FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Alcorn Service Company was formed on January 1. Year 1.

Events Affecting the Year 1 Accounting Period

1. Acquired $64,000 cash from the issue common stock.

2. Purchased $2,000 of supplies on account.

3. Purchased land that cost $26,000 cash.

4. Paid $2,000 cash to settle accounts payable created in Event 2

5. Recognized revenue on account of $50,000.

6. Paid $25,000 cash for other operating expenses.

7. Collected $42,000 cash from accounts receivable.

Information for Year 1 Adjusting Entries

8. Recognized accrued salaries of $3,600 on December 31, Year 1

9. Had $600 of supplies on hand at the end of the accounting period.

Events Affecting the Year 2 Accounting Period

1. Acquired $24,000 cash from the issue of common stock.

2. Paid $3,600 cash to settle the salaries payable obligation.

3. Paid $4,800 cash in advance to lease office space.

4. Sold the land that cost $26,000 for $26,000 cash.

5. Received $6,000 cash in advance for services to be performed in the future.

6. Purchased $1,400 of supplies on account during the year.

7. Provided services on account of $36,000.

8. Collected $37,000 cash from accounts receivable.

9. Paid a cash dividend of $9,000 to the stockholders.

10. Paid other operating expenses of $23,500.

Information for Year 2 Adjusting Entries

11. The advance payment for rental of the office space (see Event 3) was made on March 1 for a one-year term.

12. The cash advance for services to be provided in the future was collected on October 1 (see Event 5). The one-year

contract started on October 1.

13. Had $700 of supplies remaining on hand at the end of the period.

14. Recognized accrued salaries of $4,300 at the end of the accounting period.

15. Recognized $800 of accrued interest revenue.

Required

Identify each event affecting the Year 1 and Year 2 accounting periods as asset source (AS), asset use (AU), asset exchange (AE), or

claims exchange (CE). Record the effects of each event under the appropriate general ledger account headings of the accounting

equation.

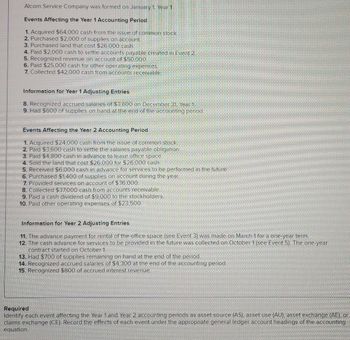

![Identify each event affecting the Year 2 accounting periods as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Record the effects of each event under the

appropriate general ledger account headings of the accounting equation. (Do not round intermediate calculations. Enter any decreases to account balances with a minus sign.)

Event

Bal

1.

2

3

4

5

6

7

8

9.

10

11.

12

13.

14.

15

Totals

Type

of

Event

Cash

01

Assets

Accounts

Receivable Supplies

0

0

ALCORN SERVICE COMPANY

Accounting Equation for Year 2

Prepaid

Rent

0

Land

0

Interest

Receivable

-

=

=

2

0] =

=

Accounts.

Payable

0

Liabilities

Salaries Unearned

Payable Revenue

0

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

0 +

Stockholders' Equity

Retained

Earnings

Common

Stock

0](https://content.bartleby.com/qna-images/question/b0c53c3c-d25b-4f46-ae7f-d9559756d1d4/13e273b2-03ff-4109-b880-0edf3e09c4d7/i57yj7_thumbnail.jpeg)

Transcribed Image Text:Identify each event affecting the Year 2 accounting periods as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Record the effects of each event under the

appropriate general ledger account headings of the accounting equation. (Do not round intermediate calculations. Enter any decreases to account balances with a minus sign.)

Event

Bal

1.

2

3

4

5

6

7

8

9.

10

11.

12

13.

14.

15

Totals

Type

of

Event

Cash

01

Assets

Accounts

Receivable Supplies

0

0

ALCORN SERVICE COMPANY

Accounting Equation for Year 2

Prepaid

Rent

0

Land

0

Interest

Receivable

-

=

=

2

0] =

=

Accounts.

Payable

0

Liabilities

Salaries Unearned

Payable Revenue

0

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

0 +

Stockholders' Equity

Retained

Earnings

Common

Stock

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following events apply to Paradise Vacations's first year of operations: 1. Acquired $32,000 cash from the issue of common stock on January 1, Year 1. 2. Purchased $1,400 of supplies on account. 3. Paid $5,640 cash in advance for a one-year lease on office space. 4. Earned $40,350 of revenue on account. 5. Incurred $14,300 of other operating expenses on account. 6. Collected $30,000 cash from accounts receivable. 7. Paid $9,600 cash on accounts payable. 8. Paid a $4,200 cash dividend to the stockholders. Information for Adjusting Entries 9. There was $270 of supplies on hand at the end of the accounting period. 10. The lease on the office space covered a one-year period beginning November 1. 11. There was $4,800 of accrued salaries at the end of the period. Required a. Record these transactions in general journal form. b. Post the transaction data from the journal to ledger T-accounts. c. Prepare a trial balance. d-1. Prepare an income statemen d-2. Prepare a statement of changes…arrow_forwardCoparrow_forwardJaguar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the following: Cash $22,000Investments (short-term) $3,000Accounts receivable $3,000Inventory $20,000Notes receivable (long-term) $1,000Equipment $50,000Factory building $90,000Intangibles $5,000Accounts payable $15,000Accrued liabilities payable. $4,000Notes payable (current) $7,000Notes payable (noncurrent) $47,000Common stock $10,000Additional paid-in capital $80,000Retained earnings $31,000 During the current year, the company had the following summarized activities: Purchased short-term investments for $10,000 cash. Lent $5,000 to a supplier, who signed a two-year note. Purchased equipment that cost $18,000; paid $5,000 cash and signed a one- year note for the balance. Hired a new president at the end of the year. The contract was for $85,000 per year plus options to purchase company stock at a set price based on company performance. The new president begins…arrow_forward

- S12arrow_forwardAnswer full question please.arrow_forwardJournalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forward

- Please help mearrow_forwardRequired information [The following information applies to the questions displayed below.] Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $31,000 cash from the issue of common stock. 2. Borrowed $43,000 cash from National Bank. 3. Earned cash revenues of $59,000 for performing services. 4. Paid cash expenses of $50,500. 5. Paid a $2,100 cash dividend to the stockholders. 6. Acquired an additional $31,000 cash from the issue of common stock. 7. Paid $11,000 cash to reduce the principal balance of the bank note. 8. Paid $50,000 cash to purchase land. 9. Determined that the market value of the land is $70,000. . Determine the net cash flows from operating activities, investing activities, and financing activities that Maben would report on the Year 1 statement of cash flows. Note: Enter cash outflows as negative amounts. Net cash flows from operating activities Net cash flows from investing activities…arrow_forwardPlease answer the full questionarrow_forward

- Required information [The following information applies to the questions displayed below.] Leach Incorporated experienced the following events for the first two years of its operations: Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $70,000 of services on account. 3. Provided $33,000 of services and received cash. 4. Collected $37,000 cash from accounts receivable. 5. Paid $16,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent. of the ending accounts receivable balance will be uncollectible. Year 2: 1. Wrote off an uncollectible account for $2,590. 2. Provided $90,000 of services on account. 3. Provided $25,000 of services and collected cash. 4. Collected $72,000 cash from accounts receivable. 5. Paid $22,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the…arrow_forward[The following information applies to the questions displayed below.] Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $35,000 cash from the issue of common stock. 2. Borrowed $35,000 cash from National Bank. 3. Earned cash revenues of $53,000 for performing services. 4. Paid cash expenses of $47,500. 5. Paid a $1,500 cash dividend to the stockholders. 6. Acquired an additional $25,000 cash from the issue of common stock. 7. Paid $9,000 cash to reduce the principal balance of the bank note. 8. Paid $58,000 cash to purchase land. 9. Determined that the market value of the land is $81,000. c. Identify the asset source transactions and related amounts for Year 1. Sources of Assets Event Total sources of assets Amountarrow_forwardPackard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $1.400 cash from the issue of common stock. 2) Borrowed $870 from a bank. 3) Earned $1,100 of revenues. 4) Paid expenses of $340 5) Paid a $140 dividend During Year 2. Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $775 of common stock. 2) Repaid $535 of its debt to the bank. 3) Earned revenues of $1,200. 4) Incurred expenses of $540. (5) Paid dividends of $190. The amount of total liabilities on Packard's Year 1 balance sheet is Multiple Choice с $870 $1,210 $610 $335 Drow 50 Nextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education