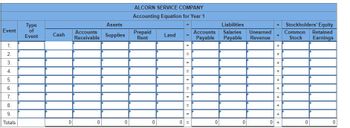

[The following information applies to the questions displayed below.]

Alcorn Service Company was formed on January 1, Year 1.

Events Affecting the Year 1 Accounting Period

-

Acquired $61,000 cash from the issue of common stock.

-

Purchased $1,400 of supplies on account.

-

Purchased land that cost $20,000 cash.

-

Paid $1,400 cash to settle accounts payable created in Event 2.

-

Recognized revenue on account of $44,000.

-

Paid $22,000 cash for other operating expenses.

-

Collected $39,000 cash from

accounts receivable .

Information for Year 1

-

Recognized accrued salaries of $3,300 on December 31, Year 1.

-

Had $300 of supplies on hand at the end of the accounting period.

Events Affecting the Year 2 Accounting Period

-

Acquired $21,000 cash from the issue of common stock.

-

Paid $3,300 cash to settle the salaries payable obligation.

-

Paid $3,900 cash in advance to lease office space.

-

Sold the land that cost $20,000 for $20,000 cash.

-

Received $5,100 cash in advance for services to be performed in the future.

-

Purchased $1,100 of supplies on account during the year.

-

Provided services on account of $33,000.

-

Collected $34,000 cash from accounts receivable.

-

Paid a cash dividend of $6,000 to the stockholders.

-

Paid other operating expenses of $20,500.

Information for Year 2 Adjusting Entries

-

The advance payment for rental of the office space (see Event 3) was made on March 1 for a one-year term.

-

The cash advance for services to be provided in the future was collected on October 1 (see Event 5). The one-year contract started on October 1.

-

Had $400 of supplies remaining on hand at the end of the period.

-

Recognized accrued salaries of $4,000 at the end of the accounting period.

-

Recognized $500 of accrued interest revenue.

Required

Identify each event affecting the Year 1 and Year 2 accounting periods as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Record the effects of each event under the appropriate general ledger account headings of the

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- [The following information applies to the questions displayed below.] Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $35,000 cash from the issue of common stock. 2. Borrowed $35,000 cash from National Bank. 3. Earned cash revenues of $53,000 for performing services. 4. Paid cash expenses of $47,500. 5. Paid a $1,500 cash dividend to the stockholders. 6. Acquired an additional $25,000 cash from the issue of common stock. 7. Paid $9,000 cash to reduce the principal balance of the bank note. 8. Paid $58,000 cash to purchase land. 9. Determined that the market value of the land is $81,000. c. Identify the asset source transactions and related amounts for Year 1. Sources of Assets Event Total sources of assets Amountarrow_forwardYowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) issued stock for $68,0002) borrowed $39,000 from its bank3) provided consulting services for $67,000 cash4) paid back $29,000 of the bank loan5) paid rent expense for $16,0006) purchased equipment for $26,000 cash7) paid $4,400 dividends to stockholders8) paid employees' salaries of $35,000 What is Yowell's net income for Year 1?arrow_forwardRequired information [The following information applies to the questions displayed below.] Cascade Company was started on January 1, Year 1, when it acquired $152,000 cash from the owners. During Year 1, the company earned cash revenues of $95,200 and incurred cash expenses of $67,000. The company also paid cash distributions of $10,000. Required Prepare a Year 1 income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows under each of the following assumptions. (Consider each assumption separately.) c. Cascade is a corporation. It issued 10,000 shares of $11 par common stock for $152,000 cash to start the business. Complete this question by entering your answers in the tabs below. Inc Stmt Stmt of Changes Bal Sheet Cash Flows Prepare a income statement for Year 1. CASCADE COMPANY Income Statement For the Year Ended December 31, Year 1arrow_forward

- Packard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $1.400 cash from the issue of common stock. 2) Borrowed $870 from a bank. 3) Earned $1,100 of revenues. 4) Paid expenses of $340 5) Paid a $140 dividend During Year 2. Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $775 of common stock. 2) Repaid $535 of its debt to the bank. 3) Earned revenues of $1,200. 4) Incurred expenses of $540. (5) Paid dividends of $190. The amount of total liabilities on Packard's Year 1 balance sheet is Multiple Choice с $870 $1,210 $610 $335 Drow 50 Nextarrow_forwardBetter Corporation completed the following transactions during Year 2: Purchased land for $5,000 cash. Acquired $25,000 cash from the issue of common stock. Received $75,000 cash for providing services to customers. Paid cash operating expenses of $42,000. Borrowed $10,000 cash from the bank. Paid a $5,000 cash dividend to the stockholders. Determined that the market value of the land purchased in event 1 is $35,000. Required a. Record the transactions in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. b. As of December 31, Year 2, determine the total amount of assets, liabilities, and stockholders’ equity and present this information in the form of an accounting equation. c. What is the amount of total assets, liabilities, and stockholders’ equity as of January 1, Year 3?arrow_forwardRequired information [The following information applies to the questions displayed below.] Laser Delivery Services, Incorporated (LDS), was incorporated January 1. The following transactions occurred during the year: a. Received $34,000 cash from the company's founders in exchange for common stock. b. Purchased land for $12,500, signing a two-year note (ignore interest). c. Bought two used delivery trucks at the start of the year at a cost of $10,000 each; paid $2,000 cash and signed a note due in three years for $18,000 (ignore interest). d. Paid $1,500 cash to a truck repair shop for a new motor, which increased the cost of one of t e. Stockholder Jonah Lee paid $290,000 cash for a house for his personal use. 4. Prepare a classified balance sheet for Laser Delivery Services at December 31. Include Retained Earnings on the balance sheet even though the account has a zero balance. LASER DELIVERY SERVICES, INCORPORATED S Balance Sheet trucks. 10 0 0 0arrow_forward

- Multiple Choice $1,095 $990 $5,665 $5,365arrow_forwardSubmit correct and complete solutions. give propriate Explanation. Provide step-by-step detailed explanations.arrow_forwardA company reported the following transactions during the year: o Issued bonds worth $100,000 o Paid $20,000 in interest o Purchased a building for $150,000 o Received dividends of $5,000 o Sold equipment for $25,000 Classify these transactions into operating, investing, and financing activities.arrow_forward

- Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $30,000 cash from the issue of common stock. 2. Borrowed $40,000 cash from National Bank. 3. Earned cash revenues of $48,000 for performing services. 4. Paid cash expenses of $45,000. 5. Paid a $1,000 cash dividend to the stockholders. 6. Acquired an additional $20,000 cash from the issue of common stock. 7. Paid $10,000 cash to reduce the principal balance of the bank note. 8. Paid $53,000 cash to purchase land. 9. Determined that the market value of the land is $75,000. e. Determine the net cash flows from operating activities, investing activities, and financing activities that Maben would report on the Year 1 statement of cash flows. Note: Enter cash outflows as negative amounts. Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financing activitiesarrow_forwardLabel each transaction as an Operating Activity, Investing activity, or Financing Activity and if it is an inflow or (outflow). 1. Drake issued 10,000 shares of common stock for $40,000 2. Drake collected $80,000 from customers on Accounts Receivables 3. Drake Paid $5,000 in interest payments on their bonds 4. Drake purchased a new copy machine and paid cash of $35,000 5. Drake sold their old copy machine for $2,000 cash 6. Drake paid a $4,500 dividend to shareholders 7. Drake borrowed $40,000 cash from the bank on December 28,2019 (payments begin 1/28/20) 8. Drake purchased a patent for $15,000 cash 9. Drake paid $65,000 cash in wages during 2019 10. Drake paid 2018 taxes due in the amount of $10,500 on April 15, 2019 Indicate the total net cashflow (Inflow-Outflow) from above for each classification: Operating Investing Financingarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education