ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

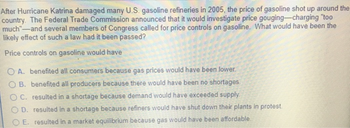

Transcribed Image Text:After Hurricane Katrina damaged many U.S. gasoline refineries in 2005, the price of gasoline shot up around the

country. The Federal Trade Commission announced that it would investigate price gouging-charging "too

much"-and several members of Congress called for price controls on gasoline. What would have been the

likely effect of such a law had it been passed?

Price controls on gasoline would have

OA. benefited all consumers because gas prices would have been lower.

OB. benefited all producers because there would have been no shortages.

OC. resulted in a shortage because demand would have exceeded supply.

OD. resulted in a shortage because refiners would have shut down their plants in protest.

OE. resulted in a market equilibrium because gas would have been affordable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The elasticity of demand for home computers is -2.5, the elasticity of demand for business computers is -.90, and the elasticity of supply for computers for both purposes is 1. a. A per-unit tax of $200 is imposed on the suppliers of computers. How much does the gross price increase in each market? [Hint: first find the tax incidence/shares.] b. Suppose the untaxed market equilibrium price and quantity in the home computer market are $850 and 10 million, respectively. In the business market, the untaxed market equilibrium price and quantity are $1200 and 15 million, respectively. What is the deadweight loss of the $200 tax? Answer part B please! Hand written asaparrow_forwardMilan Italy is trying to control the price of face masks, and it isn't going well. On April 26 2020, Domenico Arcuri, special commissioner for the coronavirus emergency, announced that surgical face masks must be sold at a fixed price of 50 European cents plus tax. A good mask used to cost as little as 10 European cents, but prices surged after Covid-19. The Civil Protection Department, Italy's national body that deals with emergencies, promptly discouraged entrepreneurs from importing masks, right as more masks were needed. No one was allowed to import masks and sell them to the highest bidder. Now, there is a government set price and a shortage of masks and many pharmacists have stopped selling masks. Far from learning its lesson, the Italian government has suggested it will repeat its price-fixing mistakes by setting the price of N95 masks. The results won't be any better.arrow_forwardImagine that a dairy farmer is willing to provide milk to the market on the basis of the supply schedule shown in the table below. Supply of Milk Price (dollars per gallan) $6.09 5.58 5.08 4.58 Quantity of Milk Supplied (thousands of gallons) Pre-Subsidy Past Subaddy 17 Instructions: Round your answers to 2 decimal places Suppose the federal government proposes a subsidy for all milk produced that results in a 15% increase in the quantity supplied of milk at every price. 8. Fill in the "Post-Subsidy" column after the subsidy takes effect. b. At a market price of $5.00 per gallon, the pre-subsidy quantity supplied was after the subsidy is thousand gallons. thousand gallons and the quantity suppliedarrow_forward

- A government is considering placing a tax on alcohol consumption (demand-side) with the goal of raising revenue in order to finance health care benefits such as Medicare. People who support the tax argue that the demand for alcohol is price inelastic in the short-run. Which of the following statements is true? a.This is a very good way to raise revenue both in the short term and in the long term because there are no substitutes for alcohol. b.No tax revenue can be raised in this way because alcohol sellers will just lower their price by the amount of the tax, and therefore the consumer price of alcohol will not change. c.This tax will not raise much revenue either in the short term or the long term because demand is price inelastic. d.The alcohol tax will raise a lot of revenue in the short-run, but it may not raise as much revenue in the long-run since people will substitute away from alcohol, making the long-run demand for alcohol more elastic.arrow_forwardI am trying to draw a demand curve with quantity on the y axis and price on the x axis - and to then draw the demand curve for 4 products, whose own price elasticity of demand are -0.48, -0.75, - 1.03, -1,31which of these products has the steeper demand curvearrow_forwardThis is the market for HOT CHOCOLATE, which is a normal good and is produced with cocoa beans. We know that hot tea is a substitute for hot chocolate and whipped cream is a complement. Quantity Surplus or Price Quantity Supplied Demanded Shortage $5 6,000 10,000 $4 8,000 8,000 $3 10,000 6,000 $2 12,000 4,000 $1 14,000 2,000 1. Complete the table above finding a Shortage or a Surplus. Draw a graphical illustration of the market and find the equilibrium price and equilibrium quantity. For the remaining questions, explain by words or show graphically how equilibrium price and equilibrium quantity of hot chocolate would change (due to changes in Supply or Demand) if: 2. The price of cocoa beans falls; 3. The price of tea falls; 4. Consumer income falls because of a recession.arrow_forward

- The table below illustrates the market's demand and supply for cheddar cheese. Price Per Pound[$] Quantity demanded Quantity Supplied 3.00 320 200 3.50 280 220 4.00 240 240 4.50 200 260 5.00 160 280 What will the excess demand or the shortage(that is, quantity demanded minus quantity supplied) be if the government institutes a price ceiling for cheese of $3.50,arrow_forwardThe price elasticity of demand for beer among young adults (age 18 to 24) is about 1.30, and the number of highway deaths is roughly proportional to the group’s beer consumption. If a state imposes a beer tax that increases the price of beer by 20%, by how much will the number of highway deaths among young adults decrease?arrow_forwarda) In the market for sugary drinks, the current equilibrium price is $10 and the equilibrium quantity is 30. The demand choke price is $50 and the supply choke price is $5 (a) Draw a demand and supply diagram, and shade the regions that represent consumer and producer welfare. Calculate the Total welfare in this market b) In this market, you now know that E D = −0.4 and E S = 1.2. Redraw your diagram in part (a) with the correct sloping curves. In this part you do not have to shade the welfare regions. All you need to do is redraw the diagram with the same equilibrium price and quantity, and choke prices but adjust the slope of each curve to reflect their respective elasticity c) If a tax was to be implemented in this market, what percentage of the burden is borne by the buyer? d) The government plans to discourage the consumption of sugary drinks and as such, they implemented a $1 tax on every bottle produced. In this situation, the suppliers are taxed directly but they hope to pass…arrow_forward

- What is the equilibrium price? What is the equilibrium quantity? Quantity Demanded 5 6 7 8 9 10 11 Price $7 6 5 4 3 2 1 Quantity Supplied 9 8 7 6 5 4 3arrow_forwardYour firm receives revenue of $40MM per year from Product A and $90MM per year from Product B. The own- price elasticity of demand for Product A is -1.5. The cross-price elasticity of demand between Product A and Product B is -1.8. Suppose you increase the price of Product A by two percent: a. How much will Product A’s revenue change? b. How much will Product B’s revenue change?arrow_forwardQ13arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education