FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

THIS IS A CASE STUDY ANALYSIS.

Read the situation and answer these questions:

1. Do you think Pearson’s historical practice of making all sales on credit is effective? Why or why not?

2. Develop a plan for Pearson to implement to ensure its revenues stay up-to-date and are not affected by fraudulent customers

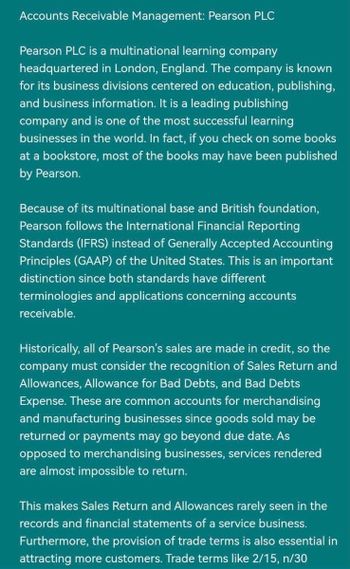

Transcribed Image Text:Accounts Receivable Management: Pearson PLC

Pearson PLC is a multinational learning company

headquartered in London, England. The company is known

for its business divisions centered on education, publishing,

and business information. It is a leading publishing

company and is one of the most successful learning

businesses in the world. In fact, if you check on some books

at a bookstore, most of the books may have been published

by Pearson.

Because of its multinational base and British foundation,

Pearson follows the International Financial Reporting

Standards (IFRS) instead of Generally Accepted Accounting

Principles (GAAP) of the United States. This is an important

distinction since both standards have different

terminologies and applications concerning accounts

receivable.

Historically, all of Pearson's sales are made in credit, so the

company must consider the recognition of Sales Return and

Allowances, Allowance for Bad Debts, and Bad Debts

Expense. These are common accounts for merchandising

and manufacturing businesses since goods sold may be

returned or payments may go beyond due date. As

opposed to merchandising businesses, services rendered

are almost impossible to return.

This makes Sales Return and Allowances rarely seen in the

records and financial statements of a service business.

Furthermore, the provision of trade terms is also essential in

attracting more customers. Trade terms like 2/15, n/30

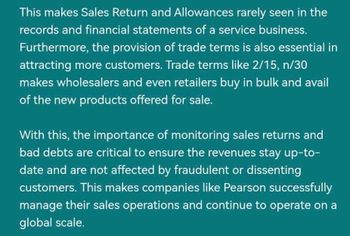

Transcribed Image Text:This makes Sales Return and Allowances rarely seen in the

records and financial statements of a service business.

Furthermore, the provision of trade terms is also essential in

attracting more customers. Trade terms like 2/15, n/30

makes wholesalers and even retailers buy in bulk and avail

of the new products offered for sale.

With this, the importance of monitoring sales returns and

bad debts are critical to ensure the revenues stay up-to-

date and are not affected by fraudulent or dissenting

customers. This makes companies like Pearson successfully

manage their sales operations and continue to operate on a

global scale.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Select the necessary words from the list of possibilities to complete the following statements. 1. A test of the completeness of recorded sales involves tracing a sample of _ 2. The best evidence of collectibility of accounts receivable is examination of subsequent 3. 4. to recorded sales. of the accounts. Loans by a company to its officers, directors, major stockholders, or affiliates require particular attention because these are not the results of arm's length bargaining by independent parties. Before goods are shipped on open account, the sale should be approved by the 5. A confirmation request asks the debtor to respond in all cases.arrow_forwardObtaining credit begins with you. After you complete a credit application, the lender decides if you are a good risk. Agencies that collect credit information about individuals are called credit bureaus. For a fee, they provide information about you that lenders need to decide if you are a good risk. The information you provide on your application is checked against the information the credit bureaus have collected about you. Why is your credit application approved or denied? ооооо Good news-your credit application was approved. What are the major factors about you that the lender used to evaluate your creditworthiness? Check all that apply. оооо APPROVED Physical appearance Character Political affiliation Capacity Religion 0000 MEGACREDIT Capital Extra 199 SIE TEL Your friend recently applied for credit and was turned down. Why was your friend probably denied credit? Check all that apply. History of personal bankruptcy FICO score greater than 850 Absence of checking, savings, or other…arrow_forwardThe COVID-19 pandemic has affected one of your customers, NEST Ltd adversely. Even though the economies are fast recovering, they have contacted your company to request to purchase on credit instead of cash on delivery. Your boss, Alan, the Marketing Manager has instructed you to review their request. He has asked you to review NEST Ltd’s latest set of financial statements. (a)In addition, identify other information(other than balance sheet, incomes statement and cash flow statement) that will be helpful in deciding whether to accede to NEST Ltd’s request? (b)You have also noticed that compared to last year, the allowance for bad debt for Nest Ltd has increased from 2% to 4 % of the accounts receivable. Discuss how this information will impact your review.arrow_forward

- Do not provide solution in imge format. and also do not provide plagarised content otherwise i dislikearrow_forwardLamar LLC is in the process of updating its revenues and receivables systems with the implementation of new accounting software. James Loden, Inc. is an independent information technology consultant who is assisting Tamar with the project. James has developed the following checklist containing internal control points that the company should consider in this new implementation: Will customer orders be received via the Internet? Are all collections from customers received in the form of checks? Are product quantities monitored regularly?arrow_forwardQuickBank has decided to lower the interest rate it charges on business loans in order to attract more business. It has succeeded in boosting the number of loan applications, but it finds that many of the applicants turn out to be very poor credit risks. This illustrates the problem known as adverse selection moral hazard the principal-agent porblem diversificationarrow_forward

- Cyber Systems’ management has been actively pursuing clients who fail to pay invoices when they fall due. Based on the experience of Cyber Systems in the 2021 financial year which ends on June 30, the longer an account receivable is outstanding, the more likely the client never pays the amount due. The longer the account is due, the more likely the client closes their travel agency and can never pay amounts due to Cyber Systems. Answer the following: (a) Identify the method and approach that is appropriate to account for bad debts in this case. (b) With reference to three relevant accounting principles, assumptions and/or qualitative characteristics, justify why the method and approach you have identified in part (a) is appropriate. Clearly label each part of your answer related to parts a and b above. In particular for part b, structure your answer as follows for each of the three relevant accounting principles, assumptions and/or qualitative characteristics:Identify accounting…arrow_forwardif a manager is incharge of the Credit Right Software Corp department which involves sells leading account sooftare product and two of his employess commited fraud. How should the manager prepare himself to understand what causes individuals to commit fraud and how it happens?arrow_forwardExplain how exception reporting would be invaluable to the manager of a credit department.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education