FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

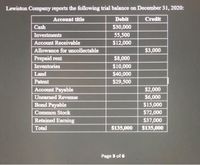

Transcribed Image Text:Lewiston Company reports the following trial balance on December 31, 2020:

Account title

Debit

Credit

Cash

$30,000

Investments

55,500

Account Receivable

$12,000

Allowance for uncollectable

$3,000

Prepaid rent

$8,000

$10,000

$40,000

$29,500

Inventories

Land

Patent

Account Payable

$2,000

$6,000

Unearned Revenue

Bond Payable

$15,000

Common Stock

$72,000

Retained Earning

$37,000

Total

$135,000

$135,000

Page 3 of 6

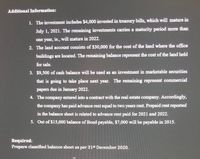

Transcribed Image Text:Additional Information:

1. The investment includes $4,000 invested in treasury bills, which will mature in

July 1, 2021. The remaining investments carries a maturity period more than

one year, ie., will mature in 2022.

2. The land account consists of $30,000 for the cost of the land where the office

buildings are located. The remaining balance represent the cost of the land held

for sale.

3. $9,500 of cash balance will be used as an investment in marketable securities

that is going to take place next year. The remaining represent commercial

papers due in January 2022.

4. The company entered into a contract with the real estate company. Accordingly,

the company has paid advance rent equal to two years rent. Prepaid rent reported

in the balance sheet is related to advance rent paid for 2021 and 2022.

5. Out of $15,000 balance of Bond payable, $7,000 will be payable in 2015.

Required:

Prepare classified balance sheet as per 31t December 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- In Year 1, Darw Inc. purchased equipment with an expected useful life of 5 years. The initial cost of the equipment was $85,000. Darw Inc.cost of capital is 12%. At the time it purchased the equipment, Darw Inc. projected the following cash inflows from use of the equipment: Year Projected Cash Inflow 1 $20,000 2 $30,000 3 $35,000 4 $25,000 5 $15,000 At the end of Year 5, the equipment had reached the end of its useful life. Darw Inc.determined that it had actually generated the following cash flows: Year Actual Cash Inflow $10,000 $20,000 $30,000 $30,000 $30,000 1) What was the net present value that Darw Inc. calculated for the equipment when the company purchased the asset?arrow_forwardThe management of a condominium association anticipates a capital expenditure of $150,000 in 3 years for the purpose of painting the exterior of the condominium. To pay for this maintenance, a sinking fund will be set up that will earn interest at the rate of 5.6%/year compounded monthly. Determine the amount of each (equal) monthly installment the association will be required to deposit into the fund at the end of each month for the next 3 years. (Round your answer to the nearest cent.)arrow_forwardThe following are futuro cash flows projected for an item of machinery (1) $200,000 to be incurred in three years tim e which will extend the life of the machine by a further five years (2)$55.000 annual revenue from products produced by the machine (2) $6,000 of finance costs on a bank loan taken out to purchase the machine (4) $60,000 maintenance costs to be incurred in 12 months time Which of the above cash flows are relevant to the calculation of the machines value in usearrow_forward

- A Property is expected to have 5 Year NOI flow of $10,000, $12,000, $15,000, $18,000, and $10,000 and a final (year 5) sale price of $90,000. Using capitalization rate of 12% what is the estimated market value of the property? 97,354 104,664 87,641 100,919 90,724arrow_forwardSuppose the subject's net operating income is $100,000, the direct capitalization rate of the land is 3.5%, the direct capitalization rate of the improvements is 6.0%, and the value of the improvements is $750,000. What is the overall value of the subject property (round to the nearest thousand)? A. $2,321,000 ⒸB. $2,036,000 OC. $1,571,000 OD.$1,286,000arrow_forwardIn Year 1, Darw Inc. purchased equipment with an expected useful life of 5 years. The initial cost of the equipment was $85,000. Darw Inc.cost of capital is 12%. At the time it purchased the equipment, Darw Inc. projected the following cash inflows from use of the equipment: Year Projected Cash Inflow 1 $20,000 2 $30,000 3 $35,000 4 $25,000 5 $15,000 At the end of Year 5, the equipment had reached the end of its useful life. Darw Inc.determined that it had actually generated the following cash flows: Year Actual Cash Inflow $10,000 $20,000 $30,000 $30,000 $30,000 2. Calculate the net present value that the equipment achieved, based on the actual cash inflows.arrow_forward

- Interest During Construction Alta Company is constructing a production complex that qualifies for interest capitalization. The following information is available: Capitalization period: January 1, 2019, to June 30, 2020 Expenditures on project: 2019: January 1 May 1 $420,000 381,000 October 1 552,000 2020: March 1 June 30 Amounts borrowed and outstanding: 1,428,000 624,000 $1.6 million borrowed at 12%, specifically for the project $4 million borrowed on July 1, 2018, at 14% $18 million borrowed on January 1, 2017, at 8% Required: Note: Round all final numeric answers to two decimal places. 1. Compute the amount of interest costs capitalized each year. Capitalized interest, 2019 $ 933,000 X Capitalized interest, 2020 $ 2,052,000 X 2. If it is assumed that the production complex has an animated life of years and a residual value of $0, compute the straight-line depreciation in 2020. Alpha-numeric input field 115,825 X $ 3. Since GAAP requires accrual accounting, if a company capitalizes…arrow_forwardThe acquisition price of a property is $380,000. The loan amount is $285,000. If the property’s NOI is expected to be $22,560, operating expenses $12,250, and the annual debt service $19,987, the debt coverage ratio (DCR) is approximately equal toarrow_forwardAn apartment property that will be held for 10 years has the following forecasted cash flows before taxes: 1 2 3 4 $ 5 2,760 2,720 2,686 2,659 2,636 $13,387 $23,199 $88,400 EOP $90,500 6 7 8 9 10 2,581 It is expected that the end of year 10 sales proceeds before taxes will be $39,697. How much initial investment can an equity investor pay for the equity portion if the investor requires a 15-percent, before-tax return? $ 2,619 2,604 2,594 2,587arrow_forward

- Assume that you purchase a property for $200,000 and it generates annual cash flows of $30,000 in years 1-3; and $45,000 in years 4&5. You are able to sell it at the end of year 5 for $400,000. Calculate the IRR for this investment property.arrow_forwardThe capital investment committee of Ellis Transport and Storage Inc. is considering two investment projects. The estimated income from operations and net cash flows from each investment are as follows: Warehouse Tracking Technology Year Income fromOperations Net CashFlow Income fromOperations Net CashFlow 1 $44,000 $145,000 $92,000 $232,000 2 44,000 145,000 70,000 196,000 3 44,000 145,000 35,000 138,000 4 44,000 145,000 15,000 94,000 5 44,000 145,000 8,000 65,000 Total $220,000 $725,000 $220,000 $725,000 Each project requires an investment of $440,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 10% for purposes of the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683…arrow_forwardAn investment made with an expenditure of $160,000 at the start of the project. The income from the project at the end of each year for 5 years is $80000, $90000, $85,000, $75,000 and $70,000. He made an investment of $20000 again at the end of 2nd year. The maintenance will cost 1500$ for the first year and it increments by 500$ for the second year and third year onwards it increments by 1000$. The salvage value is 70,000$. Draw a CFD for the project and give the analysis of the project based on the CFD.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education