FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

attached in screenshot below

thanks for help

lhewphw

appreciated it

4ti4p

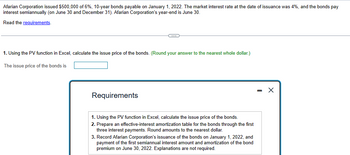

Transcribed Image Text:Afarian Corporation issued $500,000 of 6%, 10-year bonds payable on January 1, 2022. The market interest rate at the date of issuance was 4%, and the bonds pay

interest semiannually (on June 30 and December 31). Afarian Corporation's year-end is June 30.

Read the requirements.

C

1. Using the PV function in Excel, calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.)

The issue price of the bonds is

Requirements

1. Using the PV function in Excel, calculate the issue price of the bonds.

2. Prepare an effective-interest amortization table for the bonds through the first

three interest payments. Round amounts to the nearest dollar.

3. Record Afarian Corporation's issuance of the bonds on January 1, 2022, and

payment of the first semiannual interest amount and amortization of the bond

premium on June 30, 2022. Explanations are not required.

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- File Edit History View Bookmarks Profiles Tab Window Help D G YouTube Inbox (228 X MACC101 P X Accounting X | Accounting x M Question 11 x M Question 1 X b Answered: X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 9 Homework i Saved 13 30.12 points eBook Ask The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note.. Print References Mc Graw Hill Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account…arrow_forwardQuestion 3arrow_forward-Homework #9 -Co X ezto.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser=0&launchUrl=https%253A%252F%252Fnewlearn.govst.edu%252Fwebapps%252Fport... My Shelf Brytewav. Lumen Learning E Google Docs E Ch 9-Google Docs earn EReading list mework #9 i) Saved Help Save & Exit Submit 其 You received no credit for this question in the previous attempt. View previous attempt 16 TB MC Qu. 13-79 (Algo) Ari, Inc. Is working on its cash budget... Ari, Inc. is working on its cash budget for December. The budgeted beginning cash balance is $27,00O. Budgeted cash receipts total $140,000 and budgeted cash disbursements total $139,000. The desired ending cash balance is $66.000. To attain its desired ending cash balance for December, the company needs to borrow: ints Any borrowing is in multiples of $1,000 and interest is paid in the month following the borrowing. eBook To attain its desired ending cash balance for December, the company needs to borrow: References Multiple Choice $66,000.…arrow_forward

- how do I do thisarrow_forwardsf Your session h X sf Career Opport x x - ( xoqui Birdledon Writi x O Brussels Alrline x myAU Portal N X Fall 2021 Seme X to.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... seno TV erviews (Chapter 8) i Saved Help Save & Exit Which of the following service auditor reports provide evidence about the operating effectiveness of controls? Multiple Choice Type 1 report. Type 2 report. Comprehensive report. IT report. Next %24 < Prev 6. 9 jo Finacial Accounting... Finacial Account....pdf Finacial Account...pdf Finacial Account..pdf MacBook Airarrow_forward- Homework A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co... E User Management,.. H https://outlook.offi.. O FES Protection Plan System 7- North C.. 用Re mework Exercises i Soved Help Save & Exit Submit Check my work Required: Record the following transactions of Fashion Park in a general journal, Fashion Park must charge 6 percent sales tax on all sales. The company uses the perpetual inventory system. (Round your intermediate calculations and final answers to the nearest whole dollar value.) DATE TRANSACTIONS 20X1 Sold merchandise for cash, $2,540 plus sales tax. The cost of merchandise sold was $1,540. The customer purchasing merchandise for cash on April 2 returhed $270 of the merchandise; provided a cash refund to the customer. The cost of returned merchandise was $170. Sold merchandise on credit to Jordan Clark; issued Sales Slip 908 for $1,090 plus tax, terms n/30. The cost of the merchandise sold was…arrow_forward

- D Chrome View Edit File Bookmarks History Profiles Tab Window Help bjs-Google Search x C The following financial statem × 0 xiConnect - Home M Question 18 - Chapter 1 Hom ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 1 Homework Saved 18 [Ine following information applies to the questions displayed below.j The following financial statement information is from five separate companies. Company A Part 5 of 5 Beginning of year Assets Liabilities $ 36,000 29,520 Company B $ 28,080 Company C Company D Company E $ 23,040 $ 64,080 $ 98,280 19,656 12,441 44,215 ? End of year Assets 41,000 4.03 points 29,520 ? 74,620 113,160 Liabilities ? 20,073 13,460 35,817 89,396 Changes during the year Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 eBook Owner withdrawals 8,608 3,500 2,000 5,875 0 11,000 Ask Print References Mc Graw Hill Problem 1-2A (Algo) Part 5 5. Compute the amount of liabilities…arrow_forward同 Mail - Edjouline X Bb Content- ACG2 X CengageNOWv X (58) YouTube + Microsoft Office X PowerPoint from Towards a A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%=Dassignments&takeAssignmentSessionLocator=assignment-take&inpro. of mail YouTube Maps eBook Show Me How apter Nine Determine Due Date and Interest on Notes .09-03.BLANKSHEET Determine the due date and the amount of interest due at maturity on the following notes: L09-04.BLANKSHEET Date of Note Face Amount Interest Rate Term of Note 09-03.ALGO January 10* $40,000 90 days a. b. March 19 180 days 000 8. 09-04.ALGO June 5 30 days 000'06 d. September 8 90 days 90-60 3. 000'9E e. November 20 60 days 9-11 4. 000' *Assume that February has 28 days. 9-12 Assume 360-days in a year when computing the interest. -19 Note Due Date Interest > -20 (2) (b) 9-22 -24 (p) (a) 890- 8/12 items Check My Work ( Previous Next LE V O 10: Narrow_forwardChrome File Edit View History Sbis- Google Search x Bookmarks Profiles Tab Window Help M Chapter 2 Quiz - Connect x QuickLaunchSSO :: Single Sig x M Question 15 - Chapter 2 Hom x + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 2 Homework i 15 Saved Help Sav Angela Lopez owns and manages a consulting firm called Metrix, which began operations on December 1. On December 31, Metrix shows the following selected accounts and amounts for the month of December. 10.06 Cash points Accounts receivable $ 11,000 5,000 A. Lopez, Capital A. Lopez, Withdrawals $ 17,600 3,500 Notes receivable 4,000 Consulting revenue 19,500 Office supplies 3,000 Rental revenue 2,000 Prepaid insurance 2,500 Salaries expense 4,500 eBook Equipment 11,500 Rent expense 3,500 Accounts payable 6,100 Advertising expense 700 Ask Notes payable 3,900 Utilities expense 500 Unearned revenue 600 Print References Required: Mc Graw Hill 1. Prepare a…arrow_forward

- * CengageNOWv2 | Online teachin X b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false * D 9 : M Gmail O YouTube Maps Blackboard HW #9 - Chpt 21 O eBook Show Me How E Print Item 1. TMM.21.01 Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions): 2. TMM.21.02 Sales $14,100 3. TMM.21.03 Food and packaging $5,994 Рayroll 3,600 4. TMM.21.04 Occupancy (rent, depreciation, etc.) 1,986 5. EX.21,01 General, selling, and administrative expenses 2,100 $13,680 6. EX.21.02 Income from operations $420 7. EX.21.03 Assume that the variable costs consist of food and packaging; payroll; and 40% of the general, selling, and administrative expenses. 8. EX.21.06.ALGO a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million 9. EX.21.09.ALGO b. What is Wicker…arrow_forwarde Chrome File Edit View History Gbjs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Siç x Window Help M Question 5- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 3 Homework Saved 。 Help Save LO 5 9.25 points eBook Hint Ask Print References Exercise 3-8 (Algo) Adjusting and paying accrued expenses LO P3 a. On April 1, the company hired an attorney for April for a flat fee of $2,000. Payment for April legal services was made by the company on May 12. b. As of April 30, $2,102 of interest expense has accrued on a note payable. The full interest payment of $6,307 on the note is due on May 20. c. Total weekly salaries expense for all employees is $11,000. This amount is paid at the end of the day on Friday of each five-day workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3. The above…arrow_forwardChrome File Edit View History Bookmarks Profiles Tab Window Help Desmos | Graphing Calculator X ← → C InsideEWU - Eastern Washing webassign.net/web/Student/Assignment-Responses/submit?dep=33779... Math 107 Section 5.4 W Math 107 - Section 5.4 - MATH X + mywa Relaunch to update 95,00 Gmail YouTube Maps All Bookmarks te of! se. T Need Help? Read It Watch It did s Submit Answer 5. [-/1.25 Points] DETAILS JMODD8 5.4.032. ce valu MY NOTES ASK YOUR TEACHER i)" 8 Shirley Trembley buys a house for $181,900. She puts 20% down and obtains a simple interest amortized loan for the balance at 113% interest for thirty years. Ten years and six months later, she sells her house. Find the unpaid balance on her loan. (Round your answer to the nearest cent.) 3 $ Need Help? Read It Watch It Submit Answer - [0.25/1.25 Points] DETAILS PREVIOUS ANSWERS JMODD8 5.4.035. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHERarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education