FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

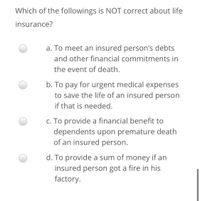

Transcribed Image Text:Which of the followings is NOT correct about life

insurance?

a. To meet an insured person's debts

and other financial commitments in

the event of death.

b. To pay for urgent medical expenses

to save the life of an insured person

if that is needed.

c. To provide a financial benefit to

dependents upon premature death

of an insured person.

d. To provide a sum of money if an

insured person got a fire in his

factory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Name a peril that is often excluded from an home or auto insurance policy. Why is the peril included in an insurance policyarrow_forwardAsaparrow_forwardName the coverage for auto insurance "Pays for damage or loss of your car if you are in accident." Property damage liability Collision Coverage Comprehensive coverage Bodily injury liabilityarrow_forward

- Identify which is taxable? A. Proceeds of life insurance received by heirs B. Excess amount received over premiums paid by insured upon surrender of policy C. Compensation for personal injuries of an employee D. Indemnification for moral damagesarrow_forwardIf an employer contributes to an Health Savings Account (HSA) on behalf of an employee, a. Is the contribution deductible by the employee? Yes No b. Is the payment considered income to the employee? Yes Noarrow_forwardSupplemental coverage for homeowner's insurance is available through endorsements. Which one of the following is not a common form of additional coverage? A) personal articles floaters B) earthquake coverage C) flood protection D) medical payments E) inflation guardarrow_forward

- A friend has a medical condition but did not inform the insurance company when he purchased the policy. He fell ill but the insurance company refuses to cover his medical expenses. What should he do?arrow_forwardYou are responsible for an automobile accident. Use the information below to determine: the total amount your liability insurance will pay for the accident the total amount your collision insurance will pay for the accident the amount of additional damages you are responsible for as a result of the accident You and the driver of the other car were the only people involved in the accident. There were no injuries from the accident. You have a 50/100/50 liability insurance policy with no deductible You have collision insurance with a deductible of $500 The other car was valued at $25,000 and requires $10,000 in repairs Your car was valued at $20,000 and requires $15,000 in repairsarrow_forwardIn the context of the health insurance and the life insurance, choose the sentence that IS NOT CORRECT: * The deductible in a health insurance is an amount of money the insured must pay before benefits become payable by the insurance company. When we buy a health insurance, we should make sure that we have enough insurance (the opportunity cost of not being adequately insured can be extremely high), but without wasting money by overinsuring Group Health Insurance (most of them being employer sponsored) represents a small percentage (around 5%) of all health insurance issued by health and life insurance companies. In a life insurance, a person purchases a policy by paying a premium and the insurance company promises to pay a sum of money at the time of the policyholder’s death to the designated beneficiary.arrow_forward

- A comprehensive general liability policy includes property damage coverage for which of the following incidents? An insured intentionally causes a fire that burns down the building in which he is the sole tenant. An insured personal property on the premises destroyed by a fire An insured repair a boiler for a dry cleaner that explodes and causes extensive damage to the building An insured leases a computer that is subsequently damaged by an employee.arrow_forward2. Your dad applied for a term life insurance (provides the insured person with a coverage for a specified period of time of one, five or more years), He got a flexible policy (allows the insured person to change certain components of the insurance plan) because some payment options include a policy payout (insurance proceeds) as soon period achieved or upon contingency (death or accident). Some companies offer insurance products that can be availed only upon death. Because of this better option, your dad decided to avail of insurance A's flagship insurance product. Your dad's contribution per year is P20,000 that earns 6% compounded monthly for 20 years. How much will be paid out to your dad after 20 years by insurance A? as the targetarrow_forwardlife insurance proceeds paid to a beneficiary because of the insured's death is taxable. true or falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education