FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

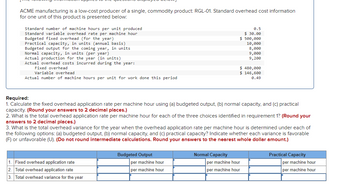

Transcribed Image Text:ACME manufacturing is a low-cost producer of a single, commodity product: RGL-01. Standard overhead cost information

for one unit of this product is presented below:

Standard number of machine hours per unit produced

Standard variable overhead rate per machine hour

Budgeted fixed overhead (for the year)

Practical capacity, in units (annual basis)

Budgeted output for the coming year, in units

Normal capacity, in units (per year)

Actual production for the year (in units)

Actual overhead costs incurred during the year:

Fixed overhead

Variable overhead

Actual number of machine hours per unit for work done this period

1. Fixed overhead application rate

2. Total overhead application rate

3. Total overhead variance for the year

Required:

1. Calculate the fixed overhead application rate per machine hour using (a) budgeted output, (b) normal capacity, and (c) practical

capacity. (Round your answers to 2 decimal places.)

2. What is the total overhead application rate per machine hour for each of the three choices identified in requirement 1? (Round your

answers to 2 decimal places.)

3. What is the total overhead variance for the year when the overhead application rate per machine hour is determined under each of

the following options: (a) budgeted output, (b) normal capacity, and (c) practical capacity? Indicate whether each variance is favorable

(F) or unfavorable (U). (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

Budgeted Output

per machine hour

per machine hour

0.5

$ 30.00

$ 500,000

10,000

8,000

9,000

9,200

Normal Capacity

$ 480,000

$ 146,600

0.49

per machine hour

per machine hour

Practical Capacity

per machine hour

per machine hour

![Required information [The following information applies to the questions displayed below.] ACME manufacturing is a low-cost producer of a single, commodity product: RGL-01. Standard

overhead cost information for one unit of this product is presented below: Required: 1. Calculate the fixed overhead application rate per machine hour using (a) budgeted output, (b)

normal capacity, and (c) practical capacity. (Round your answers to 2 decimal places.) 2. What is the total overhead application rate per machine hour for each of the three choices identified

in requirement 1 ? (Round your answers to 2 decimal places.) 3. What is the total overhead varlance for the year when the overhead application rate per machine hour is determined under

each of the following options: (a) budgeted output, (b) normal capacity, and (c) practical capacity? Indicate whether each variance is favorable (F) or unfavorable (U), (Do not round

intermediate calculations. Round your answers to the nearest whole dollar amount.) ACME manufacturing is a low-cost producer of a single, commodity product: RGL-01. Standard

overhead cost information for one unit of this product is presented below: Standard number of machine hours per unit produced standard variable overhead rate per machine hour Budgeted

fixed overhead (for the year) Practical capacity, in units (annual basis) Budgeted output for the coming year, in units Normal capacity, in units (per year) Actual production for the year (in

units) Actual overhead costs incurred during the year: Fixed overhead Variable overhead Actual number of machine hours per unit for work done this period Required: Calculate the fixed

overhead application rate per machine hour using (a) budgeted output, (b) normal capacity, and (c) practical capacity. (Round your answers to 2 decimal places.) What is the total overhead

application rate per machine hour for each of the three choices identified in requirement 1 ? (Round your answers to 2 decimal places.) What is the total overhead variance for the year when

the overhead application rate per machine hour is determined under each of the following options: (a) budgeted output, (b) normal capacity, and (c) practical capacity? Indicate whether

each variance is favorable (F) or unfavorable (U). (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)](https://content.bartleby.com/qna-images/question/79b22699-d2c4-4280-b29c-fa3a8d300e0a/fc1b262d-b862-4af2-9b06-9ae73d8c9169/h4h26c2_thumbnail.png)

Transcribed Image Text:Required information [The following information applies to the questions displayed below.] ACME manufacturing is a low-cost producer of a single, commodity product: RGL-01. Standard

overhead cost information for one unit of this product is presented below: Required: 1. Calculate the fixed overhead application rate per machine hour using (a) budgeted output, (b)

normal capacity, and (c) practical capacity. (Round your answers to 2 decimal places.) 2. What is the total overhead application rate per machine hour for each of the three choices identified

in requirement 1 ? (Round your answers to 2 decimal places.) 3. What is the total overhead varlance for the year when the overhead application rate per machine hour is determined under

each of the following options: (a) budgeted output, (b) normal capacity, and (c) practical capacity? Indicate whether each variance is favorable (F) or unfavorable (U), (Do not round

intermediate calculations. Round your answers to the nearest whole dollar amount.) ACME manufacturing is a low-cost producer of a single, commodity product: RGL-01. Standard

overhead cost information for one unit of this product is presented below: Standard number of machine hours per unit produced standard variable overhead rate per machine hour Budgeted

fixed overhead (for the year) Practical capacity, in units (annual basis) Budgeted output for the coming year, in units Normal capacity, in units (per year) Actual production for the year (in

units) Actual overhead costs incurred during the year: Fixed overhead Variable overhead Actual number of machine hours per unit for work done this period Required: Calculate the fixed

overhead application rate per machine hour using (a) budgeted output, (b) normal capacity, and (c) practical capacity. (Round your answers to 2 decimal places.) What is the total overhead

application rate per machine hour for each of the three choices identified in requirement 1 ? (Round your answers to 2 decimal places.) What is the total overhead variance for the year when

the overhead application rate per machine hour is determined under each of the following options: (a) budgeted output, (b) normal capacity, and (c) practical capacity? Indicate whether

each variance is favorable (F) or unfavorable (U). (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The controller of Ivanhoe Industries has collected the following monthly cost data for use in analyzing the behavior of maintenance costs. Month January February March April May June (a1) Total Maintenance Costs $3,041 3,456 4,147 5,184 3,686 5,633 Total Machine Hours 4,032 Variable cost per machine hour $ 4,608 6,912 9,101 5,760 9,216 Determine the unit variable costs using the high-low method for this mixed cost. (Round answer to 2 decimal places e.g. 2.25.)arrow_forwardPreble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 12.00 Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Fixed Cost Variable Cost per Month per Unit Sold. Advertising Sales salaries and commissions Shipping expenses $ 19.00 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. c. Total variable manufacturing overhead for the month was $390,600. d.…arrow_forwardam. 108.arrow_forward

- Menk Corporation has provided the following information: Cost per Unit Cost per Period Direct materials $ 6.80 Direct labor $ 3.80 Variable manufacturing overhead $ 2.00 Fixed manufacturing overhead $ 20,200 Sales commissions $ 0.50 Variable administrative expense $ 0.40 Fixed selling and administrative expense $ 10,100 Required: a. If 5,220 units are sold, what is the variable cost per unit sold? Note: Round "Per unit" answer to 2 decimal places. b. If 5,220 units are sold, what is the total amount of variable costs related to the units sold? c. If 5,220 units are produced, what is the total amount of manufacturing overhead cost incurred? a. Variable cost per unit sold b. Total variable costs c. Total manufacturing overhead costarrow_forward! Required information [The following information applies to the questions displayed below.] O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. During its first year of operations, O'Brien produced 98,000 units and sold 74,000 units. During its second year of operations, it produced 80,000 units and sold 99,000 units. In its third year, O'Brien produced 90,000 units and sold 85,000 units. The selling price of the company's product is $78 per unit. Req 4A 4. Assume the company uses absorption costing and a LIFO inventory flow assumption (LIFO…arrow_forwardPlease do not give image formatarrow_forward

- Alpesharrow_forwardAssume that a company uses a standard cost system and applies overhead to production based on direct labor-hours. It provided the following information for its most recent year: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours Actual direct labor-hours Standard direct labor-hours allowed for the actual output What is the fixed overhead volume variance? Multiple Choice O $20,000 U $20,000 F $9,000 U $9,000 F $ 300,000 $ 276,000 60,000 56,000 58, 200arrow_forward0 Ellerie, Incorporated, manufactures and sells two products Product G8 and Product 00. Data concerning the expected production of each product and the expected total direct labor hours (DLH) required to produce that output appear below: Activity Cost Pools Labor-related Expected Hours Per Production Unit 710 5.1 310 2.1 Product CB Product 00 Total direct labor-hours The direct labor rate is $22.20 per DLH. The direct materials cost per unit for each product is given below Direct Materials Cost per Unit $114.10 $ 114.50 Machine setups Order sice Direct Labor- Product CB Product 00 The company is considering adopting an activity based costing system with the following activity cost pools, activity measures, and expected activity Estimated Overhead Multiple Choice Activity Measures Total Direct Labor- Hours 3,621 651 4,272 Cost $56,055 54,890 366,008 $ 476,953 Which of the following statements concerning the unit product cost of Product GB is true? (Round your intermediate calculations…arrow_forward

- Lillibridge & Friends, Incorporated provides you with the following data for its single product: Sales price per unit Fixed costs (per quarter): Selling, general, and administrative (SG&A) Manufacturing overhead Variable costs (per unit): Direct labor Direct materials Manufacturing overhead SG&A Number of units produced per quarter a. Prime cost per unit b. Contribution margin per unit c. Gross margin per unit d. Conversion cost per unit e. Variable cost per unit f. Full absorption cost per unit g. Variable production cost per unit h. Full cost per unit 500,000 units $50 1,500,000 4,500,000 Required: Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter. Note: Round your answers to 2 decimal places. 8 600,000 units 11 9 5 500,000 unitsarrow_forwardPrimara Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours (denominator level of activity) Actual direct labor-hours Standard direct labor-hours allowed for the actual output $ 426,4e0 $ 420,400 52,ee0 53,000 50,000 Requlred: 1. Compute the fixed portion of the predetermined overhead rate for the year. (Round Flxed portion of the predetermIned overhead rate to 2 declmal places.) 2 Compute the fixed overhead budget variance and volume variance.. (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (1.e., zero varlance.). Input ell amounts as positlve values.) 1. Fixed portion of the predetermined overhead rate per DLH 2. Budget variance Volume…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education