FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

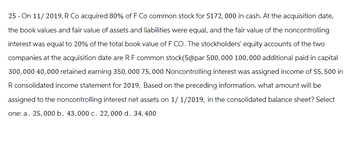

Transcribed Image Text:25 - On 11/2019, R Co acquired 80% of F Co common stock for $172,000 in cash. At the acquisition date,

the book values and fair value of assets and liabilities were equal, and the fair value of the noncontrolling

interest was equal to 20% of the total book value of F CO. The stockholders' equity accounts of the two

companies at the acquisition date are RF common stock(5@par 500,000 100,000 additional paid in capital

300,000 40,000 retained earning 350, 000 75,000 Noncontrolling interest was assigned income of $5, 500 in

R consolidated income statement for 2019, Based on the preceding information. what amount will be

assigned to the noncontrolling interest net assets on 1/1/2019, in the consolidated balance sheet? Select

one: a. 25,000 b. 43,000 c. 22,000 d. 34, 400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On January 31, 2021, Parent Inc. purchased 90% of Sub Inc., issuing common shares of Parent with a market value of $400,000. Costs were $10,000 to issue the shares and $16,000 of other legal costs. Parent and Sub Inc had the following balance sheets on January 30, 2021 immediately prior to the acquisition: Parent Inc. Sub Inc. Sub Inc. (carrying value) (carrying value) (fair value) Cash $1,200,000 $300,000 $300,000 Accounts Receivable $ 400,000 $ 64,000 $ 64,000 Inventory $ 240,000 $ 80,000 $ 60,000 Plant and Equipment (net) $ 960,000 $350,000 $300,000 Accumulated depreciation ($100,000) ($94,000) Trademark $ 20,000 $ 36,000 Total Assets $2,700,000 $720,000 $760,000 Accounts Payable $1,500,000 $300,000 $300,000 Bonds Payable $ 600,000 $240,000 $210,000 $510,000 Common Shares $ 500,000 $ 60,000 Retained Earnings $ 100,000…arrow_forwardvntarrow_forwardOn 1 January 20X0 Alpha Co purchased 90,000 ordinary $1 shares in Beta Co for $270,000. At that date Beta Co's retained earnings amounted to $90,000 and the fair values of Beta Co's assets at acquisition were equal to their book values. Three years later, on 31 December 20X2, the statements of financial position of the two companies were: Alpha Co Beta Co $ $ Sundry net assets 230,000 260,000 Shares in Beto 180,000 - Share capital Ordinary shares of $1 each 200,000…arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education