FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:LO 13-9

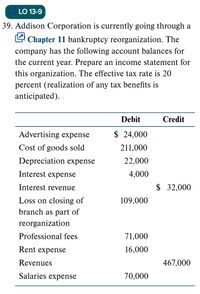

39. Addison Corporation is currently going through a

L Chapter 11 bankruptcy reorganization. The

company has the following account balances for

the current year. Prepare an income statement for

this organization. The effective tax rate is 20

percent (realization of any tax benefits is

anticipated).

Debit

Credit

Advertising expense

$ 24,000

Cost of goods sold

211,000

Depreciation expense

22,000

Interest expense

4,000

Interest revenue

$ 32,000

Loss on closing of

109,000

branch as part of

reorganization

Professional fees

71,000

Rent expense

16,000

Revenues

467,000

Salaries expense

70,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Romie Ltd is preparing accounts for the year ended 31 December 20X5. The company has an estimated tax charge of $35,000 for the year ended December 20X5. The trial balance includes an entry of $2,000 relating to an over provision of tax in the previous financial year. What is the charge for tax in the statement of profit or loss for the year ended December 20X5?arrow_forwardAt the beginning of 2021, Pitman Co. had pretax financial income of $1,200,000. Additionally, there was a timing difference of $300,000 due to an accounts receivable that will not be collected until the following year. The tax rate us 30%. A. Calculate the total taxable income for 2021. B. Calculate Income tax expense, income tax payable, and the deferred amount for 2021, and create the journal entry.arrow_forwardIn the current year, Axle, Inc., a calendar year C corporation, has $6,000,000 of adjusted taxable income, $300,000 of business interest income, zero floor plan financing interest, and $2,900,000 of business interest expense. Axle has average gross receipts for the prior three-year period of $32,000,000. What is Axle's interest deduction for the year? Answer:arrow_forward

- Blossom Corporation reported the following results for its first three years of operation: 2020 income (before income taxes) $280000 2021 loss (before income taxes) (2500000 ) 2022 income (before income taxes) 2800000 There were no permanent or temporary differences during these three years. Assume a corporate tax rate of 20% for 2020 and 2021, and 30% for 2022.Assuming that Blossom elects to use the carryback provision, what income (loss) is reported in 2021? (Assume that any deferred tax asset recognized is more likely than not to be realized.)arrow_forwardSe.125.arrow_forwardWildhorse Corporation, a publicly traded company, is preparing the comparative financial statements to be included in the annual report to shareholders. Wildhorse's fiscal year ends May 31. The following information is available. 1. 2. 3. 4. 5. 6. 7. 1. Income from operations before income tax for Wildhorse was $1,500,000 and $1,900,000, respectively, for the fiscal years ended May 31, 2021, and 2020. 2. Wildhorse experienced a loss from discontinued operations of $600,000 from a business segment disposed of on March 3, 2021. A 20% combined income tax rate applies to all of Wildhorse Corporation's profits, gains, and losses. Wildhorse's capital structure consists of preferred shares and common shares. The company has not issued any convertible securities or warrants and there are no outstanding stock options. Wildhorse issued 136,000 of $10 par value, 5% cumulative preferred shares in 2013. All of these shares are outstanding, and no preferred dividends are in arrears. Determine the…arrow_forward

- At the end of its first year of operations on December 31, 2022, the Metro Company reported pretax financial income of $100,000. An investigation of that income revealed the following items:· Bad debts expense of $12,000 was recognized (reported on 2022 income statement). The accounts will be written off (tax deductible) in 2023.· Interest received on municipal bonds: $7,500.· Warranty expenses of $16,000 were accrued for financial reporting purposes, but were not expected to result in a cash payment until 2023.· Depreciation on the tax return exceeded depreciation for financial reporting purposes by $32,000.Assume that any deferred tax assets are considered more likely than not to be realized. The enacted income tax rate for all years is 25%.Required:1) Compute taxable income. Show your calculation. If not, no credit.2) Prepare the entry to record income tax expense and any related assets and liabilities for Metro on December 31, 2022.arrow_forwardChristopher Corporation is subject to a 40% income tax rate. The following amounts were taken from the records: income before income taxes $100,000 and taxable income $120,000. Instructions: record the adjusting entry.arrow_forwardFoster Company reported pretax financial income of $350,000 for 2021. Foster uses an accelerated form of depreciation for tax purposes, and it exceeds book depreciation by $50,000. The tax rate for 2021 is 20%. Record the journal entry at the end of 2021, be sure to include calculations, as well as income tax expense, a deferred account, and income tax payable.arrow_forward

- After making four quaterly estimated payments of $3,500, a corporation's actual income tax liability for the year is $17,200. The year-end adjusting entry would require:arrow_forwardGrand Corporation reported pretax book income of $621,000. Tax depreciation exceeded book depreciation by $414,000. In addition, the company received $310,500 of tax-exempt municipal bond interest. The company’s prior-year tax return showed taxable income of $51,750. Compute the company's current income tax expense or benefit. (Leave no answer blank. Enter N/A or zero.) Current income tax N/A $0 Deferred income tax Expense ?arrow_forwardThe CFO has asked you to calculate the taxable income and prepare journal entries for Rudolf Ltd at 30th June 2022. Accounting loss before tax Impairement loss warranty expense Fines expense Doubtful Debts. Depreciation Plant warranty paid** Depreciation for tax - Plant.** Bad debts written off. ** (80,000) 1,000 10,000 5,000 4,000 20,000 8,000 30,000 10,000 Note These items ** are deductible for tax purposesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education