FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

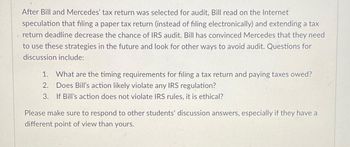

Transcribed Image Text:After Bill and Mercedes' tax return was selected for audit, Bill read on the Internet

speculation that filing a paper tax return (instead of filing electronically) and extending a tax

return deadline decrease the chance of IRS audit. Bill has convinced Mercedes that they need

to use these strategies in the future and look for other ways to avoid audit. Questions for

discussion include:

1. What are the timing requirements for filing a tax return and paying taxes owed?

2. Does Bill's action likely violate any IRS regulation?

3. If Bill's action does not violate IRS rules, it is ethical?

Please make sure to respond to other students' discussion answers, especially if they have a

different point of view than yours.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please show work or formulas/excel format. Thank you!arrow_forwardWhile conducting a fraud examination, Black, a Certified Fraud Examiner, obtained a document in 2013. Since Black obtained the document, several individuals have had it in their possession. In 2017, the document was introduced at trial. The defense objected to the admission of the document because there was no record of who had possession of the document and what they did with it. The defense’s objection is based on a failure to maintain __________. A. The evidence log. B. The relevance. C. The chain of custody. D. Who validated the evidence.arrow_forward5. What does Tina mean in her statement to the Clare County Review "the effects of an embezzlement are far reaching and detrimental for everyone"? Who were all the stakeholders that were all affected in this case? How was each of them harmed? 6. Jenifer was caught embezzling via the payroll system, how else might she have been stealing from the company that was never proven? 7. Why do you think Jenifer embezzled the money? 8. Do you think her sentencing is too lenient, too harsh, or is appropriate? Why? 9. What would you do if your friend and employee was stealing from a company that you owned?arrow_forward

- Watch the video and share with us your thoughts about the below questions:How do you define "ethics"?If you, as an American, are doing business in a country where bribery is not illegal, or unethical, how would you justify your decision to either proceed with bribery or not proceed with using bribery?arrow_forwardThis corporate con stated that she stole from the company because she believed it was "okay" to take the money because there wasn't any actual person she was stealing from, and it was right because she was being underpaid. According to the fraud triangle, her reasoning is most closely associated with O Availability Rationalization O Need/Motivation O Opportunityarrow_forwardMark Williams, CPA, was engaged by Jackson Financial Development Company to audit the financial statements of Apex Construction Company, a small closely held corporation. Williams was told when he was engaged that Jackson Financial needed reliable financial statements that would be used to determine whether to purchase a substantial amount of Apex Construction’s convertible debentures at the price asked by the estate of one of Apex’s former directors. Williams performed his audit in a negligent manner. As a result of his negligence, he failed to discover substantial defalcations by Carl Brown, the Apex controller. Jackson Financial purchased the debentures, but it would not have done so if the defalcations had been discovered. After discovery of the fraud, Jackson Financial promptly sold them for the highest price offered in the market at a $70,000 loss. If Apex Construction also sues Williams for negligence, what are the probable legal defenses Williams’s attorney would raise?…arrow_forward

- ethics question based on AICPA standards: Assume that the CPA firm of Packers and Vikings audits Chai Bears Systems. The controller of Chai, a CPA, happens to be a tax expert. During the current tax season, Packers and Vikings get far behind in reviewing processed tax returns. It does not want to approach clients and ask permission to file for an extension to the April 15 deadline so the firm approaches the controller of Chai and offers him a temporary position as a consultant for the tax season. Was it ethical for the firm to make the offer? Would it be ethically acceptable for the controller to accept the position?arrow_forwardJulia is in the process of auditing the legal liability section of the financial statements. The controller indicated that he did not want her to contact their external lawyers and he is refusing to grant her access to the detail of the legal expense for the year and any legal invoices. What should Julia do in this situation? Indicate the steps, in the proper order, that should be taken.arrow_forwardAlice owns a contracting company that receives most of its business through government contracts. A new procurement officer with a government agency implies to Alice that if she does not send him a bribe for her latest awarded contract, she will not get any further contracts. If Alice loses future contracts, her business will fail. She reluctantly gives the officer a bribe. Has Alice committed a violation? A. Yes, because Alice was not under economic duress. B. Yes, because being extorted is not a defense to giving a bribe. C. No, because Alice was under economic duress. D. No, because Alice was not the one who proposed the bribe.arrow_forward

- The IRS utilizes different audits depending upon the circumstances. I have listed 4 different scenarios. Please identify the type of audit that the IRS will likely use. Only provide one type of audit per scenario, the best option for the IRS. a. Professor Abbie B. Comey had a large amount of itemized deductions and the IRS would like to see documentation of these deductions. b. Trumff Corporation is a publicly traded corporation and has many transactions and many of them are very complex. The transactions, with large tax consequences, has reduced the tax liability of the corporation to $750. It is a large national chain of hotels headquartered in Florida. c. Ivanna and Jarry make face masks for the rich and famous, resulting in an income from their small homebased business of $75,000 in 2020. A few items were noted on the tax return by the IRS, relating to the homebased mask making business. d . Joey and Jilly sold some investments that sparked the interest of the IRS. As a result,…arrow_forwardUnder what circumstance will the Internal Revenue Service initiate contact asking for personal or financial information by email? When the customer's identity has been marked as suspicious. When the preparer of the return is found in violation of Circular 230. When a return is filed via an ERO. The IRS does not request personal information by email.arrow_forwardRead the following research paper and answer this question: How can audit seniors prevent material misstatement of revenue in future?( Hammersley, J.S., Johnstone, K. M and Kadous, K., 2011. How do audit seniors respond to heightened fraud risk? Auditing: A Journal of Practice & Theory, 30(3), pp .81-101.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education