Concept explainers

Direct materials, direct labor, and

Each unit requires 0.3 hour of direct labor.

Instructions

Determine (a) the direct materials price variance, direct materials

quantity variance, and total direct materials cost variance; (b) the direct

labor rate variance, direct labor time variance, and total direct labor cost

variance; and (c) the variable factory overhead controllable variance,

fixed factory' overhead volume variance, and total factory overhead cost

variance.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

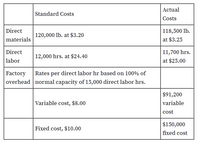

- Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 7,200 units of product were as follows: Standard Costs Actual Costs Direct materials 9,400 lb. at $4.80 9,300 lb. at $4.60 Direct labor 1,800 hrs. at $18.30 1,840 hrs. at $18.60 Factory overhead Rates per direct labor hr., based on 100% of normal capacity of 1,880 direct labor hrs.: Variable cost, $3.60 $6,420 variable cost Fixed cost, $5.70 $10,716 fixed cost Each unit requires 0.25 hour of direct labor. Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct materials price variance…arrow_forwardDirect Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Santiago Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 70,000 units of product were as follows: Line Item Description Standard Costs Actual Costs Direct materials 189,000 lbs. at $4.60 per lb. 187,100 lbs. at $4.40 per lb. Direct labor 17,500 hrs. at $18.30 per hr. 17,900 hrs. at $18.70 per hr. Factory overhead Rates per direct labor hr., based on 100% of normal capacity of 18,260 direct labor hrs.: Factory overhead Variable cost, $3.40 $58,910 variable cost Factory overhead Fixed cost, $5.40 $98,604 fixed cost Each unit requires 0.25 hour of direct labor. Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an…arrow_forwardCompute all material and labor variances correctly Rogen Corporation manufactures a single product. The standard cost per unit of product is shown below. $7.00 Direct materials-1 pound plastic at $7.00 per pound Direct labor-1.0 hours at $11.65 per hour 11.65 7.00 7.00 $32.65 Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit The predetermined manufacturing overhead rate is $14.00 per direct labor hour ($14.00 1.0). It was computed from a master manufacturing overhead budget based on normal production of 5,300 direct labor hours (5,300 units) for the month. The master budget showed total variable costs of $37,100 ($7.00 per hour) and total fixed overhead costs of $37,100 ($7.00 per hour). Actual costs for October in producing 4.600 units were as follows. Direct materials (4.770 pounds) Direct labor (4,440 hours) Variable overhead Fixed overhead Total manufacturing costs $33.867 52.614 48.942 17,258 $152.681 The purchasing department buys the…arrow_forward

- Please help me with all answers thankuarrow_forwardDirect Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 74,000 units of product were as follows: Standard Costs Actual Costs Direct materials 199,800 lbs. at $5.90 197,800 lbs. at $5.70 Direct labor 18,500 hrs. at $16.50 18,930 hrs. at $16.90 Factory overhead Rates per direct labor hr., based on 100% of normal capacity of 19,310 direct labor hrs.: Variable cost, $2.90 $53,110 variable cost Fixed cost, $4.60 $88,826 fixed cost Each unit requires 0.25 hour of direct labor. Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Materials Price Variance Direct Materials Quantity Variance Total…arrow_forwardThe following data relate to the direct materials cost for the production of automobile tires: Actual: 56,700 lbs. at $2.05 per lb.Standard: 55,600 lbs. at $2.10 per lb. a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Line Item Description Amount Variance Direct Materials Price Variance $fill in the blank 1 Direct Materials Quantity Variance $fill in the blank 3 Total Direct Materials Cost Variance $fill in the blank 5arrow_forward

- Use this information to answer the question that follow.The following data relate to direct materials costs for February:Materials cost per yard: standard, $1.96; actual, $2.03Standard yards per unit: standard, 4.73 yards; actual, 5.21 yardsUnits of production: 9,100Calculate the direct materials price variance.arrow_forwardDon't provide answers in image formatarrow_forwardplease answer all requirements or skip/leave answer with must must explanation , computation for each parts and steps clearly and completely answer in text form remember attempt if answer all or skiparrow_forward

- Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 74,000 units of product were as follows:arrow_forwardA manufacturing company reports the following for one of its products. Compute the direct materials (a) price variance and (b) quantity variance and classify each as favorable or unfavorable.arrow_forwardPlease help me with show all calculation thankuarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education