FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

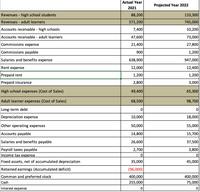

Transcribed Image Text:Actual Year

Projected Year 2022

2021

Revenues - high school students

88,200

110,300

Revenues - adult learners

571,200

745,000

Accounts receivable - high schools

7,400

10,200

Accounts receivable - adult learners

47,600

73,000

Commissions expense

21,400

27,800

Commissions payable

900

1,200

Salaries and benefits expense

638,900

947,000

Rent expense

12,000

12,400

Prepaid rent

1,200

1,200

Prepaid insurance

2,800

3,000

High school expenses (Cost of Sales)

49,400

65,300

Adult learner expenses (Cost of Sales)

68,500

98,700

Long-term debt

Depreciation expense

10,000

18,000

Other operating expenses

50,000

55,000

Accounts payable

14,800

15,700

Salaries and benefits payable

26,600

37,500

3,800

Payroll taxes payable

Income tax expense

2,700

Fixed assets, net of accumulated depreciation

35,000

45,000

Retained earnings (Accumulated deficit)

(96,000)

Common and preferred stock

400,000

75,000

400,000

Cash

255,000

Interest expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Annual tuition increases at a large university are shown below: These increases take place in the fall semester of each year. The annual tuition expense for 2007 was $5,000. Solve, a. What is the tuition expense for 2017? b. What compounded rate of increase in tuition has been experienced at this university?arrow_forward23arrow_forwardFinancearrow_forward

- For the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $8800 at 6.3% interest; student graduates 2 years and 7 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $ places, if necessary. Round to two decimal X oo Karrow_forwardGiven below is the principal owed on a student loan last month, the annual interest rate, and the way the minimum monthly payment is computed. Find this month's minimum payment due. Principal Annual Rate Method for Calculating Minimum Monthly Payment $23,800 3% finance charge+$20+1.5% of principalarrow_forwardFor the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $6400 at 7.9% interest; student graduates 3 years and 9 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $ places, if necessary. Round to two decimal X oo → Karrow_forward

- i will 10 upvotes urgent both answersarrow_forward1.On your retirement day, with a projected 6% annual earnings rate and 2% inflation rate over a 20-year period, to maintain a constant purchasing power of $50,000 annually, what need to be at least the balance in your RRSP account? a. $602,545.25 b. $679,516.32 c. $573,496.06 d. $817,571.67 2.Five years ago, you purchased a home with a 15-year mortgage of $150,000 at a 5-year fixed rate of 5.25% for monthly repayments. Assuming that the mortgage rate is currently 6.5%, what will the amount of your monthly repayments be after the renewal? a. $1,276.13 b. $1,135.48 c. $4,576.32 d. $7,875.79 3.You deposited 10 annual amounts of $100 in your saving accounts. What is the account balance after your last deposit, if the annual interest rate was 3% for the first 5 years and then 4% for the last 5 years? a. $1,254.35 b. $1,187.57 c. $1,056.32 d. $1,089.47arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education