Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

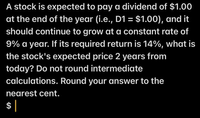

Transcribed Image Text:A stock is expected to pay a dividend of $1.00

at the end of the year (i.e., D1 = $1.00), and it

should continue to grow at a constant rate of

9% a year. If its required return is 14%, what is

the stock's expected price 2 years from

today? Do not round intermediate

calculations. Round your answer to the

nearest cent.

$|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- PeteCorp's stock has a Beta of 1.37. Its dividend is expected to be $3.19 next year, and will grow by 5% per year after that indefinitely. Assume the risk-free rate is 5%, and the Market Risk Premium is 7%. The stock price would currently be estimated to be $________. Round your FINAL answer to 2 decimal places (example: 12.3456 = 12.35), but do NOT round any intermediate work.arrow_forwardConsider the following information on a particular stock:Stock price = $88Exercise price = $84Risk-free rate = 5% per year, compounded continuouslyMaturity = 11 monthsStandard deviation =53% per year. What What is the delta of a call option?arrow_forwardA stock is expected to pay a dividend of $1 one year from now, $1.9 two years from now, and $2.3 three years from now. The growth rate in dividends after that point is expected to be 8% annually. The required return on the stock is 14%. The estimated price per share of the stock six years from now should be $_________. Do not round any intermediate work, but round your final answer to 2 decimal places (ex: $12.34567 should be entered as 12.35).arrow_forward

- A stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return is r = 10.5%, and the expected constant growth rate is g = 5.6%. What is the stock's current price?arrow_forwardA stock is expected to pay a dividend of $1.00 at the end of the year (i.e., D1 = $1.00), and it should continue to grow at a constant rate of 10% a year. If its required return is 14%, what is the stock's expected price 4 years from today? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardA share of stock with a beta of 0.79 now sells for $54. Investors expect the stock to pay a year-end dividend of $2. The T-bill rate is 6%, and the market risk premium is 9%. If the stock is perceived to be fairly priced today, what must be investors’ expectation of the price of the stock at the end of the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- Consider an example. Assume a share of preferred stock with the following characteristics: Par value $100 Dividend rate 3.0% per year Payment schedule semiannual Maturity date You are analyzing this preferred stock for possible purchase. Your required rate of return on this stock is 5% per year, compounded semiannually. Draw a time line showing the expected dividends for this preferred stock. Calculate the value of this preferred stock based on the required rate of return. Assume that the current market price for this preferred stock is $75 per share. Calculate the expected return based on the market price. Should you invest in the stock? Why or why not? Be sure to use your results from BOTH parts B and C above. You are analyzing a share of XYZ…arrow_forwardA stock price P0=$23, and is expected to pay D1 = $1.242 one year from now and to grow at a constant rate of g=8% in the future. Suppose this analysis was conducted in January 1, 2002, what is the expected price at the end of 2002 and what is the Capital gains yield?arrow_forwardA stock is expected to pay a dividend of $1.00 at the end of the year (i.e., D1 = $1.00), and it should continue to grow at a constant rate of 5% a year. If its required return is 12%, what is the stock's expected price 4 years from today? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward

- You are considering the purchase of a new stock. The stock is expected to grow at 2.52% for the foreseeable future and just paid a $2.88 dividend (D0). The required return is 8.2%. Based on this, what is the value of the stock? Round calculations to the nearest cent.arrow_forwardA stock will pay its next dividend of $7.81 exactly 1 year from now. After this first dividend, future dividends will grow at -4% for 2 years and then 3% per year every year thereafter. If the stock market is efficient and the appropriate discount rate of 12.9%, what is the best guess of the company's stock price today? Round your answer to the nearest penny.arrow_forwardYou are considering the purchase of a stock that yesterday announced EPS of $6.24. You feel that earnings will grow at 23% for the next three years. After that growth in earnings should level-off to 3% per year into the future. You require a return of 13%. Based on these assumptions, what would you pay for the stock today? $105.12 $141.83 $95.59 $119.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education