FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:8

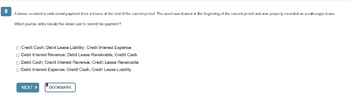

A lessor received a cash rental payment from a lesses at the end of the current period. The assel was leased at the beginning of the current period and was properly recorded as a sales-type Inase

Which journal entry should the lessor use to record the payment?

O Credit Cash; Debit Lease Liability: Credit Interest Expense

O Debit Interest Revenue; Debit Lease Receivable; Credit Cash

Debit Cash; Credit Interest Revenue; Credit Lease Receivable

Debit Interest Expense; Credit Cash; Credit Lease Liability

NEXT >

BOOKMARK

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Baillie Power leased high-tech electronic equipment from Courtney Leasing on January 1, 2021. Courtney purchased the equipment from Doane Machines at a cost of $252,000, its fair value. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Quarterly lease payments Economic life of asset Interest rate charged by the lessor 2 years (8 quarterly periods) $17,000 at Jan. 1, 2021, and at Mar. 31, June 30, Sept. 30, and Dec. 31 thereafter 5 years 12% Required: Prepare a lease amortization schedule and appropriate entries for Baillie Power from the beginning of the lease through December 31, 2021. December 31 is the fiscal year end for each company. Appropriate adjusting entries are recorded at the end of each quarter. X Answer is not complete. Complete this question by entering your answers in the tabs below.arrow_forwardView Policies Current Attempt in Progress 1. 2. Prepare the journal entries that the lessee should make to record the above transactions assuming the entities report under ASPE. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) The lessee makes a lease payment of $75,200 to the lessor for equipment in an operating lease transaction. Wildhorse Company leases equipment from Noble Construction Inc. The present value of the lease payments is $658,000. The lease qualifies as a capital lease.. No. Account Titles 1. 2. List of Accounts Save for Later Debit Credit Attempts: 0 of 1 used Submit Answerarrow_forwardWhich of the following documents must be executed at closing to create a binding relationship between the property being offered as collateral and the loan financing it? An escrow agreement and a mortgage A promissory note and a mortgage or deed of trust A promissory note and a property conveyance binder A mortgage or a deed of trust and a recordable affidavitarrow_forward

- Recording Entries for Finance Lease-No Residual On January 1 of Year 1, Ashe Company entered into a five-year equipment lease (with no renewal options) requiring payments of $28,000, with the first payment due immediately. The lessor's implicit interest rate, known to Ashe, is 6%. Ownership of the equipment remains with the lessor at expiration of the lease. There is no option to purchase the property at the end of the lease term and the equipment is expected to have no residual value. The equipment has an estimated economic life of five years. a. How would Ashe Company classify the lease? Finance lease ◆ b. Prepare a schedule of the lease liability for the 5-year lease term. • Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Date Jan. 1, Year 1 Jan. 1, Year 1 $ Jan. 1, Year 2 Jan. 1, Year 3 Jan. 1, Year 4 Jan. 1, Year 5 Total $ Lease Payment 0 x $ 0 x 0 x 0 x 0 x 0 $ Interest on Liability Lease…arrow_forwardWhich of the following would NOT be shown in the Statement of Profit or Loss? Expired portion of insurance Withdrawal of supplies by the owner Depreciation of fixed assets for the period Services rendered to a customer on accountarrow_forwardA lease transfers the right to use an identified asset for a period of time in exchange for rental payments. True Falsearrow_forward

- When a lessor receives cash on an operating lease, which of the following accounts is increased? A. Lease Payable B. Interest Revenue: Leases C. Lease Receivable D. Rent Revenuearrow_forward2). A landlord records the collection of a tenant's security deposit as a(n): 1. liability 2. prepaid expenses 3. contingent liability 4. contra liability 1). Which of the following statements regarding accounting for leases is true? a. If the lease term is one year or longer, a liability must be recognized. b. leases accounting rule will result in more assets and liabilities being recognized on the balance sheet c. Leasing will likely remain popular because leases do not require a large initial outlay of cash d. All of these are correct e. None of these are correct `arrow_forwardPlease Correct answerarrow_forward

- Larkspur Leasing Company signs a lease agreement on January 1, 2025, to lease electronic equipment to Crane Company. The term of the non-cancelable lease is 2 years, and payments are required at the end of each year. The following information relates to this agreement. 1. Crane has the option to purchase the equipment for $27,000 upon termination of the lease. It is not reasonably certain that Crane will exercise this option. 2. The equipment has a cost of $330, 000 and fair value of $368,000 to Larkspur Leasing. The useful economic life is 2 years, with a residual value of $27,000. 3. Larkspur Leasing desires to earn a return of 6% on its investment. 4. Collectibility of the payments by Larkspur Leasing is probable. Prepare the journal entries on the books of Larkspur Leasing to record the payments received under the lease and to recognize income for the years 2025 and 2026. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is…arrow_forwardCrane Leasing Company signs an agreement on January 1, 2025, to lease equipment to Cullumber Company. The following information relates to this agreement. 1. 2. 3. 4. 5. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. The cost of the asset to the lessor is $230,000. The fair value of the asset at January 1, 2025, is $230,000. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24,339, none of which is gu guaranteed. The agreement requires equal annual rental payments, beginning on January 1, 2025. Collectibility of the lease payments by Crane is probable.arrow_forwardOn January 1, 2024, QuickStream Communications leased telephone equipment from Digium, Incorporated Digium's cash selling price for the equipment is $1,959,867. The lease agreement specifies six annual payments of $450,000 beginning December 31, 2024, and on each December 31 thereafter through 2029. The six-year lease is equal to the estimated useful life of the equipment. The contract specifies that lease payments for each year will increase by the higher of (a) the increase in the Consumer Price Index for the preceding year or (b) 2%. The CPI at the beginning of the lease is 120. Digium routinely leases equipment to other firms. The interest rate in these lease arrangements is 10%. Note: Use tables, Excel, or a financial calculator. ( FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate journal entries for QuickStream to record the lease at its beginning date of January 1, 2024 - - 1 Record the beginning of the lease for QuickStream…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education