FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Current Attempt in Progress

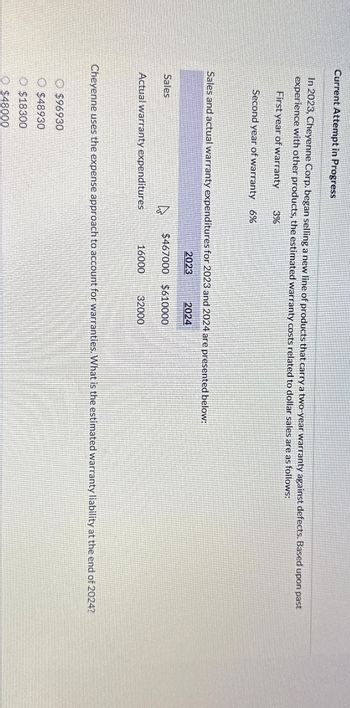

In 2023, Cheyenne Corp. began selling a new line of products that carry a two-year warranty against defects. Based upon past

experience with other products, the estimated warranty costs related to dollar sales are as follows:

First year of warranty 3%

Second year of warranty 6%

Sales and actual warranty expenditures for 2023 and 2024 are presented below:

2023

2024

Sales

Actual warranty expenditures

$467000 $610000

$96930

$48930

$18300

O $48000

16000

32000

Cheyenne uses the expense approach to account for warranties. What is the estimated warranty liability at the end of 2024?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lindy Appliance begins operations in 2021 and offers a one-year warranty on all products sold. Total appliance sales in 2021 are $1,600,000, and Lindy estimates future warranty costs in 2022 to be 2% of current sales. Actual warranty costs in 2022 are $25,000. Also in 2022, Lindy has additional sales of $2,400,000 and revises its estimate of warranty costs associated with sales in 2022 to be 1.5%.Required:1. Record the adjusting entry for estimated warranty costs at the end of 2021.2. Record the summary entry for actual warranty expenditures in 2022, assuming all costs were paid in cash.3. Record the adjusting entry for estimated warranty costs at the end of 2022.4. What is the balance in Warranty Liability at the end of 2021 and 2022?arrow_forwardHelp me selecting the right answer. Thank youarrow_forwardSmith Electic (SE) owed Estimated Warranty Payable of $1,100 at the end of 2023. During 2024, SE made sales of $100,000 and expects product warranties to cost the company 5% of the sales. During 2024, SE paid $2,600 for warranties. What is SE's Estimated Warranty Payable at the end of 2024? OA. $2,600 OB. $5,000 O C. $6,100 OD. $3,500arrow_forward

- 3arrow_forwardProduct A comes with a two year warranty when purchased by customers. The estimated warranty costs as a percentage of dollar sales are 3% in the year of sale and 5% in the second year after the sale. The following information relates to sales and warranty expenditures of Product A Actual warranty expenditures $ 10,000 $ 35,000 Year Year 1 Year 2 Sales $400,000 $500,000 Which of the following is NOT part of the required journal entry in Year 1 based on the above information? Multiple Choice Credit cash $10,000 Debit warranty expense $12,000 None of the other alternatives are correct Debit warranty expense $32,000 Credit sales $400,000arrow_forwardSales made in 2021 for $3,000,000 includes a 2-year warranty coverage, included in the price. The estimated cost for warranty is expected to be 2% for the first year and 5% for the second year. How much warranty expense should be recorded in 2021? Question 4 options: $60,000 $150,000 $100,500 $210,000arrow_forward

- 1. General Motors guarantees automobiles against defects for five years or 160,000 km, whichever comes first. Suppose GM can expect warranty costs during the five-year period to add up to 4% of sales. Assume that Forbes Motors made sales of $2,500,000 on their Buick line during 2020. Forbes received cash for 13% of the sales and took notes receivable for the remainder. Payments to satisfy customer warranty claims totalled $75,000 during 2020. Post to the Estimated Warranty Payable T-account. The beginning balance was $43,000. At the end of 2020, how much in estimated warranty payable does Forbes owe its customers?arrow_forward4arrow_forwardWoodmier Lawn Products introduced a new line of commercial sprinklers in 2023 that carry a one-year warranty against manufacturer's defects. Because this was the first product for which the company offered a warranty, trade publications were consulted to determine the experience of others in the industry. Based on that experience, warranty costs were expected to approximate 2% of sales. Sales of the sprinklers in 2023 were $2.8 million. Accordingly, the following entries relating to the contingency for warranty costs were recorded during the first year of selling the product: General Journal Accrued liability and expense Warranty expense (2% × $2,800,000) Warranty liability Actual expenditures (summary entry) Warranty liability Cash Debit 56,000 Required 1 Required 2 25,000 Credit 56,000 In late 2024, the company's claims experience was evaluated and it was determined that claims were far more than expected-3% of sales rather than 2%. View transaction list 25,000 Required: 1. Assuming…arrow_forward

- Subject:arrow_forwardPart A: Giordano Corp. sold machinery for $2,000,000 and it was delivered in November 2020. On November 20, the customer informed Giordano Corp. that they were satisfied with the machinery. Giordano Corp. provided a warranty on the machinery for two years from November 20, 2020. The initial estimated warranty cost to Giordano Corp was estimated at $200,000. The stand-alone-value of the warranty is $150,000 and of the machinery is $1,900,000. The machinery can be purchased without the warranty by the customer. What would be the amount of unearned revenue on November 20 recorded by Giordano Corp.? (Round percentages to whole numbers). Show your work. a) Between $1,800,000-$1,900,000 b) Between $150,000-$160,000 c) None of the choices d) Between $140,000 - $147,000 e) Between $1,900,000-$2,000,000arrow_forward1. ProWasher began production of a new dishwasher in June 2023, and by December 31, 2023 had sold 100,000 units to various retailers for $500 each. Each dishwasher is sold with a one-year warranty included. The company estimates that its warranty expense per dishwasher will amount to $25. Warranties similar to these are available for sale for $75. By year end, the company had already paid out $1 million in warranty expenditures on 35,000 units. ProWasher’s records currently show a warranty expense of $1 million for 2023. 2. ProWasher’s retail division rents space from Park Malls. ProWasher pays a rental fee of $6,000 per month plus 5% on the amount of yearly profits that is over $500,000. ProWasher’s CEO, Burt D. Washer, tells you that he had instructed the previous accountant to increase the estimate of bad debts expense and several other estimates in order to keep the retail division’s profits at $475,000. 3. ProWasher’s lawyer, Anna Turney, informed you that ProWasher has a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education