FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:no

Have All Questions been Answered?

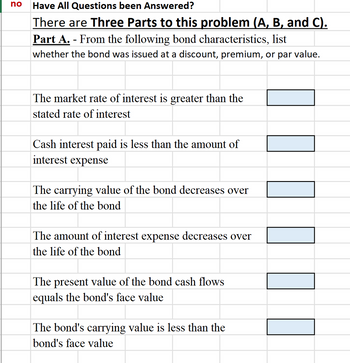

There are Three Parts to this problem (A, B, and C).

Part A. From the following bond characteristics, list

whether the bond was issued at a discount, premium, or par value.

The market rate of interest is greater than the

stated rate of interest

Cash interest paid is less than the amount of

interest expense

The carrying value of the bond decreases over

the life of the bond

The amount of interest expense decreases over

the life of the bond

The present value of the bond cash flows

equals the bond's face value

The bond's carrying value is less than the

bond's face value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- When bonds are issued at a discount and the effective interest method is used for amortization, at each successive interest payment date, the interest expense: Select one: a. Increases b. Is equal to the change in market value of the bonds c. Decreases d. Is equal to the change in carrying value of the bonds e. Stays the samearrow_forwardushaarrow_forwardWhen determining the amount of interest to be paid on a bond, which of the following information is not necessary? a. The length of the interest period, annually or semiannually b. The face rate of interest on the bonds c. The face amount of the bonds d. The selling price of the bondsarrow_forward

- Why does the required rate of return for a particular bond change over time?arrow_forwardAll of the following refer to the face rate of interest on a bond except: a. stated rate b. effective rate c. nominal rate d. coupon ratearrow_forwardDiscuss how does the length of time until maturity for a bond influence the relationship between market rates of interest and bond price.arrow_forward

- For a standard U.S. Treasury bond, when are the following characteristics of the bond determined? The amounts of any interest payments. The dates of any interest payments. The bond's market yield. The bond's market price. The amount that the Treasury returns to the bondholder, when the bond matures. The price that the bondholder pays to the Treasury to acquire the bond. The maturity date. 1. 2. Fixed before the bonds are sold and does not change. Fixed when the bonds are sold and does not change. 3. Fluctuates continually.arrow_forwardUnder what situation might a bond discount arise when issuing bonds? Select one: a. The coupon rate is less than the effective or yield rate. b. The effective or yield rate is less than the coupon rate. c. The coupon rate is less than the cash rate of interest. d. The effective or yield rate is less than the market rate of interest.arrow_forwardFrom page 9-3 of the VLN, when determining the issue price of a bond, which interest rate would you use? Group of answer choices A. Stated rate B. Market rate C. Nominal rate D. Compound ratearrow_forward

- What happens to Bond prices, quantities, and interest rates if (Make sure to include the supply and demand graph for bonds for each question : a) Decrease in wealth b) Increase in risk c) Decrease in liquidityarrow_forwardWhich of the following is considered the principal when figuring interest for a bond? Group of answer choices face of the bond effective interest rate life of bond none of thesearrow_forwardWhich of the following is FALSE regarding bonds? Long term bonds have greater interest rate risk than do short term bonds. A bond indenture describes the terms of the bond issue. Bonds represent ownership in the company. if interest rates in the market go up, the present value of existing bonds goes down. A bond issuer is legally required to make the interest payments and repay the par value at maturity. Previous Page Next Page Page 12 of 30arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education