Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

13.) How much is adjusted Accounts Receivable on December 31, 2021?

Please stop rejecting my questions...

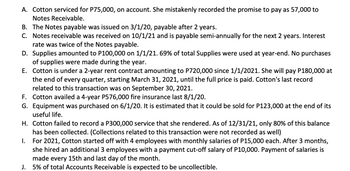

Transcribed Image Text:A. Cotton serviced for P75,000, on account. She mistakenly recorded the promise to pay as 57,000 to

Notes Receivable.

B. The Notes payable was issued on 3/1/20, payable after 2 years.

C. Notes receivable was received on 10/1/21 and is payable semi-annually for the next 2 years. Interest

rate was twice of the Notes payable.

D. Supplies amounted to P100,000 on 1/1/21. 69% of total Supplies were used at year-end. No purchases

of supplies were made during the year.

E.

Cotton is under a 2-year rent contract amounting to P720,000 since 1/1/2021. She will pay P180,000 at

the end of every quarter, starting March 31, 2021, until the full price is paid. Cotton's last record

related to this transaction was on September 30, 2021.

F. Cotton availed a 4-year P576,000 fire insurance last 8/1/20.

G. Equipment was purchased on 6/1/20. It is estimated that it could be sold for P123,000 at the end of its

useful life.

H. Cotton failed to record a P300,000 service that she rendered. As of 12/31/21, only 80% of this balance

has been collected. (Collections related to this transaction were not recorded as well)

I.

For 2021, Cotton started off with 4 employees with monthly salaries of P15,000 each. After 3 months,

she hired an additional 3 employees with a payment cut-off salary of P10,000. Payment of salaries is

made every 15th and last day of the month.

J. 5% of total Accounts Receivable is expected to be uncollectible.

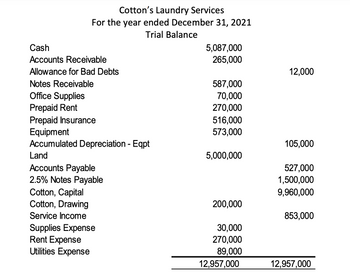

Transcribed Image Text:Cotton's Laundry Services

For the year ended December 31, 2021

Trial Balance

5,087,000

265,000

587,000

70,000

270,000

516,000

573,000

5,000,000

200,000

30,000

270,000

89,000

12,957,000

Cash

Accounts Receivable

Allowance for Bad Debts

Notes Receivable

Office Supplies

Prepaid Rent

Prepaid Insurance

Equipment

Accumulated Depreciation - Eqpt

Land

Accounts Payable

2.5% Notes Payable

Cotton, Capital

Cotton, Drawing

Service Income

Supplies Expense

Rent Expense

Utilities Expense

12,000

105,000

527,000

1,500,000

9,960,000

853,000

12,957,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed the following information relating to its receivables: The company has a recourse liability of 700 related to a note receivable sold to a bank. During 2019, credit sales (terms, n/EOM) totaled 2,200,000, and collections on accounts receivable (unassigned) amounted to 1,900,000. Uncollectible accounts totaling 18,000 from several customers were written off, and a 1,350 accounts receivable previously written off was collected. Additionally, the following transactions relating to Blackmons receivables occurred during the year: On December 31, 2019, an aging of the accounts receivable balance indicated the following: Required: 1. Prepare the journal entries to record the preceding receivable transactions during 2019 and the necessary adjusting entry on December 31, 2019. Assume a 360-day year for interest calculations and round calculations to the nearest dollar. 2. Prepare the receivables portion of Blackmons December 31, 2019, balance sheet. 3. Next Level Compute Blackmons accounts receivable turnover in days, assuming a 360-day business year. What is your evaluation of its collection policies? 4. If Blackmon uses IFRS, what might be the heading of the section for the receivables reported in Requirement 2?arrow_forwardAl Hajar Co. provides you the following account balances for the year ended on 31 December 2019. Sales Revenue OMR 100,000 Cr. Accounts Receivable OMR 25,000 Dr. Allowance for Doubtful accounts OMR 1000 Cr. Scenario 1 Bad debts are estimated based on the aging schedule given below Aging class Receivable Balance (OMR) Estimate % of uncollectible 0–30 days 15,000 10 31–60 days 5,000 15 61–90 days 3,500 20 Over 90 days 1,500 25 Actual bad debt - OMR 1,100 and amount recovered - OMR 800. Scenario 2 Estimated amount of bad debts - 12% of receivables, Actual bad debt - OMR 1,500 and amount recovered later on - OMR 900. Scenario 3 Estimated amount of bad debts - 3.5% of Sales, Actual bad debt - OMR 1,300 and amount recovered - OMR 1000. Required: For each scenario given above; a)Estimate the uncollectible amounts. b)Pass adjusting entry to record the estimated uncollectible. c)Pass all the journal entries for actual write off and recovery…arrow_forwardQuestion 57 Choose the correct answer from the choices.arrow_forward

- 3. The following data are presented concerning the Allowance for Bad Debts of Company A for the year ended December 31, 2023: Allowance for Bad Debts, Jan.1,2023 Write off of Accounts Receivable during 2023 P250,000 50,000 150,000 Recovery of Previously Written off Accounts Receivable Credit Sales for the year 1,200,000 Accounts Receivable, Jan. 1, 2023 Collections during 2023 Required: Determine the following for the year ended December 31,2023: 3.1. Bad Debts Expense assuming the company provides 2% Credit Sales 9,000,000 4,000,000 3.2. Ending Balance of Allowance for Bad debts using the assumption in number 3.1 3.3. Net Realizable Value of Accounts Receivable using the assumption in number 3.1 3.4. Bad Debts Expense assuming the company provides 10% of Ending Accounts Receivable 3.5. Ending Balance of Allowance for Bad debts using the assumption in number 3.4 3.6. Net Realizable Value of Accounts Receivable using the assumption in number 3.4arrow_forwardA company reports net accounts receivable of $251,000 on its December 31, 2019 balance sheet. The Allowance for Bad Debts account has a credit balance of $22,000. What is the balance of Accounts Receivable? $273.000 O$251.000 $229,000 $22.000 Previous 0 7 +arrow_forwardQuestion attached in the SS thanks appreciate it itj2jy2o4jy2404 h04h0hje0hh d0arrow_forward

- Subject: acountingarrow_forwardACCT101 FALL 2020-2021 Collection of an R.O 1500 Accounts Receivable. The effect on the components of the basic accounting equation of the Company is: Select one: a. Decreases a liability R.O 1500; increases owner's equity R.O 1500. O b. Increases an asset R.O 1500; decreases an asset R.O 1500. c. Increases an asset R.O 1500; decreases a liability R.O 1500. O d. Decreases a liability R.O 1500; decreases a liability R.O 1500. e. Decreases an asset R.O 1500; decreases a liability R.O 1500. Nextagearrow_forwardAccounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yarnell engaged in the following activities involving notes receivable: a. On September 1, 2019, Yarnell sold a $10,000 system to Ross Company. Ross gave Yarnell a 6-month, 7% note as payment. b. On December 1, 2019, Yarnell sold a $6,000 system to Searfoss Inc. Searfoss gave Yarnell a 9-month, 9% note as payment. c. On March 1, 2020, Ross paid the amount due on its note. d. On September 1, 2020, Searfoss paid the amount due on its note. Required: Prepare the necessary journal and adjusting entries for Yarnell Electronics to record these transactions.arrow_forward

- C. Complete the following comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. NOREN COMPANY Comparative Income Statments Year Ended December 31, 2019 Original Categories Categories Change Net Credit Sales $1,270,000 $1,270,000 Cost of Goods Sold 60,000 60,000 Gross Margin $1,210,000 $1,210,000 Expenses: General and Administrative Expense $300,500 $300,500 Bad Debt Expense Total Expenses Net Income (Loss) D. How does the new total uncollectible amount affect net income and net accounts receivable? a. Bad debt expense is lower, net income is higher, and net receivables are higher. b. Bad debt expense is lower, net income is higher, and net receivables are lower. c. Bad debt expense is higher, net income is lower, and net receivables are higher. d. Bad debt expense is higher, net income is lower, and net receivables are lower.arrow_forward21. Brotherhood Company had the following information relating to its accounts receivable: Accounts receivable, 12/31/21 Credit sales for 2022 Collections from customers for 2022, excluding recovery Accounts written off 9/30/22 Collection of accounts written off in prior year (customer credit was not reestablished) Estimated uncollectible receivable per aging of receivable at 12/31/22 1,300,000 5,400,000 4,750,000 125,000 25,000 165,000 On December 31, 2022, the amortized cost of accounts receivable is 1,825,000 1,800,000 O 1,635,000 O 1,660,000arrow_forwardIni ESPAÑOL INGLÉS FRANCÉS In 2021, XYZ made the mistake of not amortizing the Note Payable Discount account. Indicate the effect on Net Income reported in the Statement of Income and Expenses for the period ending December 31, 2021. to. Overstated b. Understated С. Although it affects the ledger accounts, the net effect is zero. d. It has no effect on the ledger accounts. Enviar comentarios MacBook Airarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College