FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

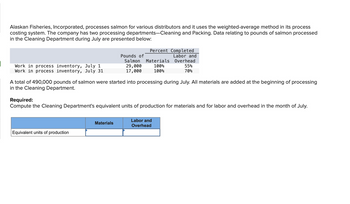

Transcribed Image Text:Alaskan Fisheries, Incorporated, processes salmon for various distributors and it uses the weighted-average method in its process

costing system. The company has two processing departments-Cleaning and Packing. Data relating to pounds of salmon processed

in the Cleaning Department during July are presented below:

Work in process inventory, July 1

Work in process inventory, July 31

Percent Completed

Labor and

Overhead

Equivalent units of production

Pounds of

Salmon Materials

29,000 100%

17,000 100%

A total of 490,000 pounds of salmon were started into processing during July. All materials are added at the beginning of processing

in the Cleaning Department.

Materials

Required:

Compute the Cleaning Department's equivalent units of production for materials and for labor and overhead in the month of July.

55%

70%

Labor and

Overhead

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Easy Incorporated uses the FIFO method in its process costing system. The following data concern the operations of the company’s first processing department for a recent month. Work in process, beginning: Units in process 1,400 Percent complete with respect to materials 90% Percent complete with respect to conversion 10% Costs in the beginning inventory: Materials cost $ 1,910 Conversion cost $ 1,502 Units started into production during the month 24,600 Units completed and transferred out 24,700 Costs added to production during the month: Materials cost $ 71,821 Conversion cost $ 543,448 Work in process, ending: Units in process 1,300 Percent complete with respect to materials 70% Percent complete with respect to conversion 70% Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d.…arrow_forwardpre.2arrow_forwardThe information below was obtained from the records of the first processing department of California Corporation for the month of July. The company uses the weighted-average method in its process costing system. units percent completed: Labor and overhead work in process inventory, July 1 20,000 40% started during the month 70,000 completed during the month 80,000 Work in process inventory, July 31 ? 25% All materials are added at the beginning of the manufacturing process. The equivalment units for labor and overhead for the month is: 70,000 90,000 80,000 82,500arrow_forward

- Alaskan Fisheries, Inc., processes salmon for various distributors and it uses the weighted-average method in its process costing system. The company has two processing departments—Cleaning and Packing. Data relating to pounds of salmon processed in the Cleaning Department during July are presented below: Percent Completed Pounds of Salmon Materials Labor and Overhead Work in process inventory, July 1 20,000 100 % 30 % Work in process inventory, July 31 25,000 100 % 60 % A total of 380,000 pounds of salmon were started into processing during July. All materials are added at the beginning of processing in the Cleaning Department. Required: Compute the Cleaning Department's equivalent units of production for materials and for labor and overhead in the month of July.arrow_forwardPureform, Incorporated, uses the weighted-average method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow. Units 76,000 Materials $ 68,400 Labor $ 30,200 Overhead $ 41,900 Work in process inventory, beginning Units started in process 719,000 Units transferred out 740,000 Work in process inventory, ending 55,000 Cost added during the month $ 984,725 $ 372,370 $ 517,225 The beginning work in process Inventory was 90% complete with respect to materials and 75% complete with respect to labor and overhead. The ending work in process inventory was 70% complete with respect to materials and 10% complete with respect to labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Determine the first department's cost per equivalent unit for materials, labor, and overhead for the month. (Round your answers to…arrow_forwardPureform, Incorporated, uses the FIFO method of process costing. It manufactures a product passing through two departments. Data for a recent month for the first department follow: bints Work in process inventory, beginning Units started in process Units transferred out eBook Print Work in process inventory, ending Cost added during the month References Units 58,000 549,000 570,000 Materials $ 56,200 Labor $ 19,700 Overhead $ 24,100 37,000 $ 627,670 $ 164,130 $ 191,485 The beginning work in process inventory was 80% complete for materials and 65% complete for labor and overhead. The ending work in process inventory was 60% complete for materials and 40% complete for labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Compute the first department's cost per equivalent unit for materials, labor, overhead, and in total for the month. Note: Round your answers to 2 decimal places. 1. Equivalent…arrow_forward

- Carlberg Company has two manufacturing departments, Assembly and Painting. The Assembly department started 12,200 units during November. The following production activity in both units and costs refers to the Assembly department's November activities. Assembly Department Beginning work in process inventory. Units started this period Units completed and transferred out Ending work in process inventory Cost of beginning work in process Direct materials Conversion Costs added this month Direct materials Conversion Cost per Equivalent Unit of Production Costs added this period Costs of beginning work in process Total costs + Equivalent units of production Cost per equivalent unit of production Units 3,000 12,200 10,000 5,200 Direct Materials $ Percent. Complete for Direct Materials 70% $ 1,484 804 12,936 16,926 85% Calculate the Assembly department's cost per equivalent unit of production for materials and for conversion for November. Use the weighted average method. 1,484 1,484 $ $ 2,288…arrow_forwardHearty Soup Co. uses a process cost system to record the costs of processing soup, which requires the cooking and filling processes. Materials are entered from the cooking process at the beginning of the filling process. The inventory of Work in Process—Filling on April 1 and debits to the account during April were as follows:Bal., 800 units, 30% completed:Direct materials (800 × $4.30) $ 3,440Conversion (800 × 30% × $1.75) 420 $ 3,860From Cooking Department, 7,800 units $34,320Direct labor 8,562Factory overhead 6,387During April, 800 units in process on April 1 were completed, and of the 7,800 units entering the department, all were completed except 550 units that were 90% completed.Charges to Work in Process—Filling for May were as follows:From…arrow_forwardMercier Manufacturing produces a plastic part in three sequential departments: Extruding, Fabricating, and Packaging. Mercier uses the weighted-average process costing method to account for costs of production in all three departments. The following information was obtained for the Fabricating Department for the month of September. Work in process on September 1 had 15,000 units made up of the following: Degree of Amount Completion Prior department costs transferred in from the Extruding Department Costs added by the Fabricating Department Direct materials Direct labor Manufacturing overhead Work in process, September 1 Direct materials Direct labor Manufacturing overhead Total costs added During September, 75,000 units were transferred in from the Extruding Department at a cost of $356,250. The Fabricating Department added the following costs: $ 214, 200 64,800 33,480 $ 312,480 Manufacturing overhead Direct materials. 100% Direct labor 60 50 $ 75,750 $36,000 9,300 8,520 $ 53,820 $…arrow_forward

- Super Sports Drinks, Inc. has two departments: Mixing and Bottling. Direct materials are added at the beginning of the mixing process and at the end of the bottling process. Conversions costs are added evenly throughout each process. Data for the month of May for the Mixing Department are as follows: Units Amount Beginning Work-in-Process Inventory 0 units Started in production 7,780 units Completed and transferred out to Bottling 4,110 units Ending Work-in-Process Inventory 60% through mixing process 3,670 units Costs Amount Beginning Work-in-Process Inventory $0.00 Costs added during May: Direct Materials $8,531 Direct Labor $2,264 Manufacturing overhead allocated $4,680 Total costs added during May $15,475 Complete the production report for the month of May.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forwardAlchemy Manufacturing produces a pesticide chemical and uses process costing. There are three processing departments Mixing, Refining, and Packaging. On January 1, the first department-Mixing-had no beginning inventory. During January, 52,000 fl. oz. of chemicals were started in production. Of these, 36,000 fl. oz. were completed and 16,000 fl. oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process, and conversion costs are applied evenly throughout the process. The weighted average method is used. At the end of the month, Alchemy calculated equivalent units of production. The ending inventory in the Mixing Department was 70% complete with respect to conversion costs. With respect to direct materials, what is the number of equivalent units of production in the ending inventory? OA. 16,000 equivalent units B. 36,000 equivalent units OC. 52,000 equivalent units OD. 11,200 equivalent units ***arrow_forward1. Assume that George Mason Medical Center has investments in a Building Replacement Fund with the following balances as of July 15, 2022 listed by category. The Investment Committee of the Board has approved a recommendation to reallocate these funds, and to include for the first-time common stocks from non-US companies. Assume that the portfolio will be rebalanced on August 1, 2022, to equal the Board's targeted desired allocation percentages. George Mason Medical Center Recommended Asset Allocation for Building Replacement Fund Rebalancing of Investment Portfolio as of July 15, 2022 Investment Description Cash and Cash Equivalents Fixed Income - Domestic Bonds Fixed Income - International Bonds Equities Large Cap Growth Equities - Large Cap Value Equities- Mid/Small Cap Growth Equities - Mid/Small Cap Value Equities International Total S Balance on 7/15/2022 12,000,000 32,000,000 10,000,000 13,000,000 25,000,000 11,000,000 12,000,000 S 115.000.000 Current Allocation % 10.4% 27.8%…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education