FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

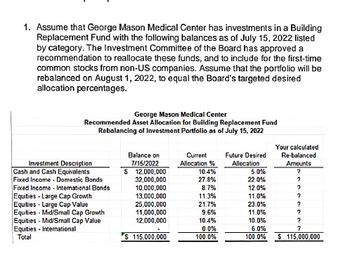

Transcribed Image Text:1. Assume that George Mason Medical Center has investments in a Building

Replacement Fund with the following balances as of July 15, 2022 listed

by category. The Investment Committee of the Board has approved a

recommendation to reallocate these funds, and to include for the first-time

common stocks from non-US companies. Assume that the portfolio will be

rebalanced on August 1, 2022, to equal the Board's targeted desired

allocation percentages.

George Mason Medical Center

Recommended Asset Allocation for Building Replacement Fund

Rebalancing of Investment Portfolio as of July 15, 2022

Investment Description

Cash and Cash Equivalents

Fixed Income - Domestic Bonds

Fixed Income - International Bonds

Equities Large Cap Growth

Equities - Large Cap Value

Equities- Mid/Small Cap Growth

Equities - Mid/Small Cap Value

Equities International

Total

S

Balance on

7/15/2022

12,000,000

32,000,000

10,000,000

13,000,000

25,000,000

11,000,000

12,000,000

S 115.000.000

Current

Allocation %

10.4%

27.8%

8.7%

11.3%

21.7%

9.6%

10.4%

0.0%

100.0%

Your calculated

Re-balanced

Amounts

5.0%

?

22.0%

?

12.0%

?

11.0%

?

23.0%

?

11.0%

?

10.0%

?

6.0%

?

100.0% $ 115,000,000

Future Desired

Allocation

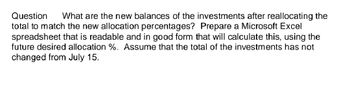

Transcribed Image Text:Question What are the new balances of the investments after reallocating the

total to match the new allocation percentages? Prepare a Microsoft Excel

spreadsheet that is readable and in good form that will calculate this, using the

future desired allocation %. Assume that the total of the investments has not

changed from July 15.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carrow_forward-Based on the ratios calculated in Part 1, you will perform a ratio-based analysis. You should divide your discussion into four parts: liquidity, solvency, operational efficiency, and profitability. Ensure to choose the right ratios to discuss a specific part. -Find the relationships among ratios and trends over the three years compared. Also, compare these relationships and trends with those of Target. -In the last part of your discussion, you will show your investment decision: buy or not buy Walmart. You may want to split your investment between two companies. Tell me your rationale for your decision - Your discussion and final investment decision should solely be based on the ratio analysis, although investors also use various non financial information in their investment decision-making.arrow_forwardTo calculate the withdrawal amount from an account in which you want to decrease the balance, you use the __________________ formulaarrow_forward

- To evaluate a decision today you should compare _______. To evaluate a prior decision at the end of the year you should compare _______. Required and expected; required and realized Required and realized; required and expected Expected and required; expected and realized Expected and realized; expected and required Expected and realized; required and realized Required and realized; expected and realizedarrow_forwardA) Calculate the Return on Investment (ROI) for each of the portfolio. B) Based on the required rate of return, determine the Residual Income (RI)for each of the portfolio. C) If King Bhd is to choose only ONE (1) portfolio to invest in, advise the management team based of your answer in (a). Please provide a calculation for each of them.arrow_forwardMatch each sentence to the correct concept. a) the amount an investment is worth after one or more time periods is referred to as............................ b) the process of finding the present value of some future amount is called.............................. c) calculating the present value of a future cash flow to determine its value today is known as....................................... d) Interest earned on the principal and may be for a number of years may be called...................................... e .................................. is the process of acculating interest in an investment over time to earn more interest. f) the interest earned on both the initial principal and the interest reinvested from prior periods is reffered to as............... ..........................arrow_forward

- Which of the following returns is known at the beginning of an investment (or at the beginning of the semester for your grades)? Realized and required Realized and expected Expected and requiredarrow_forwardTo 4-digit accuracy, what is the Mean of IWM return and the Mean of EEM return?arrow_forwardCop dogarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education