FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

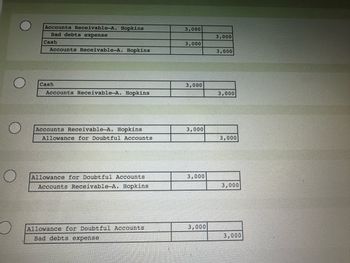

Transcribed Image Text:Accounts Receivable-A. Hopkins

3,000

Bad debts expense

3,000

Cash

3,000

Accounts Receivable-A. Hopkins

3,000

Cash

Accounts Receivable-A. Hopkins

Accounts Receivable-A. Hopkins

Allowance for Doubtful Accounts

3,000

3,000

3,000

3,000

O

Allowance for Doubtful Accounts

Accounts Receivable-A. Hopkins

3,000

3,000

Allowance for Doubtful Accounts

Bad debts expense

3,000

3,000

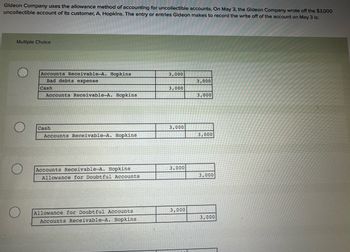

Transcribed Image Text:Gideon Company uses the allowance method of accounting for uncollectible accounts. On May 3, the Gideon Company wrote off the $3,000

uncollectible account of its customer, A. Hopkins. The entry or entries Gideon makes to record the write off of the account on May 3 is:

Multiple Choice

Accounts Receivable-A. Hopkins

3,000

Bad debts expense

3,000

Cash

3,000

Accounts Receivable-A. Hopkins

3,000

O

Cash

Accounts Receivable-A. Hopkins.

Accounts Receivable-A. Hopkins

Allowance for Doubtful Accounts

3,000

3,000

3,000

3,000

Allowance for Doubtful Accounts

Accounts Receivable-A. Hopkins

3,000

3,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forward1 Calculate, record, post, and analyze the adjustment to recognize bad debt expense under the following information provided: Account DR CR Accounts receivable Allowance for doubtful accounts 365,000 15,000 Net credit sales 827,000 Amount % Estimated Total Estimated Number of Days Outstanding Receivable Uncollectible Uncollectible 0-30 175,000 1.00% 31-60 80,000 2.00% 61-90 50,000 42,000 18,000 5.00% Page 1 91-120 20.00% Over 120 40.00% TOTALS 365,000 Page 2 General Ledger Accounts Receivable A Allowance for Doubtful XA Bad Debt Expense E Debit Credit Debit Credit Debit Credit Transaction Analysis ASSETS LIABILITIES EQUITY REVENUES EXPENSES NET INCOME + General Journal DR CR 2 What is the net realizable value of Accounts receivable?arrow_forwardAccountingarrow_forward

- From page 5-3 of the VLN, what is the appropriate relationship to compute net accounts receivable? Accounts receivable - Allowance for uncollectible accounts Accounts receivable - bad debt expense Accounts receivable - accumulated depreciationarrow_forwardHow do I solve this?arrow_forwardCalculate the total estimated uncollectibles based on the below information. Accounts receivable % uncollectible Estimated Bad debts Total $307,100 $ 0-30 $100,200 1% $ 31-60 $65,900 4% Number of Days Outstanding $ 61-90 $59,800 5% 91-120 $44,600 8% $ Over 120 $36.600 20%arrow_forward

- Accounts Receivable Beg. Bal. $ 187 18 150 6 64 15 19 End. Bal. $ ? Which of the following is an accurate description of the transactions effecting Accounts Receivable? Group of answer choices A. Customers of Careful charged more on their accounts than they paid. B. Customers of Careful paid more on their accounts than they charged. C. Careful incurred more debt than if paid off. D. Carefeul paid off debt. the ending balance of Accounts Receivable for Careful is: Group of answer choices A. $401 debit B. $343 debit C. $343 credit D. $ 58 creditarrow_forwardll.2arrow_forwardAt what amount will accounts receivable for Anderson Company be reported on the balance sheet if the gross receivable balance is $52,000 and the allowance for doubtful accounts is estimated at 4% of gross receivables? Select one: A. $28,200 B. $49,920 C. $52,960 D. $47,000arrow_forward

- 1. From page 5-4 of the VLN, when using the percent of receivables method, the math of multiplying accounts receivable by the percent of uncollectible accounts directly calculates: Group of answer choices A. The ending balance of the allowance for uncollectible accounts. B. Bad debt expense C. Net accounts receivable D. The amount to use in the adjusting entry to recognize bad debt expense 2. From page 5-4 of the VLN, what is the appropriate amount to record for bad debt expense when the company records the adjusting entry on 12/31? 3. Using the data from page 5-4 of the VLN, assume that instead of having a $500 credit balance in the Allowance for Uncollectible Accounts (AUA), the company had a $600 credit balance in the account. How would that affect the ending balance in the AUA after the company prepared the adjusting entry and posted it to the AUA? Group of answer choices A. The higher balance before the adjusting entry would cause the ending balance in the AUA to…arrow_forwardQUESTION 10 Match the term on the left to the appropriate classification or description on the right. v Allowance for doubtful accounts A. Discounts for early payment of A/R, recorded as contra- revenues v Net accounts receivable B. An account that the firm credits when it records bad debt v Sales discounts expense v Write-offs of A/R C. Entries that reduce gross accounts receivable D. Gross accounts receivable minus Allowance for doubtful accountsarrow_forwardKk.427.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education