FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:After hearing a knock at your front door, you are surprised to see the Prize Patrol from your state's online lottery agency. Upon opening

your door, you learn you have won the lottery of $12.5 million. You discover that you have three options: (1) you can receive $1.25

million per year for the next 10 years, (2) you can have $10 million today, or (3) you can have $4 million today and receive $1 million for

each of the next eight years. Your lawyer tells you that it is reasonable to expect to earn an annual return of 10 percent on investments.

Required:

1. What is the present value of the above options? (FV of $1, PV of $1, FVA of $1, and PVA of $1)

Note: Use appropriate factor(s) from the tables provided.

2. Which option do you prefer?

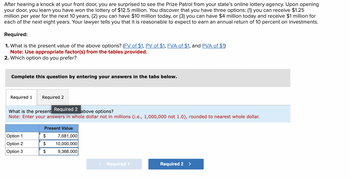

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 2

above options?

What is the present

Note: Enter your answers in whole dollar not in millions (i.e., 1,000,000 not 1.0), rounded to nearest whole dollar.

Present Value

Option 1

$

7,681,000

Option 2

$

10,000,000

Option 3

$

9,368,000

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Peggy just won the lottery! She could either receive $75,000 today or $1,000,000 in 40 years. At what rate of interest, compounded annually, would Peggy be indifferent between accepting the lottery winnings of $75,000 today and investing it on her own? A) 6.7%B) 6.1%C) 5.5%D) 2.4%arrow_forwardEllen won a lottery that will pay her $100,000 a year for 20 years, or she can accept $1,500,000 today. A)Assuming she can earn 2.5% and maximizing her winnings is the only consideration, which offer should she accept? Show your calculations. B)Assuming she can earn 3%, what would be the lump sum today equivalent to the 20 payments of $100,000?arrow_forwardYour dreams of becoming rich have just come true. You have won the State of Tranquility's Lottery. The State offers you two payment plans for the$4,000,000 advertised jackpot. You can take annual payments of $160,000 at the end of the year for the next 25 years or $1,864,573 today. b. If your investment rate over the next 25 years is 6%, what is the present value of the $160,000 annual payments today?arrow_forward

- Use a financial calculator or computer software program to answer the following questions: a) Melanie is trying to save money for retirement and has a future goal of $750,000 at the end of 20 years. Determine the present value of her goal using a discount rate of 12%. b) How would the present value change if the $750,000 is to be received at the end of 15 years instead? Explain the impact and show your work?arrow_forwardGeorge has planned ahead and identified his dream house purchase in 3 years’ time. The current value of the house is $580 000. It is expected that the house will increase in value at a rate of 4.5% p.a. 3, Does the amount saved in part (ii) meet the 10% requirement from the bank as a deposit at the end of year 3?Show formula, variables, calculations and a concluding statement in your response.arrow_forwardYour answer is partially correct. Chris Long has just learned he has won a $506,800 prize in the lottery. The lottery has given him two options for receiving the payments. (1) If Chris takes all the money today, the state and federal governments will deduct taxes at a rate of 46% immediately. (2) Alternatively, the lottery offers Chris a payout of 20 equal payments of $39,500 with the first payment occurring when Chris turns in the winning ticket. Chris will be taxed on each of these payments at a rate of 26%. Click here to view factor tables. Compute the present value of the cash flows for lump sum payout. (Round answer to O decimal places, e.g. 458,581.) Lump sum payout $ Assuming Chris can earn an 9% rate of return (compounded annually) on any money invested during this period, compute the present value of the cash flows for annuity payout. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) Present value of annuity payout…arrow_forward

- Congratulations! You have just won a small lottery. Lottery officials give you three alternatives for receiving your winnings: a)$8000 now b)$1000 per year for 12 years c)$15000 in 10 years If you can earn 6.5% on your money, which alternative should you choose?arrow_forwardCammie won the lottery. She can take a single lump sum payout of $10 million dollars or receive $750,000 per year, beginning immediately, for the next 25 years. What rate of return would Cammie need to break even if she took the lump sum amount instead of the annuity? O 5.31% O 6.19 % O 4.98% 5.56%arrow_forwardYou like to buy lottery tickets every week. The lottery pays an insurancecompany that pays the winner an annuity. If you win a $60,000,000 lotteryand elect to take an annuity, you get $3,000,000 per year at the beginningof each year for the next 20 years.a. How much must the state pay the insurance company if money can earn3 percent?b. How much interest is earned on this lump-sum payment over the 20 years?c. If you take the cash rather than the annuity, the state pays you $30,000,000in one lump sum today. You must pay 40 percent of this in taxes. If you arecurrently working and invest this money at 6 percent, how much moneywill you have in a mutual fund at the end of 20 years?d. Are you better off with the annuity, or should you take the cash? Explain.arrow_forward

- I solved the problem, but please put the information you provided in an excel spreadsheet to get the answers I have please and explain the steps/formula used. 1. John won a $45 million lottery today. The payout is the following: John gets $1.5 million today and $1.5 million each year for the next 29 years. How much money worth today for the lottery assuming John’s federal tax rate is 39.6%, state tax is 8.5% and his annual discount rate is 12%? Annual Discount Rate = 12% Annual Income = 1.5 million Annual Federal Tax = 39.6% * 1.5 million = 0.594 million Annual State Tax = 8.5% * 1.5 million = 0.1275 million Annual Net Income = 1.5 million - 0.594 million - 0.1275 million = 0.7785 million Calculate Total Present Value by using the PVOA Formula. Annuity Factor i = 12% ; time = 29 years ; Factor = 8.0218 PVOA = PMT x Annuity Factor = 0.7785 x 8.0218 = 6.244971 million Total PV = Initial Net Income + PVOA = 0.7785 million + 6.244971 million = 7.02 millionarrow_forwardMelody won a $30 million lottery today. The payout is the following: Melody gets $1 million today and $1 million each year for the next 29 years. Suppose that the discount rate is 6%, how much money worth today for the lottery assuming federal tax rate is 25% and state tax is 8%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education