FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:al 15 Chapter Four

Activity Cost Pool

Machining

Machine setups

Production design.

General factory

Activity Measure

Machining

Required information

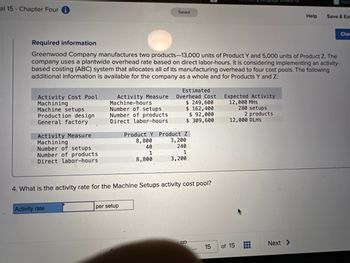

Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The

company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-

based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following

additional information is available for the company as a whole and for Products Y and Z:

Number of setups

Number of products.

Direct labor-hours

Activity Measure.

Machine-hours

Number of setups

Number of products

Direct labor-hours.

Activity rate

Saved

per setup

Estimated

Overhead Cost

$ 249,600

$ 162,400

$ 92,000

$ 309,600

4. What is the activity rate for the Machine Setups activity cost pool?

Product Y Product Z

8,800

3,200

40

240

1

1

8,800

3,200

S

15

Expected Activity

12,000 MHS

280 setups

of 15

2 products

12,000 DLHS

www

www

Help

Next >

Huma

Save & Exi

Che

Expert Solution

arrow_forward

Step 1

Activity rate is the rate which is use to charged overhead to related products. this rate is usees in activity based costing where we need to calculate activity rates for each activity.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume a company manufactures only two products-14,000 units of Product G and 6,000 units of Product H. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to three cost pools. The following additional information is available for the company as a whole and for Products G and H: Activity Cost Pool Machining Machine setups Product design Activity Measure Machine-hours Number of setups Number of products Activity Measure Machine-hours Number of setups Number of products Product G Product H 9,000 50 1 6,000 150 1 Estimated Overhead Cost Expected Activity 15,000 MH 200 Setups $ 300,000 $ 150,000 $ 78,000 2 Products Using the ABC system, how much total overhead cost would be assigned from all of the activities to Product H?arrow_forwardnaion manufactures two models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled: Number of Number of Number of Product Setups Components Direct Labor Hours 16 Standard 265 Deluxe 34 14 245 Overhead costs $50,000 $58.900 Nrter of setups and number of components are identified as activity- cost drivers for overhead. Assuming an activity - based costing system is used, what is the total amount of overhead costs assigned to the standard modela OA $54,600 OB $77 400 OC. S54,450 O0 $31.500 O Time Remaining: 02:58:03 Nextarrow_forwardRequired information Greenwood Company manufactures two products-15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Number of setups Number of products Direct labor-hours Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 227,700 $ 153,908 Product Y Product Z 8,700 60 1 8,700 2,300 210 1 1,300 Expected Activity 11,000 MHS 270 setups $ 91,000. $ 257,000 2 products 10,000 DLHS 14. Using the ABC system, what percentage of the Product Design cost is assigned to Product Y and Product Z? (Round your answers to 2…arrow_forward

- Single Plantwide and Multiple Production Department Factory Overhead Rate Methods and Product Cost Distortion The management of Nova Industries Inc. manufactures gasoline and diesel engines through two production departments, Fabrication and Assembly. Management needs accurate product cost information in order to guide product strategy. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering the multiple production department factory overhead rate method. The following factory overhead was budgeted for Nova: $765,000 315,000 $1,080,000 Fabrication Department factory overhead Assembly Department factory overhead Total Direct labor hours were estimated as follows: Fabrication Department Assembly Department Total In addition, the direct labor hours (dlh) used to produce a unit of each product in each department were determined from engineering records, as follows: Production Departments…arrow_forwardneed true help with full workingarrow_forward- Chapter Four Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Required information Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Number of setups Number of products Direct labor-hours Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Activity rate Saved Product Y Product Z 8,800 3,200 240 40 1 1 8,800 3,200 5. What is the activity rate for the Product Design activity cost pool? per product Savearrow_forward

- Helm Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system: Costs: Manufacturing overhead Selling and administrative expenses Total Distribution of resource consumption: Manufacturing overhead Selling and administrative expenses $304,500 $493,000 Activity Cost Pools Customer Support 85% 20% O $116,000 O $428,000 Order Size 5% 60% S S Other 10% 20% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools. How much cost, in total, would be allocated in the first-stage allocation to the Customer Support activity cost 480,000 100,000 580,000 Total 100% 100%arrow_forwardRequlred Information Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z Estimated Overhead Cost $ 242,400 $114,400 86,000 $ 302,400 Expected Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours 12,000 MHs 220 setups 2 products 12,000 DLHS Activity Measure Machining, Number of setups Number of products Direct labor-hours Product Y 8,200 40 1. 8,200 Product Z 3,800 180 1. 3,800 Required: 1. What is the company's plantwide overhead rate? (Round your enswer to 2 declmal places.) Predetermined overhead rate, per DLH of 15 甜…arrow_forwardRequired information [The following information applies to the questions displayed below.] Hickory Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $829,500 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Product design Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 246,000 Expected Activity 12,000 MHS $ 89,000 $ 357,000 14,400 250 setups 2 products DLHS $ 137,500 General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y Product Z 7,500 40 1 8,500 4,500 210 1 5,900 2. Using the plantwide overhead rate, how much manufacturing…arrow_forward

- Assume a company manufactures only two products—14,000 units of Product C and 6,000 units of Product D. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to three cost pools. The following additional information is available for the company as a whole and for Products C and D: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 300,000 15,000 MH Machine setups Number of setups $ 150,000 200 Setups Product design Number of products $ 78,000 2 Products Activity Measure Product C Product D Machine-hours 9,000 6,000 Number of setups 50 150 Number of products 1 1 Using the ABC system, how much overhead cost would be assigned from the Machine Setups cost pool to Product D? Multiple Choice $115,200 $112,500 $122,500 $102,500arrow_forwardRequlred Informatlon Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Estimated Overhead Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Expected Activity 12, 000 МHs 220 setups 2 products 12,000 DLHS Cost $ 242,400 $ 114,400 $ 86,000 $ 302,400 Activity Measure! Machining Number of setups Number of products Direct labor-hours, Product Y 8,200 40 1. 8,200 Product Z 3,800 180 3,800 3. What is the activity rate for the Machining activity cost pool? (Round your answer to2 declmal places.) Activity rate per MH 15…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education