Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

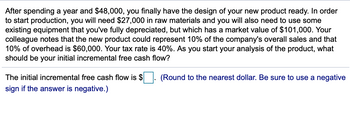

Transcribed Image Text:After spending a year and $48,000, you finally have the design of your new product ready. In order

to start production, you will need $27,000 in raw materials and you will also need to use some

existing equipment that you've fully depreciated, but which has a market value of $101,000. Your

colleague notes that the new product could represent 10% of the company's overall sales and that

10% of overhead is $60,000. Your tax rate is 40%. As you start your analysis of the product, what

should be your initial incremental free cash flow?

The initial incremental free cash flow is $

sign if the answer is negative.)

.

(Round to the nearest dollar. Be sure to use a negative

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Heer Enterprises needs someone to supply it with 160,000 cartons of machine screws per year to support its manufacturing needs over the next three years, and you've decided to bid on the contract. It will cost you $840,000 to install the equipment necessary to start production and you estimate that it can be salvaged for $160,000 at the end of the three-year contract. Your fixed production costs will be $290,000 per year, and your variable production costs should be $8.50 per carton. If you require a 12 percent return on your investment, what is the minimum bid price you should submit?arrow_forwardYour bakery can produce 3,000 unit of bagel per week for 48 weeks of operation per year. You aim to stay in this business for five years. You can either make the dough for the bagels in house or buy them from a different source. If you make the dough in house, you face with annual labour costs: $30,000, annual safety regulation costs: $5,000 and annual material costs: $20,000. But, if you choose to buy the dough from a different source, you must have a special dough-mixer machine to make adjustment for your production. Therefore, you need to pay $5,000 for the dough mixer machine, which has $1,000 salvage value at the end of 5 years. Furthermore, you face with annual maintaining costs including labour costs: $20,000 and additional overhead costs: $10,000 Using this information, find the unit cost of buy the bagel option with MARR 20%. Question 4 options: a) Between $0.70 and $0.80 b) None of the answers are correct…arrow_forwardThe Chief Operations Officer (COO) of a manufacturing firm recommends one of the manufacturing sites to undergo a process improvement initiative. He claims that this project will enable the company to realize a net savings of at least $3.25 Mln. The Chief Financial Officer (CFO) of the company tasked you to conduct a financial analysis to verify the claims of the COO. After performing cost analysis, you estimated that the project will require an initial investment of $2 Mln today and $1 Mln in Year 1. Afterwards, the initiative will yield an annual cost savings of $850k from Year 2 to Year 10. You assume that these cost savings are realized at the end of each year. (a) Suppose that you use a discount rate of 5%. Will the resulting net savings support the claim of the COO? (b) Determine the Internal Rate of Return (IRR) of the process improvement initiative. (c) Show the NPV profile of the project.arrow_forward

- Your IT company is working on a four-month project for a local mining company. The total planned value of the project (BAC) is $600,000. You are at the end of month three. By the end of month three you scheduled to spend $500,000(PV). The actual cost through this three-month mark is $450,000 (AC). The total work completed at the end of month three is 94 percent. Calculate the earned value, EV=arrow_forwardA manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forwardPlease show workarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education