FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

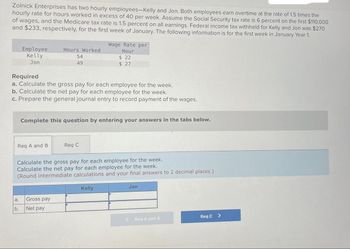

Transcribed Image Text:Zolnick Enterprises has two hourly employees-Kelly and Jon. Both employees earn overtime at the rate of 1.5 times the

hourly rate for hours worked in excess of 40 per week. Assume the Social Security tax rate is 6 percent on the first $110,000

of wages, and the Medicare tax rate is 1.5 percent on all earnings. Federal income tax withheld for Kelly and Jon was $270

and $233, respectively, for the first week of January. The following information is for the first week in January Year 1.

Employee

Kelly

Jon

Required

a. Calculate the gross pay for each employee for the week.

b. Calculate the net pay for each employee for the week.

c. Prepare the general journal entry to record payment of the wages.

Req A and B

a.

b.

Hours Worked

54

49

Complete this question by entering your answers in the tabs below.

Wage Rate per

Hour

$ 22

$ 27

Gross pay

Net pay

Req C

Calculate the gross pay for each employee for the week.

Calculate the net pay for each employee for the week.

(Round intermediate calculations and your final answers to 2 decimal places.)

Kelly

Jon

Req A and B

Req C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sean Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, married, 2 allowances), social security taxes, and state income tax (2%). Enter deductions beginning with a minus sign (-). Click here to access the Wage-Bracket Method Tables. Gross pay $ Federal income tax Social security taxes - OASDI Social security taxes - HI State income tax Net pay $arrow_forwardKmuarrow_forwardOld Town Entertainment has two employees in Year 1. Clay earns $3,500 per month, and Philip, the manager, earns $10,400 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $130,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 16 percent of gross earnings for Clay and 21 percent for Philip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December. c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee? Complete this question by entering your answers in the tabs below. Reg A and B Req C a. Clay a Philip b. Clay b. Philip Reg D Calculate the net pay for both Clay and Philip for March. Calculate the net pay for both Clay and Philip for December. (Do not…arrow_forward

- Peter Greeda's regular hourly wage rate is $13, and he receives 1.5 times his normal rate for hours worked in excess of 40. During a March pay period, Peter worked 47 hours. Peter's federal income tax withholding is $80, and he has no voluntary deductions. Compute Peter's gross earnings for the pay period. Round your answer to 2 decimal places.arrow_forwardOld Town Entertainment has two employees in Year 1. Clay earns $4,500 per month, and Philip, the manager, earns $10,700 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $110,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 15 percent of gross earnings for Clay and 22 percent for Philip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December. c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee? Complete this question by entering your answers in the tabs below. Req A and B a. Clay Calculate the net pay for both Clay and Philip for March. Calculate the net pay for both Clay and Philip for December. (Do not round intermediate calculations and…arrow_forwardHolden Smith manages a Dairy World drive-in. His straight-time pay is $18 per hour, with time-and-a-half for hours in excess of 40 per week. Smith's payroll deductions include withheld income tax of 30%, FICA tax, and a weekly deduction of $10 for a charitable contribution to United Way. Smith worked 57 hours during the week. (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 1. Compute Smith's gross pay and net pay for the week. Assume earnings to date are $10,000. (Round all amounts to the nearest cent.) Begin by computing Smith's gross pay for the week. Gross Pay Compute Smith's net pay for the week. (Round all amounts to the nearest cent.) Withholding deductions:arrow_forward

- The following information is available for the employees of Webber Packing Company for the first week of January Year 1 1. Kayla earns $26 per hour and 1½ times her regular rate for hours over 40 per week. Kayla worked 50 hours the first week in January. Kayla’s federal income tax withholding is equal to 11 percent of her gross pay. Webber pays medical insurance of $57 per week to a retirement plan for her. 2. Paula earns a weekly salary of $1,150. Paula’s federal income tax withholding is 17 percent of her gross pay. Webber pays medical insurance of $145 per week for Paula and contributes $135 per week to a retirement plan for her. 3. Vacation pay is accrued at the rate of 2 hours per week (based on the regular pay rate) for Kayla and $75 per week for Paula. Assume the Social Security tax rate is 6 percent on the first $110,000 of salaries and the Medicare tax rate is 1.5 percent of total salaries. The state unemployment tax rate is 5.4 percent and the federal unemployment…arrow_forwardLaura Corbin’s regular hourly wage rate is $20, and she receives an hourly rate of $30 for work in excess of 40 hours. During a January pay period, Laura works 45 hours. Laura’s federal income tax withholding is $98, she has no voluntary deductions, and the FICA tax rate is 7.65%. Use January 15 for the end of the pay period and the payment date.1. Prepare the journal entries to record (a) Laura’s pay for the period and (b) the payment of Laura’s wages. (Round Intermediate calculation and final answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardCarrie Rosenburg worked 45 hours the first week of the calendar year and earns regular wages of $16/hour. She is paid an overtime rate 1.5 times her regular wage rate, contributes 4% of her gross pay to a 401(k) plan, and contributes $30/week to a flexible spending account. Her Social Security tax for the week is $____?arrow_forward

- Justin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, head of household), social security taxes, and state income tax (2%).arrow_forwardHerbert Sully manages a Frosty Boy drive-in. His straight-time pay is $20 per hour, with time-and-a-half for hours in excess of 40 per week. Sully's payroll deductions include withheld income tax of 30%, FICA tax, and a weekly deduction of $6 for a charitable contribution to United Way. Sully worked 56 hours during the week. (Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Compute Sully's gross pay and net pay for the week. Assume earnings to date are $14,000. (Round all amounts to the nearest cent.) Begin by computing Sully's gross pay for the week. Gross Payarrow_forwardOn March 31 AAA Company paid cash to Amal Green at a rate of $140 per day for eight days' work. Amal is not married. Her wages are deducted for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $112. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee and FICA Medicare taxes are 1.45% of gross pay. Required:1. Calculate her net pay for the eight days' work paid on March 31. (Round your answer to 2 decimal places. Do not round intermediate calculations.) 2. Record the journal entry for March 31 to reflect the payroll payment to Amal. (Round your answers to 2 decimal places. Do not round intermediate calculations.)3. Record the journal entry to reflect the (employer) payroll tax expenses for the March 31 payroll payment. Assume Amal has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company. (Round your answers to 2 decimal places.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education