FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

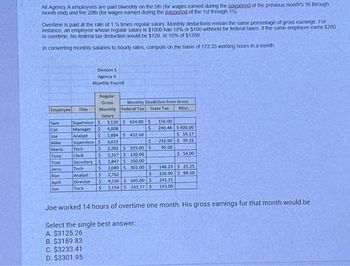

Transcribed Image Text:All Agency A employees are paid biweekly on the 5th (for wages earned during the payperiod of the previous month's 16 through

month end) and the 20th (for wages earned during the payperiod of the 1st through 15)

Overtime is paid at the rate of 1 % times regular salary Monthly deductions remain the same percentage of gross earnings. For

instance, an employee whose regular salary is $1000 has 10% or $100 withheld for federal taxes. If the same employee earns $200

in overtime, his federal tax deduction would be $120, or 10% of $1200

In converting monthly salaries to hourly rates, compute on the basis of 173.33 working hours in a month.

Employee Title

Sam

Cat

Joe

Mike

Maria

Tony

Tom

Jerry

Ron

April

Jon

Division S

Agency A

Monthly Payroll

Monthly Federal Tax

Salary

Supervisor S 3,120 $ 624.00 $

Manager $4,008

S

Analyst

Tech

Clerk

Regular

Gross

Tech

Analyst

Director

Tech

Monthly Deudction from Gross

State Tax

Misc.

156.00

240.48

$

Supervisor S

2,884 $ 432.60

3,615

S

95.00

2,202 S315.00 S

S

S

1,317 $130.00

1,847 $ 250.00

Secretary S

$ 2,089 $ 301.00 $

$

$ 2,762

$4,536 S 695.00 $

$ 2,154 5 333.77 S

$600.00

$14.17

216.90 $39.15

$ 54.00

146.23 $ 25.25

126.00 $98.10

241.31

193.00

Joe worked 14 hours of overtime one month. His gross earnings for that month would be

Select the single best answer:

A. $3125.26

B. $3189.83

C. $3233.41

D. $3301.95

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Thomas Martin receives an hourly wage rate of $16, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $363; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? Oa. $832 Ob. $1,536 Oc. $1,152 Od. $768arrow_forwardIn 20--, the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. Round your answers to the nearest cent. If an amount is zero, enter "0". a. November 15 Name and Title AnnualSalary OASDI TaxableEarnings OASDI Tax HI TaxableEarnings HI Tax Hanks, Timothy, President $152,520 $ $ $ $ Grath, John, VP Finance 137,760 James, Sally, VP Sales 68,400 Kimmel, Joan, VP Mfg. 58,800 Wie, Pam, VP Personnel 52,800 Grant, Mary, VP Secretary 45,600 b. December 31 Name and Title AnnualSalary OASDI TaxableEarnings OASDI Tax HI TaxableEarnings HI Tax Hanks, Timothy, President $152,520 $ $ $ $ Grath, John, VP Finance 137,760 James, Sally, VP Sales 68,400 Kimmel, Joan, VP Mfg. 58,800 Wie, Pam, VP Personnel 52,800…arrow_forwardZolnick Enterprises has two hourly employees-Kelly and Jon. Both employees earn overtime at the rate of 1.5 times the hourly rate for hours worked in excess of 40 per week. Assume the Social Security tax rate is 6 percent on the first $110,000 of wages, and the Medicare tax rate is 1.5 percent on all earnings. Federal income tax withheld for Kelly and Jon was $270 and $233, respectively, for the first week of January. The following information is for the first week in January Year 1. Employee Kelly Jon Required a. Calculate the gross pay for each employee for the week. b. Calculate the net pay for each employee for the week. c. Prepare the general journal entry to record payment of the wages. Req A and B a. b. Hours Worked 54 49 Complete this question by entering your answers in the tabs below. Wage Rate per Hour $ 22 $ 27 Gross pay Net pay Req C Calculate the gross pay for each employee for the week. Calculate the net pay for each employee for the week. (Round intermediate…arrow_forward

- Thomas Martin receives an hourly wage rate of $25, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $308; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? a.$1,300 b.$1,800 c.$2,400 d.$1,200arrow_forwardThomas Martin receives an hourly wage rate of $16, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 47; federal income tax withheld, $354; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? a.$1,504 b.$808 c.$1,128 d.$752arrow_forwardOn January 15, the end of the first pay period of the year, North Company's employees earned $40,000 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $3,100 of federal income taxes, $593 of medical insurance deductions, and $230 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record North Company's January 15 salaries expense and related liabilities. View transaction list Journal entry worksheet 1 Record the employee payroll for period. Note: Enter debits before credits. Date January 15 General Journal Debit Credit Record entry Clear entry View general journalarrow_forward

- sarrow_forwardThomas Martin receives an hourly wage rate of $17, with time-and-a-half pay for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $324; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? Round your answer to the nearest whole dollar. O a. $1,564 O b. $782 O c. $833 O d. $1,173arrow_forwardSwifty Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Employee Hours Worked Hourly Rate Federal Income Tax Withholdings United Fund Ben Abel 40 $14.00 $59.00 $5.00 Rita Hager 41 16.00 64.00 5.00 Jack Never 44 13.00 60.00 8.00 Sue Perez 46 13.00 62.00 5.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.6%. 1. Prepare a payroll register for the weekly payroll. No employee has reached the Social Security limit of $132,900 or the FUTA/SUTA limit of $7,000 2. Journalize the payroll on March 15, 2022, and the accrual of employer payroll taxes. 3. Journalize the payment of the payroll on March 16,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education