FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer general Accounting question

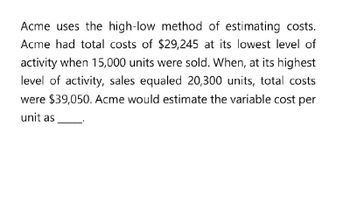

Transcribed Image Text:Acme uses the high-low method of estimating costs.

Acme had total costs of $29,245 at its lowest level of

activity when 15,000 units were sold. When, at its highest

level of activity, sales equaled 20,300 units, total costs

were $39,050. Acme would estimate the variable cost per

unit as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ziegler Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced Total Costs 1,400 $302,400 2,740 425,040 4,200 470,400 a. Determine the variable cost per unit and the total fixed cost. Variable cost: (Round to the nearest dollar.) $fill in the blank 1 per unit Total fixed cost: $fill in the blank 2 b. Based on part (a), estimate the total cost for 2,020 units of production. Total cost for 2,020 units: $fill in the blank 3arrow_forwardTashiro Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced Total Costs 60,000 $19,200,000 69,000 20,010,000 90,000 24,090,000 a. Determine the variable cost per unit and the total fixed cost. Variable cost (Round to two decimal places.) $fill in the blank 1 per unit Total fixed cost $fill in the blank 2 b. Based on part (a), estimate the total cost for 86,000 units of production. Total cost for 86,000 units $fill in the blank 3arrow_forwardCena Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows:Units Produced Total Costs80,000 $25,200,00099,000 25,220,000130,000 31,770,000a. Determine the variable cost per unit and the total fixed cost. b. Based on part (A), estimate the total cost for 115,000 units of production.arrow_forward

- Stancil Dry Cleaners has determined the following about its costs: Total variable expenses are$42,000,total fixed expenses are $24,000, and the sales revenue needed to break even is $48,000. Determine the company's current 1) sales revenue and 2) operating income. (Hint: First, find the contribution margin ratio; then prepare the contribution margin income statement.) Use the contribution margin income statement and the shortcut contribution margin approaches to determine Stancil's current (1) sales revenue and (2) operating income. Begin by computing the contribution margin ratio. (Enter the result as a whole number.) The contribution margin ratio is %.arrow_forwardStancil Dry Cleaners has determined the following about its costs: Total variable expenses are$42,000,total fixed expenses are $24,000, and the sales revenue needed to break even is $48,000. Determine the company's current 1) sales revenue and 2) operating income. (Hint: First, find the contribution margin ratio; then prepare the contribution margin income statement.) Use the contribution margin income statement and the shortcut contribution margin approaches to determine Stancil's current (1) sales revenue and (2) operating income. Begin by computing the contribution margin ratio. (Enter the result as a5 whole number.) The contribution margin ratio is 50 %. Prepare the contribution margin income statement at the calculated sales level. NOTE: the other picture is to show the options.arrow_forwardCould you help solve this question:arrow_forward

- Tashiro Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced Total Costs 6,000 $672,000 2,000 432,000 3,600 540,960 a. Determine the variable cost per unit and the total fixed cost. Variable cost (Round to two decimal places.) $fill in the blank 1 per unit Total fixed cost $fill in the blank 2 b. Based on part (a), estimate the total cost for 2,880 units of production. Total cost for 2,880 units: $fill in the blank 3arrow_forwardColton Dry Cleaners has determined the following about its costs: Total variable expenses are $42,000, total fixed expenses are $30,000, and the sales revenue needed to break even is $50,000. Determine the company's current 1) sales revenue and 2) operating income. (Hint: First, find the contribution margin ratio; then prepare the contribution margin income statement.) Use the contribution margin income statement and the shortcut contribution margin approaches to determine Anderson's current (1) sales revenue and (2) operating income. Begin by computing the contribution margin ratio. (Enter the result as a whole number.) The contribution margin ratio is %.arrow_forwardDry Cleaners has determined the following about its costs: Total variable expenses are screenshot attache dtahnkng rnkgwrarrow_forward

- Using the costs data from Rose Company, answer the following questions: A. If 15,000 units are produced, what is the variable cost per unit? B. If 28,000 units are produced, what is the variable cost per unit? C. If 21,000 units are produced, what are the total variable costs?arrow_forwardDetermine this onearrow_forwardSierra Company produces its product at a total cost of $120 per unit. Of this amount, $40 per unit is selling and administrative costs. The total variable cost is $96 per unit, and the desired profit is $24.00 per unit. Determine the markup percentage using the (a) total cost, (b) product cost, and (c) variable cost methods. Round your answers to one decimal place. a. Total cost b. Product cost c. Variable cost % % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education