FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

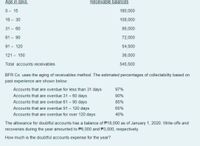

Transcribed Image Text:Age in days

Receivable balances

0- 15

180,000

16 - 30

108,000

31 - 60

95,000

61 - 90

72,000

91 - 120

54,500

121 - 150

36,000

Total accounts receivables

545,500

BFR Co. uses the aging of receivables method. The estimated percentages of collectability based on

past experience are shown below:

Accounts that are overdue for less than 31 days

97%

Accounts that are overdue 31 – 60 days

Accounts that are overdue 61 - 90 days

90%

85%

Accounts that are overdue 91 - 120 days

Accounts that are overdue for over 120 days

65%

40%

The allowance for doubtful accounts has a balance of P18,000 as of January 1, 2020. Write-offs and

recoveries during the year amounted to P6,000 and P3,000, respectively.

How much is the doubtful accounts expense for the year?

Transcribed Image Text:BFR Co. sells to wholesalers on terms of 2/15, net 30. An analysis of BFR Co.'s trade receivable

balances on December 31, 20x1, revealed the following:

Age in days

Receivable balances

0- 15

180,000

16 - 30

108,000

31 - 60

95,000

61- 90

72 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Daley Company prepared the following aging of receivables analysis at December 31. Total 0 Accounts receivable Percent uncollectible $ 625,000 $ 407,000 1 to 30 $ 101,000 Days Past Due 31 to 60 $ 47,000 61 to 90 $ 29,000 Over 90 $ 41,000 3% 4% 7% 9% 12% a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,100 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,100 debit. Answer is not complete. Complete this question by entering your answers in the tabs below. Req A Req B and C Estimate the balance of the Allowance for Doubtful Accounts assuming the company…arrow_forwardEstimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as follows. Age Class PercentUncollectible Not past due 2% 1-30 days past due 4 31-60 days past due 18 61-90 days past due 40 Over 90 days past due 75 Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff Industries Estimate the Allowance for Doubtful Accounts Balance Not PastDue Days PastDue 1-30 Days PastDue 31-60 Days PastDue 61-90 Days PastDue Over 90 Subtotals $1,050,000 $600,000 $220,000 $115,000 $85,000 $30,000 Conover Industries 30,000 30,000 Keystone Company 18,000 18,000 Moxie Creek Inc. 9,000 9,000 Rainbow Company 26,400 26,400 Swanson Company 46,600 46,600 Total receivables 1,180,000 626,400 266,600 124,000 103,000 60,000 Percentage uncollectible 2% 4% 18% 40% 75%…arrow_forwardNonearrow_forward

- Required information [The following information applies to the questions displayed below.] Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due 31 to 60 $ 56,000 7% Accounts receivable Percent uncollectible Total 0 $ 670,000 $ 416,000 Req A Req B and C 3% Complete this question by entering your answers in the tabs below. 1 to 30 $ 110,000 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $14,000 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $3,000 debit. Estimated balance of allowance for uncollectibles 4%arrow_forwardd. The company collects Y5,000 subsequently on a specific account that had previously been determined to be uncollectible in (c.). Prepare the journal entry(ies) necessary to restore the account and record the cash collection.arrow_forwardEstimating Uncollectible Accounts and Reporting Accounts Receivable LaFond Company analyzes its accounts receivable at December 31, and arrives at the age categories below along with the percentages that are estimated as uncollectible. Accounts Estimated Receivable Loss % $ 90,000 20,000 11,000 6,000 Over 180 days past due 4,000 Total accounts receivable $ 131,000 Age Group 0-30 days past due 31-60 days past due 61-120 days past due 121-180 296 4 The balance of the allowance for uncollectible accounts is $520 on December 31, before any adjustments. Transaction Record bad debts expense 5 10 25 (a) What amount of bad debts expense will LaFond report in its income statement for the year? $0 Cash Asset (b) Use the financial statement effects template to record LaFond's bad debts expense for the year. Use negative signs with your answers, when appropriate. Noncash Assets Balance Sheet Liabilities Contributed Capital (c) What is the balance of accounts receivable on it December 31 balance…arrow_forward

- Vishalarrow_forwardTammany Professional Engineers uses the Percentage of Receivables method to account for bad debt. The following is a summary of Tammany’s Accounts Receivable Aging Report. Cash Sales $42,000 Credit Sales $21,000 Allowance for Uncollectible Accounts December 31, 2020 $4,375 Current > 30 >60 >90 $115,000 $98,000 $75,000 $15,000 Estimated Uncollectible 1% 2% 4% 5% Required: Prepare the total estimate of uncollectible accounts and give the amount of the required adjustment. Do not prepare a journal entry. Please show your work if possible. In addition to submitting your answer here, you should also write it down so you an use it for the next problem.arrow_forwardWohoo Publishers uses the allowance method to estimate uncollectible accounts receivables. The company produced the following aging of the accounts receivable at year-end (Y in thousands). Accounts receivable % uncollectible Estimated bad debts Total 200,000 0-30 days 77,000 2% 31-60 days 46,000 5% 61-90 days 91-120 days 39,000 6% 23,000 10% Over 120 days 15,000 25%arrow_forward

- Daley Company prepared the following aging of receivables analysis at December 31. Total Days Past Due 0 1 to 30 31 to 60 61 to 90 Over 90 Accounts receivable $ 575,000 $ 397,000 $ 91,000 $ 37,000 $ 19,000 $ 31,000 Percent uncollectible 2% 3% 6% 8% 11% Complete the table below to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts receivable. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $3,700 credit. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $200 debit. Complete the table below to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts receivable. Accounts Receivable x Percent Uncollectible (%) = Estimated…arrow_forwardNonearrow_forwardWhat is the value of the total assets?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education