increase in the monetary base? Assume the reserve ratio is unchanged. O a. Demand for money decreases. Ob. Demand for money increases. O c. Quantity demanded of money decreases. O d. Price level decreases. O e. Nominal interest rate falls.arrow_forwardConsider a situation where the central bank increases the money supply. equal, if nominal GDP increased by $800 billion during a time when veloc did the central bank increase the money supply? O $400 million O $200 million O $200 billion O $400 billion No new data to save. Last checkarrow_forward

- Nonearrow_forwardindicates that, in the long run, if the money supply increases at a slower rate than real GDP, there will be _ in the price level. Select one: O A. The equation of exchange; an increase O B. The quantity theory of money; an increase O . The equation of exchange; a decrease O D. The quantity theory of money; a decreasearrow_forwardThe reserve requirement is 10%. Suppose that the Fed sells $100,000 worth of U.S. government securities from a bond dealer, electronically debiting the dealer's deposit account at Reliable Bank. Which of the following correctly describes the immediate effect of this transaction on the money supply? O A. The money supply decreases by $1,000.000. O B. The money supply decreases by $100,000. O C. The money supply decreases by $90,000. O D. There is no change in the money supply. O E. None of the above.arrow_forward

- If economists say that monetary policies cannot affect GDP in the long run, what do they mean? O a. Monetary policy will change potential output and inflation by equal amounts O b. Only fiscal policies can affect potential output O C. Workers and firms have money illusion O d. Workers and firms have no money illusionarrow_forwardIf the quantity of money supplied is greater than the quantity of money demanded, then the a. price level falls. O b. money supply decreases. C. nominal interest rate rises. d. nominal interest rate falls. O e. price of bonds falls.arrow_forwardThe monetary multiplier is 3 and the change in the monetary base is $100,000. How much will the quantity of money increase? O a. $300,000 O b. $70,000 c. $200,000 O d. $100,000 O e. $33,333arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education