Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

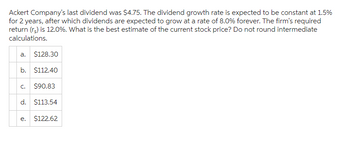

Transcribed Image Text:Ackert Company's last dividend was $4.75. The dividend growth rate is expected to be constant at 1.5%

for 2 years, after which dividends are expected to grow at a rate of 8.0% forever. The firm's required

return (rs) is 12.0%. What is the best estimate of the current stock price? Do not round intermediate

calculations.

a. $128.30

b. $112.40

C. $90.83

d. $113.54

e.

$122.62

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3D printing Corp paid a dividend yesterday of $1 per share. The dividend is expected to grow at 29.00% per year for 2 years and then the growth rate will slow to 2.90% per year forever. If the required rate of return is 7.40%, then what is the current stock price? (Pls use formulas) a. $34.11 b.$36.63 c. 27.62 d.$35.63 e. $33.36arrow_forwardInvestors require an 8% rate of return on Mather Company's stock (l.e., rs = 8%). a. What is its value if the previous dividend was Do = $3.00 and Investors expect dividends to grow at a constant annual rate of (1) -6%, (2) 0%, (3) 3 %, or (4) 5%? Do not round intermediate calculations. Round your answers to the nearest cent. (1) $ (2) $ (3) $ (4) $ 20.14 37.50 61.80 b. Using data from part a, what would the Gordon (constant growth) model value be if the required rate of return was 8% and the expected growth rate was (1) 8% or (2) 12%? Round your answers to the nearest cent. If the value is undefined, enter N/A. (1) $ (2) $arrow_forwardDetroit irons last dividend was$3.00. the company's growth is expected to remain at a constant 5 percent for the foreseeable future. if investors demand a 13 percent return what is the firm's current stock price? Show formula and work. A.52.50 B.45.00 C.42.86 D.39.38 E.37.50arrow_forward

- The stock of Business Adventures sells for $65 a share. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows: Boom Normal economy Recession Expected return Standard deviation Dividend $2.40 1.60 0.85 Required: a. Calculate the expected holding-period return and standard deviation of the holding-period return. All three scenarios are equally likely. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected return Standard deviation Stock Price $73 66 57 % % b. Calculate the expected return and standard deviation of a portfolio invested half in Business Adventures and half in Treasury bills. The return on bills is 3%. (Do not round intermediate calculations. Round your answers to 2 decimal places.) %arrow_forwardGHI's last dividend was P2.00. The dividend growth rate is expected to be constant at 3% for 2 years, after which dividends are to expected to grow at a rate of 8% forever. The company's required rate of return is 12%. What is the company's current stock price? A. P57.30 B. P51.40 C. P53.80 D. P49.20 E. Answer not givenarrow_forward3) see picturearrow_forward

- A firm is expected to pay a dividend of $3.90 one year from now and $4.25 two years from now and $4.30 three years from now. The firm's stock price is expected to be $110.50 in four years. What is the firm's stock value using a 13.78% required return? ○ $75.56 $201.47 $73.36 ○ $65.93arrow_forwardBaghibenarrow_forwardHuang Company's last dividend was $2.45. The dividend growth rate is expected to be constant at 22.5% for 3 years, after which dividends are expected to grow at a rate of 6% forever. If the firm's required return (rs) is 10%, what is its current stock price? Do not round intermediate calculations. a. $108.70 b. $90.67 c. $98.82 d. $101.27 e. $102.08arrow_forward

- NoRagrets, Inc is expected to pay a dividend in year 1 of $2 and a dividend in year 2 of $2.40. After year 2, dividends are expected to grow at the rate of 6% per year. An appropriate required return for the stock is 9%. The stock should be worth today. Select one: O a. $73.37 O b. $79.63 O c. $67.32 O d. $73.21arrow_forwardHolt Enterprises recently paid a dividend, D0, of $1.75. It expects to have nonconstant growth of 18% for 2 years followed by a constant rate of 8% thereafter. The firm's required return is 18%. What is the firm's horizon, or continuing, value? Do not round intermediate calculations. Round your answer to the nearest centarrow_forwardThe RLX Company just paid a dividend of $2.60 per share on its stock. The dividends are expected to grow at a constant rate of 5.75 percent per year, indefinitely. Assume investors require a return of 12 percent on this stock. a. What is the current price? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What will the price be in four years and in sixteen years? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. a. Current price b. Price in four years Price in sixteen years $ 43.99arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education