Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Assume all bonds have a face or par value of 1,000 unless told otherwise

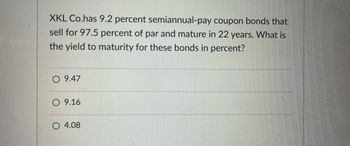

Transcribed Image Text:XKL Co.has 9.2 percent semiannual-pay coupon bonds that

sell for 97.5 percent of par and mature in 22 years. What is

the yield to maturity for these bonds in percent?

O 9.47

O 9.16

O 4.08

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- III. Discuss why the effective interest method to amortize bonds premiums or discounts is preferable to straight line method. Present your views in maximum 200 words. D Focusarrow_forwardThe debt component of convertible bonds issued using IFRS is the a. present value of the future cash flows at the market interest rate b. present value of the future cash flows at the stated interest rate c. market value of similar bonds without a conversion feature d. same as the calculation for GAAParrow_forward39. Help me selecting the right answer. Thank youarrow_forward

- In theory (disregarding any other marketplace variables), the proceeds from the sale of a bond will be equal to The face amount of the bond plus the present value of the interest payments made during the life of the bond. The sum of the face amount of the bond and the periodic interest payments The face amount of the bond The present value of the bond maturity value plus the present value of the interest payments to be made during the life of the bond.arrow_forwardFrom page 9-3 of the VLN, when determining the issue price of a bond, which interest rate would you use? Group of answer choices A. Stated rate B. Market rate C. Nominal rate D. Compound ratearrow_forwardWhich of the following is considered the principal when figuring interest for a bond? Group of answer choices face of the bond effective interest rate life of bond none of thesearrow_forward

- The coupon rate of a bond is typically __________.a. fixed at the time of bond issuanceb.subject to change based on the federal funds ratec.zero in the case of zero - coupon bondsd. Both A and Carrow_forward22) The effective interest rate method of amortizing bonds allocates the same amount of interest expense to each period. TRUE FALSEarrow_forwardHow do you calculate the price of a bond? It is: The sum of the present value of the face amount and the value of credit default swaps The sum of the future value of annuity of interest and the fair value of its inventory The sum of the present value of annuity of interest and the face amount of the bond The sum of the current value of the issuing corporation of accounts receivables None of the above.arrow_forward

- 3. Which of the following bonds pay no interest until maturity? a. zero-coupon bondsb. registered bondsc. serial bondsd. debenture bondsarrow_forward11. Under the straight-line amortization method, interest expense on a bond sold at a premium is equal to the a. interest paid plus bond premium amortizationb. interest rate times the book value of the bondsc. interest rate times the face value of the bondsd. interest paid minus bond premium amortizationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education