FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

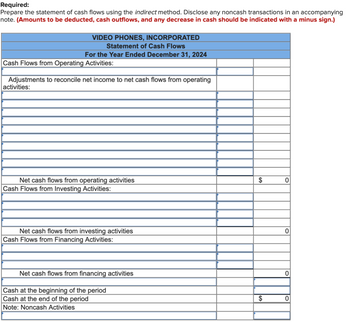

Transcribed Image Text:Required:

Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying

note. (Amounts to be deducted, cash outflows, and any decrease in cash should be indicated with a minus sign.)

VIDEO PHONES, INCORPORATED

Statement of Cash Flows

For the Year Ended December 31, 2024

Cash Flows from Operating Activities:

Adjustments to reconcile net income to net cash flows from operating

activities:

Net cash flows from operating activities

Cash Flows from Investing Activities:

Net cash flows from investing activities

Cash Flows from Financing Activities:

Net cash flows from financing activities

Cash at the beginning of the period

Cash at the end of the period

Note: Noncash Activities

$

$

0

0

0

0

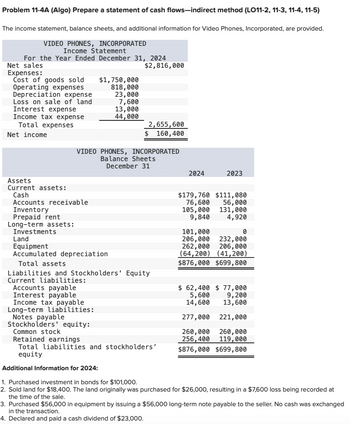

Transcribed Image Text:Problem 11-4A (Algo) Prepare a statement of cash flows-indirect method (LO11-2, 11-3, 11-4, 11-5)

The income statement, balance sheets, and additional information for Video Phones, Incorporated, are provided.

VIDEO PHONES, INCORPORATED

Income Statement

For the Year Ended December 31, 2024

Net sales

Expenses:

Cost of goods sold

Operating expenses

Depreciation expense

Loss on sale of land

Interest expense

Income tax expense

Total expenses

Net income

Assets

Current assets:

Cash

Accounts receivable

Inventory

Prepaid rent

Long-term assets:

Investments

$1,750,000

818,000

23,000

7,600

13,000

44,000

Land

Equipment

Accumulated depreciation

Accounts payable

Interest payable

VIDEO PHONES, INCORPORATED

Balance Sheets

December 31

$2,816,000

2,655,600

$ 160,400

Total assets

Liabilities and Stockholders' Equity

Current liabilities:

Additional Information for 2024:

Income tax payable

Long-term liabilities:

Notes payable

Stockholders' equity:

Common stock

Retained earnings

Total liabilities and stockholders'

equity

2024

2023

$179,760 $111,080

76,600

56,000

105,000 131,000

9,840

4,920

101,000

0

206,000

232,000

262,000 206,000

(64,200) (41,200)

$876,000 $699,800

$ 62,400 $ 77,000

5,600

9,200

14,600

13,600

277,000 221,000

260,000 260,000

256,400 119,000

$876,000 $699,800

1. Purchased investment in bonds for $101,000.

2. Sold land for $18,400. The land originally was purchased for $26,000, resulting in a $7,600 loss being recorded at

the time of the sale.

3. Purchased $56,000 in equipment by issuing a $56,000 long-term note payable to the seller. No cash was exchanged

in the transaction.

4. Declared and paid a cash dividend of $23,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please read through the questions carefully and enter answers carefully with the table providedarrow_forwardUse the following excerpts from Yardley Company's financial information. Dec. 31, 2018 Dec. 31, 2017 Cash $245,100 $225,000 Accounts Receivable 38,350 35,350 Merchandise Inventory 59,900 58,700 Land 165,000 65,000 Plant Assets 170,000 170,000 Accumulated Depreciation (49,000) (37,000) Total Assets $629,350 $517,050 Accounts Payable $29,100 $27,300 15,500 12,000 Accured Liabilities 45,000 20,000 Common Stock 539,750 457,750 Retained Earnings $629,350 $517,050 Total Liabilities and Equity Additional Information: $95,000 Net Income for 2018 12,000 Depreciation Expense for 2018 100,000 Land Purchased, for Cash 25,000 Stock Issued in Exchange for Cash, At Pat Value 13,000 Dividend Declared and Paid Prepare a statement of cash flows (indirect method) for the year 2018. Use the minus sign to indicate cash outflows, a decrease in cash or cash payments. Yardley Companyarrow_forwardView previous at Required information Assume a company prepares the statement of cash flows using the indirect method. The company purchases its Inventory on credit from suppliers. How should a decrease in accounts payable be reflected In the section that reconciles net income to cash flow from operating activitles? Multiple Choice It would be added if the section starts with net income and subtracted if it starts with a net loss It would be added in reconciling net income to cash flow from operafing activities It would be subtracted in reconciling net income to cash flow from operating activities A change in accounts payable does not affect the reconciliation of net income to cash flow from operating activities < Prev 15 of 15 Next Form 1040Sch...pdf 6 Form1040 Sch...pdf B1040 Sohedul...pdf Form8829 (1).pdf MacBook Airarrow_forward

- ans in txt formarrow_forwardProvide iand Create nformation needed to create a Statement of Cash Flows using the Indirect Method. You MUST include: Net Income At least 3 items that go under operating activities. At least 2 items that go under investing activities. At least 2 items that go under financing activities. And 1 non-cash transaction.arrow_forwardVery important please be correct thank youarrow_forward

- Please do not give solution in image format thankuarrow_forwardD&D Company reports select items from its statement of cash flows. Identify those items related to investing activities and co- net cash flows from investing activities. Activity Cash paid to purchase property Cash from selling merchandise Cash paid for income taxes Cash received from a long-term note Cash paid to repurchase stock Cash received from sale of investments Cash received from issuing equity shares Cash paid to purchase merchandise Cash paid to purchase investment securities Cash paid in salaries and wages Note: Cash outflows should be indicated by a minus sign. Activity Net cash flows from investing activities $ Amount 0 Amount $ 400,000 688,000 135,000 850,000 100,000 40,000 500,000 710,000 50,000 410,000arrow_forwardState the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transactions: Note: Only consider the cash component of each transaction. Use the minus sign to indicate amounts that are cash out flows, cash payments, decreases in cash, or any negative adjustments. If your answer is not reported in an amount box does not require an entry, leave it blank or enter "0". a. Received $120,000 from the sale of land costing $70,000. Investing activities $fill in the blank 2 Operating activities $fill in the blank 4 b. Purchased investments for $75,000. Investing activities $fill in the blank 6 c. Declared $35,000 cash dividends on stock. $5,000 dividends were payable at the beginning of the year, and $6,000 were payable at the end of the year. Financing activities $fill in the blank 8 d. Acquired equipment for…arrow_forward

- Hamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement Sales Revenue $1,860 Expenses: Cost of Goods Sold 850 Depreciation Expense Salaries and Wages Expense Rent Expense 150 450 200 Insurance Expense 75 Interest Expense Utilities Expense 45 Net Income 35 Selected Balance Sheet Accounts Current Year Prior Year 72 Inventory Accounts Receivable 55 355 400 Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 10 14 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardPrepare a complete statement of cash flows using the indirect method for the current year. Note: Amounts to be deducted should be indicated with a minus sign. Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATION Comparative Balance Sheets December 31 Current Year Prior Year Assets Cash $ 178,000 $ 122,400 Accounts receivable 104,000 85,000 Inventory 622,000 540,000 Total current assets 904,000 747,400 Equipment 372,700 313,000 Accumulated depreciation—Equipment (165,000) (111,000) Total assets $ 1,111,700 $ 949,400 Liabilities and Equity…arrow_forwardDive In Company was started several years ago by two diving instructors. The company's comparative balance sheets and income statement, as well as additional information, are presented below. Balance Sheet at December 31 Cash Accounts Receivable. Prepaid Rent Total Assets Salaries and Wages Payable Common Stock Retained Earnings Total Liabilities and Stockholders' Equity Income Statement Service Revenue Salaries and Wages Expense Rent and Office Expenses Net In Current Year $ 3,340 1,100 110 $ 4,550 $ 400 1,300 2,850 $ 4,550 $ 35,050 31,000 3,700 $ 350 Previous Year Additional Data: a. Rent is paid in advance each month, and Office Expenses are paid in cash as incurred. b. An owner contributed capital by paying $250 cash in exchange for the company's stock. $ 4,145 550 55 $4,750 $ 1,200 1,050 2,500 $4,750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education