FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

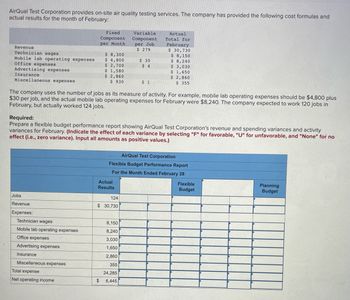

Transcribed Image Text:AirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and

actual results for the month of February:

Revenue

Technician wages

Mobile lab operating expenses

Office expenses

Advertising expenses

Insurance

Miscellaneous expenses

Jobs

Revenue

Expenses:

Technician wages

Mobile lab operating expenses

Office expenses

Fixed

Component

per Month

Advertising expenses

Insurance

$ 8,300

$ 4,800

$ 2,700

$ 1,580

$ 2,860

$930

Miscellaneous expenses

Total expense

Net operating income

The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,800 plus

$30 per job, and the actual mobile lab operating expenses for February were $8,240. The company expected to work 120 jobs in

February, but actually worked 124 jobs.

Required:

Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity

variances for February. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no

effect (i.e., zero variance). Input all amounts as positive values.)

Variable

Component

per Job

$ 279

Actual

Results

$ 30

$ 4

124

$ 30,730

$ 1

8,150

8,240

3,030

1,650

2,860

355

24,285

$ 6,445

Actual

Total for

February

$ 30,730

$ 8,150

$ 8,240

$ 3,030

$1,650

$ 2,860

$ 355

AirQual Test Corporation

Flexible Budget Performance Report

For the Month Ended February 28

Flexible

Budget

Planning

Budget

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- AirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: Fixed Component per Month Variable Component Revenue per Job $ 278 Actual Total for February $ 33,390 Technician wages $ 8,600 $ 8,450 Mobile lab operating expenses $ 5,000 $ 33 $ 9,130 Office expenses $ 2,700 $ 2 $ 2,810 Advertising expenses $ 1,570 $ 1,640 Insurance $ 2,860 Miscellaneous expenses $ 930 $ 1 $ 2,860 $ 365 The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $5,000 plus $33 per job, and the actual mobile lab operating expenses for February were $9,130. The company expected to work 130 jobs in February, but actually worked 136 jobs. Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February. (Indicate the effect of each variance by selecting…arrow_forwardCalculate and Use Overhead Rate Selected data for the consulting department of Austin Consulting, Inc., follow:. Estimated consulting overhead cost for the year $440,000 Estimated direct labor cost for the year (@ $9/hr.) 180,000 Actual manufacturing overhead cost for January 19,500 Actual direct labor cost for January (1,200 hours) 11,000 Assuming that direct labor hours is the basis for applying consulting overhead, a. Calculate the predetermined overhead rate. $ per direct labor hour b. Prepare a journal entry that applies consulting overhead for January. General Journal Description Debit Credit c. By what amount is consulting overhead over- or under applied in January?arrow_forwardanswer in text form please (without image)arrow_forward

- PLEASE DO NOT GIVE ASNWER IN IMAGE FORMATarrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company provided the following cost formulas and actual results for the month of February: Fixed Component per Month Variable Component Actual Total per Job for February Revenue Technician wages Office expenses $ 280 $ 36,450 $ 8,500 $ 8,350 Mobile lab operating expenses $ 4,700 $ 34 $ 9,300 $ 2,200 $ 3 $ 2,470 Advertising expenses $ Insurance 1,590 $ 2,860 $ Miscellaneous expenses $ 940 $ 2 1,660 $ 2,860 $ 525 The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,700 plus $34 per job, and the actual mobile lab operating expenses for February were $9,300. The company expected to work 140 jobs in February but actually worked 146 Jobs. Required: Prepare a flexible budget performance report for February. Note: Indicate the effect of each variance by selecting "F" for favorable. "U" for unfavorable, and "None" for no effect (I.e., zero variance).…arrow_forwardDecker Screw Manufacturing Company produces special screws made to customer specifications. During June, the following data pertained to these costs: Summary of Direct Materials Requisitions Department Job Requisition Cost per Number Number Number Quantity 4,950 Unit 1 2906 B9766 $ 1.30 2 2907 B9767 190 22.00 1 2908 B9768 1,160 9.00 1 2906 B9769 4,830 1.31 2 2908 B9770 31 48.00 Summary of Direct Labor Time Tickets Cost per Department Job Ticket Number Number Number Hours Unit $ 6.50 1,118 152 1 2906 1056-1168 2907 2121-2130 9.00 1 2908 1169-1189 167 6.50 2 2908 2131-1239 48 9.00 2906 1190-1239 826 6.50 Summary of Factory Overhead Application Rates Department Number Basis of Application Rates $3 per direct labor hour 1 2 150% of direct labor cost Decker had no beginning Work-in-Process Inventory for June. Of the jobs begun in June, Job 2906 was completed and sold on account for $30,000, Job 2907 was completed but not sold, and Job 2908 was still in process. Required: 1. Calculate the…arrow_forward

- immy Author Company has the following data for the past year: Actual overhead $512,000 Applied overhead: Work-in-process inventory $125,000 Finished goods inventory 170,000 Cost of goods sold 150,000 Total $445,000 Calculate the overhead variance for the year and close it to cost of goods sold. Provide all the details and working outs.arrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company provided the following cost formulas and actual results for the month of February: Revenue Technician wages Mobile lab operating expenses Office expenses Advertising expenses Insurance Miscellaneous expenses Fixed Component per Month Variable Component per Job $ 276 Actual Total for February $ 30,370 $8,150 $ 8,540 $ 8,300 $ 4,500 $ 35 $2,700 $3 $2,910 $1,550 $ 2,860 $940 $ 1,620 $2,860 $1 $ 365 The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,500 plus $35 per job, and the actual mobile lab operating expenses for February were $8,540. The company expected to work 120 jobs in February but actually worked 122 jobs. Required: Prepare a flexible budget performance report for February. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all…arrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: Revenue Technician wages Mobile lab operating expenses Office expenses Advertising expenses Insurance Miscellaneous expenses Fixed Component per Month $ 8,300 $ 4,600 $ 2,200 $ 1,590 $ 2,860 $ 960 Variable Component per Job $ 279 $ 32 $ 3 $ 1 Actual Total for February $ 30,730 $ 8,150 $ 8,280 $ 2,410 $ 1,660 $ 2,860 $ 385 The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,600 plus $32 per job, and the actual mobile lab operating expenses for February were $8,280. The company expected to work 120 jobs in February, but actually worked 128 jobs. Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February. (Indicate the effect of each variance by selecting…arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardManjiarrow_forwardSunland Co. gathered the following information on power costs and factory machine usage for the last six months: Power Cost Factory Machine Hours $28,390 15,800 36,069 21,400 32,895 18,700 ITT 26,235 15,100 23,890 13,500 20,700 Month January February March April May June Using the high-low method of analyzing costs, answer the following questions and show computations to support your answers. (a) Your answer is correct. What is the estimated variable portion of power costs per factory machine hour? (Round answer to 2 decimal places, e.g. 15.25.) Variable power costs $ (b) eTextbook and Media * Your answer is incorrect. 10.500 Fixed power costs What is the estimated fixed power cost each month? High 1.41 per factory machine hour 20,683 $ Low Attempts: 1 of 5 usedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education