FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

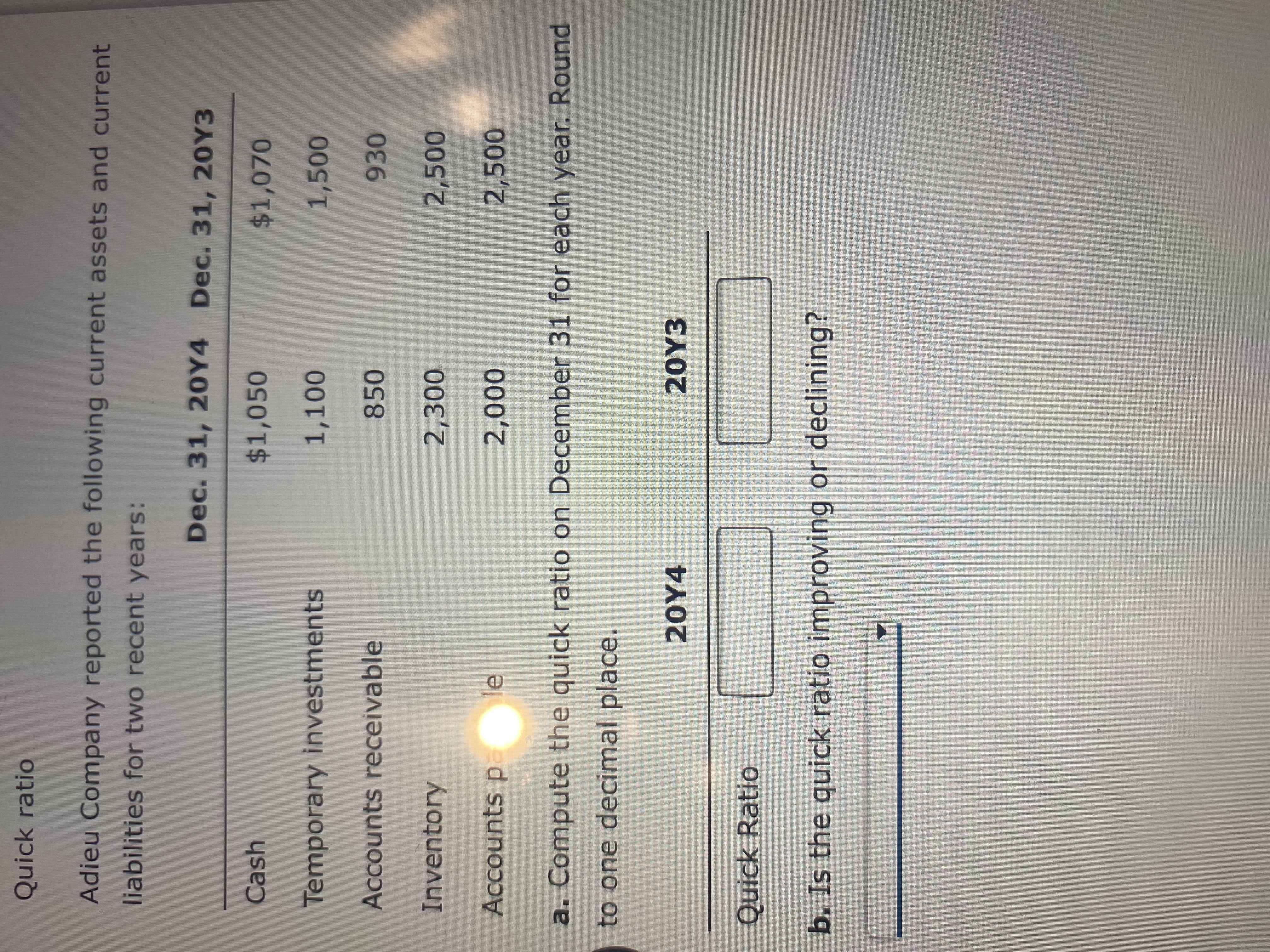

Transcribed Image Text:Quick ratio

Adieu Company reported the following current assets and current

liabilities for two recent years:

Dec. 31, 20Y4 Dec. 31, 20Y3

Cash

$1,050

$1,070

Temporary investments

1,100

1,500

Accounts receivable

850

930

Inventory

2,300

2,500

Accounts p le

2,500

a. Compute the quick ratio on December 31 for each year. Round

to one decimal place.

20Y4

20Y3

Quick Ratio

b. Is the quick ratio improving or declining?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How to calculate Net Operating Asset from this balance sheet for fiscal year-end 2015 .arrow_forwardItem Prior year Current year Accounts payable 8,109.00 7,758.00 Accounts receivable 6,059.00 6,782.00 Accruals 1,036.00 1,609.00 Cash ??? ??? Common Stock 11,891.00 11,189.00 COGS 12,683.00 18,018.00 Current portion long-term debt 4,980.00 4,993.00 Depreciation expense 2,500 2,813.00 Interest expense 733 417 Inventories 4,192.00 4,777.00 Long-term debt 13,329.00 13,523.00 Net fixed assets 50,636.00 54,376.00 Notes payable 4,329.00 9,999.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,278.00 29,801.00 Sales 35,119 47,221.00 Taxes 2,084 2,775 What is the firm's total change in cash from the prior year to the current year?arrow_forwardBALANCE SHEET AT END OF YEAR (Figures in $ millions) Assets 2021 2022 Liabilities and Shareholders' Equity 2021 2022 Current assets $ 102 $ 200 Current liabilities $ 74 $ 96 Net fixed assets 920 1,020 Long-term debt 660 870 INCOME STATEMENT, 2022 (Figures in $ millions) Revenue $ 2,010 Cost of goods sold 1,090 Depreciation 410 Interest expense 252 g. Net fixed assets increased from $920 million to $1,020 million during 2022. What must have been South Sea’s gross investment in fixed assets during 2022?........... (M1)arrow_forward

- Item Prior year Current year Accounts payable 8,194.00 7,893.00 Accounts receivable 6,066.00 6,786.00 Accruals 977.00 1,572.00 Cash ??? ??? Common Stock 11,869.00 12,264.00 COGS 12,616.00 18,108.00 Current portion long-term debt 5,038.00 5,064.00 Depreciation expense 2,500 2,825.00 Interest expense 733 417 Inventories 4,145.00 4,778.00 Long-term debt 13,680.00 14,055.00 Net fixed assets 50,966.00 54,551.00 Notes payable 4,331.00 9,956.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,104.00 29,983.00 Sales 35,119 45,456.00 Taxes 2,084 2,775 What is the firm's net income in the current year? . .arrow_forwardSubject: accountingarrow_forwardHelparrow_forward

- Item Prior year Current year Accounts payable 8,109.00 7,758.00 Accounts receivable 6,059.00 6,782.00 Accruals 1,036.00 1,609.00 Cash ??? ??? Common Stock 11,891.00 11,189.00 COGS 12,683.00 18,018.00 Current portion long-term debt 4,980.00 4,993.00 Depreciation expense 2,500 2,813.00 Interest expense 733 417 Inventories 4,192.00 4,777.00 Long-term debt 13,329.00 13,523.00 Net fixed assets 50,636.00 54,376.00 Notes payable 4,329.00 9,999.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,278.00 29,801.00 Sales 35,119 47,221.00 Taxes 2,084 2,775 What is the firm's cash flow from investing?arrow_forwardSherwood, Inc., had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $4,165 $4,528 Short-term investments, at cost 2,958 8,408 Accounts and notes receivable, net 9,404 8,624 Inventories 1,771 787 Prepaid expenses and other current assets 590 291 Short-term obligations (liabilities) 315 3,342 Accounts payable and other current liabilities 7,453 6,813 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio fill in the blank 1 fill in the blank 2 Quick ratio fill in the blank 3 fill in the blank 4arrow_forwardBest Buy Co., Inc.Balance SheetAt January 30, 2016($ in millions)AssetsCurrent assets:Cash and cash equivalents $ 1,976Short-term investments 1,305Accounts receivable, net 1,162Merchandise inventories 5,051Other current assets 392Total current assets 9,886Long-term assets 3,633Total assets $13,519Liabilities and Shareholders’ EquityCurrent liabilities:Accounts payable $ 4,450Other current liabilities 2,475Total current liabilities 6,925Long-term liabilities 2,216Shareholders’ equity 4,378Total liabilities and shareholders’ equity $13,519Best Buy Co., Inc.Income StatementFor the Year Ended January 30, 2016($ in millions)Revenues $ 39,528 Costs and expenses 38,153Operating income 1,375 Other income (expense)* (65)Income before income taxes 1,310 Income tax expense 503Net income $ 807*Includes $80 of interest expense.Liquidity and solvency ratios for the industry are as follows:Industry AverageCurrent ratio 1.23Acid-test ratio 0.60Debt to equity 0.70Times interest earned 5.66…arrow_forward

- View Policies Current Attempt in Progress The comparative statement of financial position for Sunland Corporation shows the following noncash current asset and liability accounts at March 31: 2021 2020 Accounts receivable $65,000 $42,000 Inventory 80,000 63,500 Accounts payable 35,000 44,000 Dividends payable 1,400 2,400 Sunland's statement of income reported the following selected information for the year ended March31, 2021: net income was $270,000, depreciation expense was $65,000, and a loss on the disposal of land was $15,000. Sunland uses a perpetual inventory system. Calculate net cash provided (used) by operating activities using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) SUNLAND CORPORATION Statement of Cash Flows (Partial) Operating activities Adjustments to reconcile net income toarrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education