FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

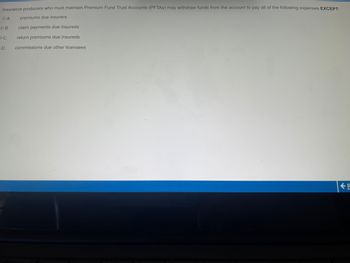

Transcribed Image Text:Insurance producers who must maintain Premium Fund Trust Accounts (PFTAS) may withdraw funds from the account to pay all of the following expenses EXCEPT:

premiums due insurers

A.

B.

C.

D.

claim payments due insureds

return premiums due insureds

commissions due other licensees

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- All of the following statements about life insurance company investments are true EXCEPT income from these investments reduces the cost of insurance. funds for these investments are derived primarily from premium income, investment earnings, and maturing investments that must be reinvested. a primary objective in making these investments is safety of principal. the majority of these investments are short-term investments.arrow_forwardCredit unions are Group of answer choices not providers of insured deposits. mutual associations. available to the general public. mortgage lenders. special commercial lenders. \arrow_forwardUnder the revised Annuity Suitability Model Regulation, all obligations to meet the consumer best interest standard and ensure that a consumer's financial needs and objectives are addressed now fall to the producer. Insurers have no obligations or practice standards under the new regulation. A.True b. Falsearrow_forward

- Mulitple choice question When are liabilities recognized for the federal Social Security program? Select one: a. When benefits are paid to the recipients b. When benefits are earned by the recipients c. When benefits are due and payable at the end of a reporting period d. When the social security trust fund receives cash from employees and employersarrow_forwardWhen creating an Income Statement and calculating Net Patient Service Revenue, which of the accounts do you actually record as a line item on the Income Statement? O Discounts Charity Care Accounts Receivable Bad Debtarrow_forwardThe Director of Insurance has the power to. make reasonable insurance rules and regulations determine standard insurance rales Veto insurance laws issue insurance policiesarrow_forward

- A savings account that is insured by the FDIC/NCUA meansarrow_forwardTrue or False : Insurance companies are regulated by the federal government, which helps maintain uniform coverage and premiumsarrow_forwardFor-profit healthcare Corporation creates a bond issue that receives its credit ratings from the agency of the state government where the health care business is incorporated. Group of answer choices True Falsearrow_forward

- Insurance companies may use all of he following sources to oblain underwriting information about an applicant EXCEPT. A.The Medical Information Bureau (MIB) B.Inspection report companies C.Actuarial raling bureaus D.A Fair Credit reportarrow_forward8. What is the difference between a copay and coinsurance? a. Copay is typically a percentage of the health care service, coinsurance is a flat fee b. Copay is typically a flat fee, coinsurance is a percentage of the health care service c. Copay is paid by the individual when receiving a health care service, coinsurance is paid by the insurance companyarrow_forwardWith respect to employer-sponsored health insurance plans, the amount of money a covered participant must pay before health insurance benefits become active is known as which of the following? Select one: a. Premium b. Safe harbor c. Deductible d. Coinsurancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education