The Government places a luxury tax on cars that sell for over $50k. What would happen to the supply of Bentleys?

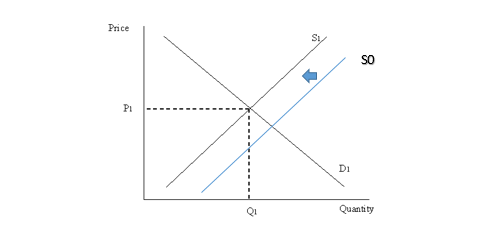

The impact of the tax on the demand-supply equilibrium level of output and price is to move the amount toward a point where the before-tax amount demanded short the before-tax supply is the measure of the tax. A tax builds the value a purchaser pays by not exactly the tax. Essentially, the value/price the merchant gets falls, however by not exactly the tax. According to the question, the government is placing the luxury tax on cars above the price of $50k so that will leads to decline the level of supply because of the less demand in the market because some now not able to purchase the Bentley's. Graph for the same is given below

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Pepsi and coke are Substitute or compliment good?arrow_forwardThe subway fare in your town has just been increased from 50 cents to $1.00 per ride. As a result, the transit authority notes a decline in ridership of 60 percent. What is the price elasticity of demand for subway rides?arrow_forwardhey im confused. when i enter this into my calculator 50/(1+0.05) + 50/(1+0.05)2 + 1000/(1+0.05)2 i get a 1000.so shouldnt quantity demanded be 2000?arrow_forward

- Elasticity of demand is 0.39 If the rise in price is 16% Find the call in quantity demandedarrow_forwardThe price elasticity of supply of a good is 0.8. Its price rises by 50% calculate the percentage rise in supply.arrow_forwardThe Teenager Company makes and sells skateboards at an average price of $70 each. During the past year, they sold 4,000 of these skateboards. The company believes that the price elasticity for this product is about -2.5. If it decreases the price to $63, what should be the quantity sold? Will revenue increase? Why.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education