FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

HELP! first answer I received was incorrect.

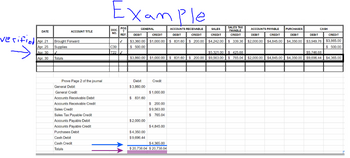

ADD a single-line rule above the totals and a double-line rule below the totals to indicate that the amount column totals have been verified as correct. On the example image you can see that some columns are mean't to be verified.

- Journal the following transactions related to the business Barbara’s Book Nook, a bookstore owned by Barbara Baker.

- August 1. Purchased merchandise for cash, $1,200.00. Check No. 121.

- August 9. Purchased merchandise on account from Book Wholesalers, $1,950.00. Purchase Invoice No. 132.

- August 14. Barbara Baker withdrew merchandise for personal use, $300.00. Memorandum No. 143.

- August 30. Recorded cash and credit card sales, $5,459.00, plus sales tax, $545.90. Cash Register Tape No. 124.

- Total the columns and prove and rule page 1 of the journal.

- Prove cash. The beginning cash balance on August 1 is $2,340.00. The balance on the next unused check stub is $7,144.90.

Transcribed Image Text:verified

DATE

Apr. 21

Apr. 25

Apr. 30

Apr. 30

ACCOUNT TITLE

Brought Forward

Supplies

Totals

Prove Page 2 of the journal

General Debit

General Credit

Accounts Receivable Debit

Accounts Receivable Credit

Sales Credit

Sales Tax Payable Credit

Accounts Payable Debit

Accounts Payable Credit

Purchases Debit

Cash Debit

Cash Credit

Totals

Example

POS

T

PURCHASES

DOC.

ACCOUNTS RECEIVABLE

DEBIT

NO. REF. DEBIT

SALES

CREDIT

ACCOUNTS PAYABLE

DEBIT

CREDIT

CREDIT

CREDIT

DEBIT

DEBIT

CREDIT

✓

$3,360.00 $1,000.00 $ 831.60 $ 200.00 $4,242.00 $ 339.36 $2,000.00 $4,845.00 $4,350.00 $3,949.76 $3,865.00

$ 500.00

$ 500.00

GENERAL

C39

T22✓

$3,860.00 $1,000.00 $ 831.60 $ 200.00

Debit

$3,860.00

$ 831.60

$2,000.00

$4,350.00

$9,696.44

Credit

$1,000.00

$ 200.00

$9,563.00

$ 765.04

$4,845.00

SALES TAX

PAYABLE

CREDIT

$4,365.00

$20,738.04 $20,738.04

CASH

$5.321.00 $425.68

$5.746.68

$9,563.00 $765.04 $2,000.00 $4,845.00 $4,350.00 $9,696.44 $4,365.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cashier for Bell Buoy rang up sales totaling $5,100, but had $5,110 to deposit, which journal entry would be recorded? Multiple Choice A debit to Cash for $5,110, a credit to Cash Overage for $10, and a credit to Sales Revenue for $5,100. A debit to Sales for $5,110, a debit to Cash Overage for $10, and a credit to Cash for $5,100. A debit to Cash for $5,100, a debit to Cash Shortage for $10, and a credit to Sales Revenue for $5,110. A debit to Cash for $5.100. a debit to Cash Shortage for $10, and a credit to Unearned Revenue for $5.110 < Prev 34 of 50 Nextarrow_forward9. Ashley Martinez's checkbook balance was $149.21 on October 5. The checkbook register below shows her transactions since then. What is her balance after each transaction? Trans Type Date Description of Transaction or Check # 571 DEP 572 AT 10/6 Pettisvile Flowers 10/9 Deposit 10/10 Donald's Bookstore 10/19 Langley Phone Co. Payment / Debit ✔ Deposit / Credit (+) (-) Balance Brought Forward 45 79 16 94 75 25 213 80 Balance 149 21arrow_forwardpost to general ledgerarrow_forward

- Use the transactions to fill in the plank chart of purchases. I’ve also wrote them below: Transactions: August; Purchased $1,500.00 in merchandise on account from Beads R Us, invoice 158. Bought a new computer on account from Best Buy for $1,600.00, invoice 822. Purchased gems (merchandise) from The Gem Mine for $1,100.00 on account, terms 2/15, n/30, invoice Purchased $525.00 in pens and paper from Staples on account, terms n/30, invoice 28. Bought an office desk on account from Office Depot for $750.00, invoice 76. Bought merchandise on account from The Gem Mine for $5,000.00, terms 2/15, n/30, invoice 282. Purchasesarrow_forwardSales-Related Transactions, Including the Use of Credit Cards Journalize the entries for the following transactions: a. Sold merchandise for cash, $22,060. The cost of the merchandise sold was $13,240. (Record the sale first.) fill in the blank 36fbb5ffffdef81_2 fill in the blank 36fbb5ffffdef81_3 fill in the blank 36fbb5ffffdef81_5 fill in the blank 36fbb5ffffdef81_6 fill in the blank 36fbb5ffffdef81_8 fill in the blank 36fbb5ffffdef81_9 fill in the blank 36fbb5ffffdef81_11 fill in the blank 36fbb5ffffdef81_12 b. Sold merchandise on account, $13,920. The cost of the merchandise sold was $8,350. (Record the sale first.) fill in the blank e95153f82fd6002_2 fill in the blank e95153f82fd6002_3 fill in the blank e95153f82fd6002_5 fill in the blank e95153f82fd6002_6 fill in the blank e95153f82fd6002_8 fill in the blank e95153f82fd6002_9 fill in the blank e95153f82fd6002_11 fill in the blank e95153f82fd6002_12…arrow_forwardMoving to another question will save Question 13 A. Cash payments journal A company entered into the following transactions. Match each transaction with the appropriate journal in which it should be record Purchased merchandise from Able Co. for $2,000 terms 2/10, n/30. Invoice dated August 1. B. Purchases journal - Paid cash to incite Telephone Co. for monthly telephone bill $250, Check No. 758. c. General Journal - Sold merchandise on credit to Delta Corp. for $3,000, terms, 2/10, n/30, Involce No. 246. Cost of Goods Sold is $1,740. D. Cash receipts journal Received cash payment in full from Delta Corp. for August 5 sale. E. Sales Journal -Recorded cash sales for the month, $9,000. Returned defective inventory purchased on account from Able Co. for $550.arrow_forward

- Journalize the transactions for Williams Market during December of the current year. Use page 12 of a general journal. Journalize the January transaction on page 16 of a cash payments journal. Source documents are abbreviated as follows: memorandum, M; debit memorandum, DM; credit memorandum, CM; sales invoice, S. No C is required in the Ck. No. column.arrow_forwardEnter the following transactions in the appropriate journal (purchases journal and cash payment journal) *October 11 Purchased merchandise from Lafferty Company, $500 on account, credit terms 1/15, n/45. Invoice No. 65. *15 Purchased merchandise from Alsted, Inc., $400 cash. Check No. 751. * 21 Paid amount due Lafferty Company, less discount. Check No. 752.arrow_forwardHelp needed please ?arrow_forward

- The cash register tape for Tamarisk Industries reported sales of $8,103.30.Record the journal entry that would be necessary for each of the following situations. (a) Sales per cash register tape exceeds cash on hand by $59.85. (b) Cash on hand exceeds cash reported by cash register tape by $33.39. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Transactions Account Titles and Explanation Debit Credit (a) enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places (b) enter an account title enter a debit amount rounded to 2 decimal…arrow_forwardrecord any necessary journal entries for Mary’s Hat Shop April 10 Mary's Hat Shop purchases $2500 worth of merchandise with cash from a manufacturer. Shipping charges are an extra $120.00 cash. Termsof the purchase are FOB shipping point. April 14 Mary’s Hat Shop sells $3,000 worth of merchandise to a customer who pays with cash. The merchandise has a cost to Mary’s of $1,800. Shipping charges are an extra $120 cash. Terms of the sale are FOB Shipping Point. Assume the perpetual inventory system is used.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education