FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

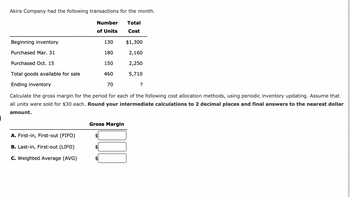

Transcribed Image Text:Akira Company had the following transactions for the month.

Total

Cost

Beginning inventory

Purchased Mar. 31

Number

of Units

A. First-in, First-out (FIFO)

B. Last-in, First-out (LIFO)

C. Weighted Average (AVG)

130

180

150

460

Purchased Oct. 15

Total goods available for sale

Ending inventory

Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that

all units were sold for $30 each. Round your intermediate calculations to 2 decimal places and final answers to the nearest dollar

amount.

70

$1,300

2,160

2,250

5,710

Gross Margin

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ojo Industries tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the accounting period, January 31. The inventory’s selling price is $12 per unit. Transactions Unit Cost Units Total Cost Inventory, January 1 $ 4.00 190 $ 760 Sale, January 10 (170 ) Purchase, January 12 4.50 240 1,080 Sale, January 17 (110 ) Purchase, January 26 5.50 70 385 Assume that for Specific identification method the January 10 sale was from the beginning inventory and the January 17 sale was from the January 12 purchase. Required: Compute the amount of goods available for sale, ending inventory, and cost of goods sold at January 31 under each of the following inventory costing methods: (Round your intermediate…arrow_forwardFLCL Company had the following transactions for the month: Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. first-in, first-out (FIFO) last-in, first-out (LIFO) weighted averagearrow_forwardScrappers Supplies tracks the number of units purchased and sold throughout each accounting perlod but applies Its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions Units Unit Cost Beginning inventory, January 1 Transactions during the year: a. Purchase on account, March 2 b. Cash sale, April 1 ($48 each) c. Purchase on account, June 30 d. Cash sale, August 1 ($48 each) 170 $ 32 330 34 (410) 220 38 (80) Required: 1-a. Calculate the Cost of Goods Sold and Ending Inventory for Scrappers Supplies assuming it applies the LIFO cost method perpetually at the time of each sale. TIP: The sale of 410 units on April 1 is assumed, under LIFO, to consist of the 330 units purchased March 2 and 80 units from beginning inventory. 1-b. Does the use of a perpetual inventory system result in a higher or lower Cost of Goods…arrow_forward

- Park Company’s perpetual inventory records indicate the following transactions in the month of June: 1. Compute the cost of goods sold for June and the inventory at the end of June using each of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places and other amounts to the nearest dollar.) 2. Next Level Why are the cost of goods sold and ending inventory amounts different for each of the three methods?what do these amounts tell us about the purchase price of inventory during the year? 3. Next Level Which method produces…arrow_forwardOahu Kiki tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki's records show the following for the month of January. Sales totaled 310 units. Beginning Inventory Purchase Purchase Date January 1 January 15 January 24 Units 140 470 240 Unit Cost $ 85 95 115 Total Cost $ 11,900 44,650 27,600 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO, (b) LIFO, and (c) weighted average cost methods.arrow_forwardThe following data are available for Sellco for the fiscal year ended on January 31, 2020: Sales 830 units Beginning inventory 230 units @ $ 4 Purchases, in chronological order 290 units @ $ 5 450 units @ $ 7 250 units @ $ 7 Required:a. Calculate cost of goods sold and ending inventory under the cost flow assumptions, FIFO, LIFO and Weighted average (using a periodic inventory system): (Round unit cost to 2 decimal places.) b. Assume that net income using the weighted-average cost flow assumption is $15,300. Calculate net income under FIFO and LIFO. (Round unit cost to 2 decimal places.)arrow_forward

- Akira Company had the following transactions for the month. Numberof Units Costper Unit Beginning Inventory 150 $10 Purchased Mar. 31 170 15 Purchased Oct. 15 150 18 Ending Inventory 50 ? Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Round your intermediate calculations to 2 decimal places and final answers to the nearest dollar amount. Ending Inventory A. First-in, First-out (FIFO) $fill in the blank 1 B. Last-in, First-out (LIFO) $fill in the blank 2 C. Weighted Average (AVG) $fill in the blank 3arrow_forwardOahu Kiki tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki's records show the following for the month of January. Sales totaled 260 units. Beginning Inventory Purchase Purchase Date January 1 January 15 January 24 Units 100 360 240 Unit Cost $ 75 95 115 Total Cost $ 7,500 34,200 27,600 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO, (b) LIFO, and (c) weighted average cost methods.arrow_forwardWhat is the Weighted average cost per unit?arrow_forward

- A company reports the following beginning inventory and 2 purchases for the month of January. On January 26, the company sells 350 units. Ending inventory at January 31 totals 150 units Units Unit Cost Beginning Inventory 320 units $10.00 Purchases on January 9 80 5.20 Purchases on January 25 100 5.54 Required Assume the perpetual inventory system is used. Determine the costs assigned to the ending inventory when costs are assigned based on a. The weighted average method ( Round per unit costs and inventory amounts to cents)arrow_forwardAkira Company had the following transactions for the month. Numberof Units Costper Unit Beginning Inventory 150 $10 Purchased Mar. 31 160 15 Purchased Oct. 15 150 18 Ending Inventory 50 ? Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Round your intermediate calculations to 2 decimal places and final answers to the nearest dollar amount. Ending Inventory A. First-in, First-out (FIFO) $fill in the blank 1 B. Last-in, First-out (LIFO) $fill in the blank 2 C. Weighted Average (AVG) $fill in the blank 3arrow_forwardTrini Company had the following transactions for the month. Calculate the ending inventory dollar value for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. first-in, first-out (FIFO) last-in, first-out (LIFO) weighted average (AVG)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education