FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Solvency and Profitability Trend Analysis

Addai Company has provided the following comparative information:

| 20Y8 | 20Y7 | 20Y6 | 20Y5 | 20Y4 | ||||||

| Net income | $273,406 | $367,976 | $631,176 | $884,000 | $800,000 | |||||

| Interest expense | 616,047 | 572,003 | 528,165 | 495,000 | 440,000 | |||||

| Income tax expense | 31,749 | 53,560 | 106,720 | 160,000 | 200,000 | |||||

| Total assets (ending balance) | 4,417,178 | 4,124,350 | 3,732,443 | 3,338,500 | 2,750,000 | |||||

| Total |

3,706,557 | 3,433,152 | 3,065,176 | 2,434,000 | 1,550,000 | |||||

| Average total assets | 4,270,764 | 3,928,396 | 3,535,472 | 3,044,250 | 2,475,000 | |||||

| Average total stockholders' equity | 3,569,855 | 3,249,164 | 2,749,588 | 1,992,000 | 1,150,000 |

You have been asked to evaluate the historical performance of the company over the last five years.

Selected industry ratios have remained relatively steady at the following levels for the last five years:

| 20Y4–20Y8 | ||

| Return on total assets | 28% | |

| Return on stockholders’ equity | 18% | |

| Times interest earned | 2.7 | |

| Ratio of liabilities to stockholders’ equity | 0.4 |

Required:

1. Determine the following for the years 20Y4 through 20Y8 for each of the graphs below. Use the amounts given above in your calculations. Round to one decimal place:

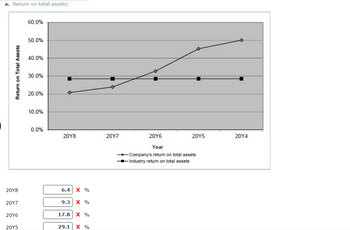

a. Return on total assets:

| 20Y8 | fill in the blank 1 % |

| 20Y7 | fill in the blank 2 % |

| 20Y6 | fill in the blank 3 % |

| 20Y5 | fill in the blank 4 % |

| 20Y4 | fill in the blank 5 % |

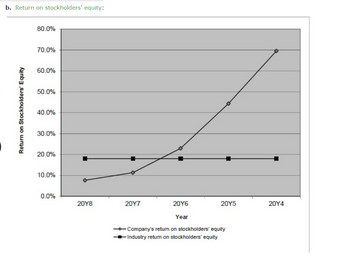

b. Return on stockholders' equity:

| 20Y8 | fill in the blank 6 % |

| 20Y7 | fill in the blank 7 % |

| 20Y6 | fill in the blank 8 % |

| 20Y5 | fill in the blank 9 % |

| 20Y4 | fill in the blank 10 % |

c. Times interest earned:

| 20Y8 | fill in the blank 11 |

| 20Y7 | fill in the blank 12 |

| 20Y6 | fill in the blank 13 |

| 20Y5 | fill in the blank 14 |

| 20Y4 | fill in the blank 15 |

d. Ratio of liabilities to stockholders' equity:

| 20Y8 | fill in the blank 16 |

| 20Y7 | fill in the blank 17 |

| 20Y6 | fill in the blank 18 |

| 20Y5 | fill in the blank 19 |

| 20Y4 | fill in the blank 20 |

Transcribed Image Text:a. Return on total assets:

Return on Total Assets

20Y8

20Y7

20Y6

20Y5

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

20Y8

6.4 X %

9.3 X %

17.8 X %

29.1 X %

20Y7

20Y6

20Y5

Year

-Company's return on total assets

Industry return on total assets

20Y4

Transcribed Image Text:b. Return on stockholders' equity:

Return on Stockholders' Equity

80.0%

70.0%

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

20Y8

20Y7

20Y6

Year

- Company's return on stockholders' equity

- Industry return on stockholders' equity

20Y5

20Y4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- profit marginarrow_forwardWhat is the sustainable growth rate for 2015? Narrow Falls Lumber 2015 Income Statement Net sales Cost of goods sold Depreciation EBIT Interest Taxable income Taxes Net income Dividends Cash Accounts receivable Inventory Net fixed assets Total assets Select one: a. 10.91% b. 14.46% c. 15.54% d. 12.63% e. 13.97% $28,200 $848,600 542,800 147,400 $158,400 12,600 $145,800 51,800 $94.000 Narrow Falls Lumber Balance Sheets as of December 31, 2014 and 2015 2015 2014 $ 32,300 $ 26,900 74,700 72,300 99,500 97,800 707,100 705,000 $913.600 $902,000 Accounts payable Notes payable Long-term debt Common stock and paid-in surplus ($1 par value) Retained earnings Total liabilities & owners' equity 2015 2014 $ 78,900 $ 79,200 40,000 354,500 50,000 295,600 170,000 175,000 319.100 253,300 $913.600 $902,000arrow_forwardPlease answer very fast then i ll upvote Calculate EBIT. Revenue 1,061,751.0 Cost of sales 690,135.0 Selling, general and administration 53,087.0 Other income 11,796.0 Operating income 330,325.0 Interest expense 19,874.0 Profit before tax 310,451.0 Tax expense 46,500.0 Net income 263,951.0 The footnotes mention the following: Cost of sales includes inventory write off costs 39,677.0 Cost of sales includes distribution costs 120,458.0 SG&A includes corporate restructuring expenses 15,570.0 Responses 385,572.0 275,078.0 330,325.0 506,030.0arrow_forward

- Trend Analysis Critelli Company has provided the following comparative information: Year 5 Year 4 Year 3 Year 2 Year 1 Net income $940,300 $810,600 $681,200 $582,200 $493,400 Interest expense 319,700 291,800 252,000 192,100 153,000 Income tax expense 300,896 226,968 190,736 151,372 118,416 Average total assets 5,779,817 5,103,704 4,360,748 3,704,785 3,153,171 Average stockholders' equity 1,975,420 1,769,869 1,548,182 1,373,113 1,203,415 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: Industry Ratios Return on total assets 21.5 % Return on stockholders’ equity 44.4 % Times interest earned 4.6 Instructions: Calculate three ratios for Year 1 through Year 5. Round to one decimal place. a. Return on total assets: Year 5…arrow_forwardusing the following table (image attached) calculate the financial leverage multiplier used in the BMC systemarrow_forwardSolvency and Profitability Trend Analysis Addai Company has provided the following comparative information: 20Υ8 20Y7 20Υ6 20Y5 20Υ4 Net income $273,406 $367,976 $631,176 $884,000 $800,000 Interest expense 616,047 572,003 528,165 495,000 440,000 Income tax expense 31,749 53,560 106,720 160,000 200,000 Total assets (ending balance) 4,417,178 4,124,350 3,732,443 3,338,500 2,750,000 Total stockholders' equity (ending balance) 3,706,557 3,433,152 3,065,176 2,434,000 1,550,000 Average total assets 4,270,764 3,928,396 3,535,472 3,044,250 2,475,000 Average total stockholders' equity 3,569,855 3,249,164 2,749,588 1,992,000 1,150,000 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: 20Υ4-2ΟY8 Return on total assets 28% Return on stockholders' equity 18% Times interest earned 2.7 Ratio of liabilities to stockholders' equity 0.4 Required: 1.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education