After-Tax

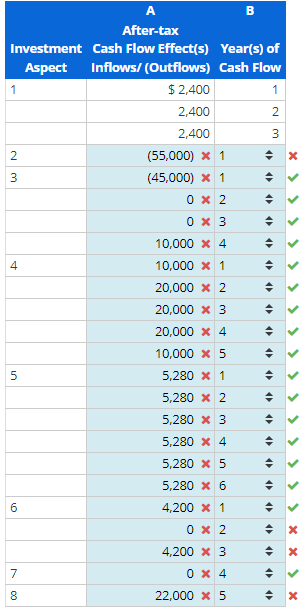

Below is a list of aspects of various capital expenditure proposals that the capital budgeting team of Anchor, Inc., has incorporated into its

1. Pre-tax savings of $4,000 in cash expenses will occur in each of the next three years.

2. A machine is purchased now for $46,000 cash.

3. A long-haul tractor costing $36,000 will be

4. Equipment costing $215,000 will be depreciated over five years on the tax return in the following amounts: $26,875 $53,750 $53,750 $53,750 and $26,875.

5. Pre-tax savings of $10,800 in cash expenses will occur in each of the next six years.

6. Pre-tax savings of $9,000 in cash expenses will occur in the first, third, and fifth years from now.

7. The tractor described in aspect 3 will be sold after four years for $7,000 cash.

8. The equipment described in aspect 4 will be sold after four years for $22,000 cash.

a. Calculate and record in column A the related after-tax cash flow effect(s).

b. Indicate in column B the timing of each cash flow shown in column A. Use 0 to indicate immediately and 1, 2, 3, 4, and so on for each year involved.

The answer to investment aspect 1 is presented as an example.

Use negative signs with answers that are cash outflows.

Under Column B, select the appropriate year for the timing of each cash flow using the drop down menu.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Cash PaybackAnderson Company must evaluate two capital expenditure proposals. Anderson's hurdle rate is 12%. Data for the two proposals follow. Proposal X Proposal Y Required investment $360,000 $360,000 Annual after-tax cash inflows 80,400 After-tax cash inflows at the end of years 3, 6, 9, and 12 188,000 Life of project 12 years 12 years What is the cash payback period for Proposal X? For Proposal Y? Hint: For Proposal Y, in what year (3, 6, 9 or 12) will the full original investment be recovered? Round Proposal X answer to one decimal place, if applicable. Proposal X Answer years Proposal Y Answer yearsarrow_forwardQuantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9%. 0 2 4 1 395 330 3 Project A Project B -1,000 -1,000 640 240 What is Project A's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $ 210 360 260 710 What is Project B's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardRomanos Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Laura Berenstein, staff analyst at Romanos, is preparing an analysis of the three projects under consideration by Chester Romanos, the company's owner. Data Table A B C D 1 Project A Project B Project C 2 Projected cash outflow 3 Net initial investment $3,000,000 $2,100,000 $3,000,000 4 Projected cash inflows 5 Year 1 $1,200,000 $1,200,000 $1,700,000 6 Year 2 1,200,000 600,000 1,700,000 7 Year 3 1,200,000 500,000 200,000 8 Year 4 1,200,000 100,000 9 Required rate of return 10% 10% 10% 1. Because the company's cash is limited, Romanos thinks the payback method should be used to choose between the capital budgeting projects. a. What are the…arrow_forward

- Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 11%. 0 1 2 3 4 Project A -1,050 600 360 300 290 Project B -1,050 200 295 450 740 What is Project A’s IRR? Do not round intermediate calculations. Round your answer to two decimal places. _________ % What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. _________% If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which…arrow_forwardA firm with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including yearly depreciation, are as follows: Project M -$6,000 $2,000 $2,000 $2,000 $2,000 $2,000 Project N -$18,000 $5,600 $5,600 $5,600 $5,600 $5,600 Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: years Project N: yearsarrow_forwardQuantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 7%. 1 1 -1,250 600 -1,250 200 What is Project A's MIRR? Do not round intermediate calculations. Round your answer to two decimal places. 8 % Project A Project B 0 2 1 395 330 3 + 220 370 4 1 270 720 Show All Feedback What is Project B's MIRR? Do not round intermediate calculations. Round your answer to two decimal places. 9 %arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education